Knee Implant Market

Increasing cases of knee injuries, particularly among athletes and active people, have accentuated the demand for knee implants to address trauma-related joint damage are among the factors contributing to the growing knee implant market size. As the population ages and lifestyles continue to emphasize physical activity, the knee implant market is expected to expand further to provide effective and advanced orthopedic solutions for joint replacement procedures.

The knee implant market trends include increasing prevalence of osteoarthritis and a rise in knee injury cases. Osteoarthritis, known as the most common type of arthritis, has demonstrated a substantial surge, particularly among aging populations and individuals affected by obesity. This trend has underscored the growing need for knee implant surgeries to alleviate pain, restore mobility, and improve the quality of life for affected individuals. Moreover, with technological advancements and a focus on patient-specific implant designs, the knee implant market is positioned to address the diverse needs of patients, ensuring improved outcomes, enhanced durability, and better functional restoration, thus contributing to the market’s continued growth within the orthopedic industry.

However, high cost of orthopedic procedures and limited availability impede the knee implant market growth. The considerable expenses associated with orthopedic surgeries, including knee implant procedures, can restrict access to these treatments, particularly for patients with limited financial resources or those residing in underserved areas. Additionally, the extensive training, expertise, and infrastructure required for orthopedic surgeries and the complex nature of knee implant procedures have led to a scarcity of skilled orthopedic surgeons in certain regions. This limited availability may create significant waiting times for orthopedic procedures, impacting patient access and healthcare delivery. Specialized training programs, surgical assistance through telemedicine, and expanded healthcare infrastructure are thus essential to overcome these challenges and improve access to orthopedic care, which would ultimately foster the growth of the knee implant market.

The “knee implant market analysis” has been carried out by considering the following segments: based on type of procedures, implant type, material, and end user. By type of procedures, the market is divided into total knee replacement, partial knee replacement, and revision knee replacement. Based on implant type, the knee implant market is bifurcated into fixed-bearing prostheses and mobile-bearing prostheses. In terms of material, the market is divided into total cemented and non-cemented. By end user, the market is segmented into hospitals, ambulatory surgical centers, and others.

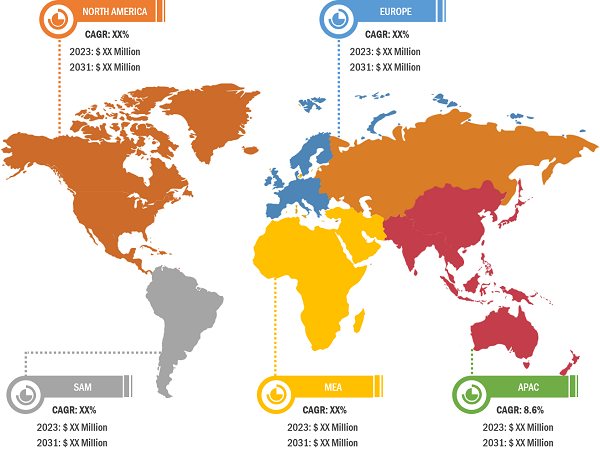

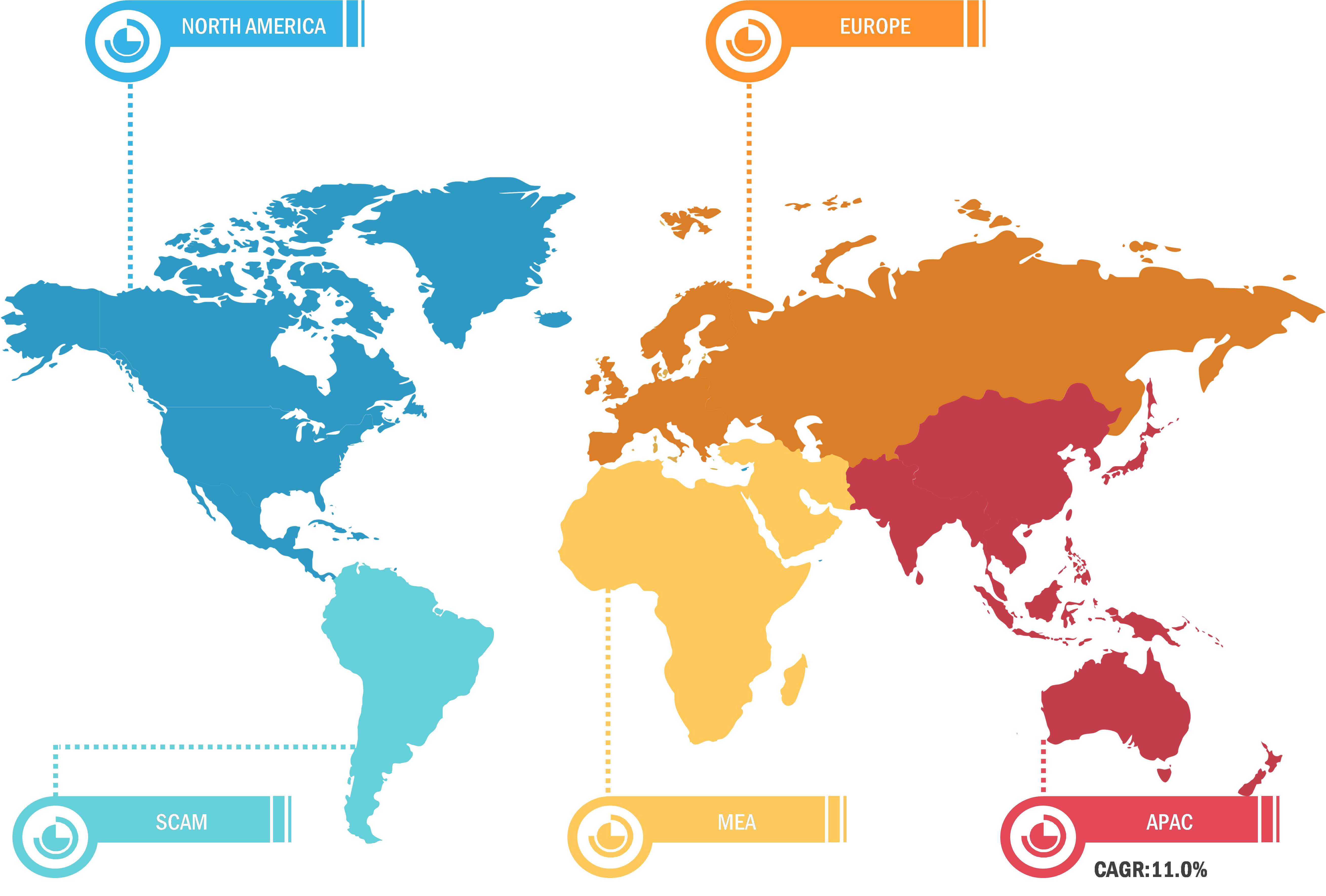

Geographically, the knee implant market report is primarily divided into North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

In terms of revenue North America dominated the knee implant market share owing to a higher incidence of knee replacement in the US. Furthermore, factors such as an increase in accident cases and a rise in the number of people with degenerative diseases are responsible for the spike. According to a report released in June 2021 by the Canadian Institute for Health Information, about 75,073 knee replacements were carried out in Canada in 2020. Additionally, it stated that Canada spends more than US$ 1.4 billion annually on knee replacement surgery. However, the region’s disabled population has found life particularly difficult as a result of the COVID-19 pandemic lockdown. In 2020, the Disability Inclusion Fund (DIF) in the US and other nations announced the establishment of a US$ 200,000 quick-reaction fund to assist individuals with disabilities in meeting their requirements related to the COVID-19 pandemic. As a result, this kind of occurrence suggests modest market expansion in this area.

The US knee replacement market is growing due to several factors, such as key product introductions, a high concentration of manufacturers or market players, and alliances and acquisitions among prominent competitors. Furthermore, the strategic presence of key players positions US is a key country for the knee implant market growth. For instance, the newest handheld smart instrument for knee replacement surgery, Lantern, was introduced in November 2021 by OrthAlign, a privately held business in the US. The device provides precise, customized alignment for every patient with just one use. It is a portable, intelligent instrument with many implant systems and surgical techniques. Such ongoing product launches are expected to propel the market expansion in the country.

Knee Implant Market: Competitive Landscape and Key Developments

Zimmer Biomet; CONMED; Stryker; Smith and Nephew; DePuy Synthes; Aesculap Implants Systems, LLC; Medacta; Exactech, Inc.; MicroPort Scientific; Kinamed, Inc.; ConforMIS; and OMNIlife science, Inc. are a few key companies operating in the knee implant market report. Market players adopt product innovation strategies to meet evolving customer demands, maintaining their brand image in the knee implant market.

A few recent developments by the knee implant market players are mentioned below:

In October 2023, the first KA-optimized femoral component for total knee replacement, GMK SpheriKA, was released by Medacta Group S.A. This Swiss firm offers cutting-edge, customized, and sustainable solutions for sports medicine, spine surgery, and joint replacement. On November 2, 2023, during the American Association of Hip and Knee Surgeons (AAHKS) Annual Meeting, GMK SpheriKA made its global debut.

In November 2021, Zimmer Biomet Holdings, Inc. received FDA 510(k) clearance for Persona OsseoTi Keel Tibia for cementless knee replacement in the US. The newest member of the clinically proven Persona Knee System, Persona OsseoTi, boasts a new porous version of the Persona anatomic tibia owing to Zimmer Biomet’s OsseoTi Porous Metal Technology, which combines 3D printing technology with anatomical data to create a structure that closely resembles the architecture of human cancellous or spongy bone. Combining this substance and a keeled design provides biological fixing and stable initial attachment.