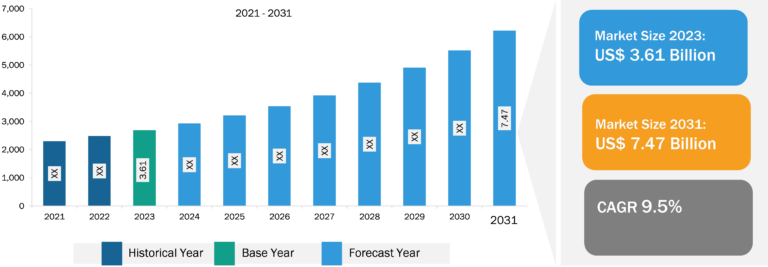

GNSS Chip Market

Real-time, accurate location data is crucial for various navigation and mapping applications, including ride-hailing services, delivery drones, and precise driving directions. GNSS chips enable these applications by providing real-time positioning information.

GNSS surveying technologies offer a wide range of accuracy levels and approaches to satisfy the needs of many applications. Single point positioning (SPP) offers simple location; real-time kinematic (RTK) and post-processing kinematic (PPK) offer centimeter-level precision, and Differential Positioning (DGPS) enhances accuracy. Owing to its lower latency and real-time corrections, RTK stands out as the most accurate approach. High accuracy in surveying operations can be attained with the help of sophisticated data processing software, integrated sensor systems, and high-end GNSS receivers with multi-constellation and multi-frequency capabilities. Through a comprehensive understanding of the various GNSS surveying techniques and suitable equipment selection, experts can guarantee precise and dependable outcomes for their projects. Thus, the increasing demand for real-time, accurate data drives the GNSS chip market growth. In addition, the emergence of technological advances and new applications propels the need for reliable and efficient GNSS solutions.

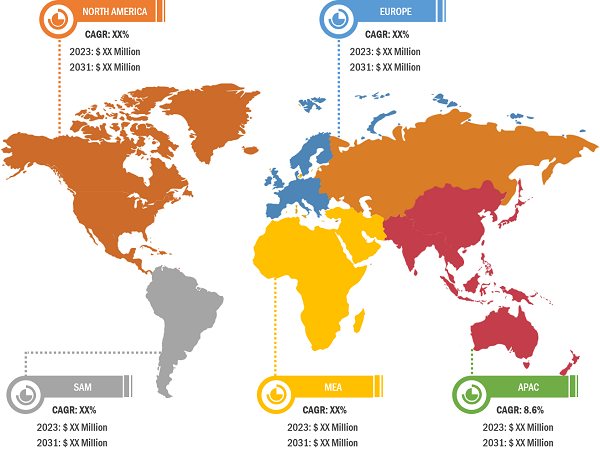

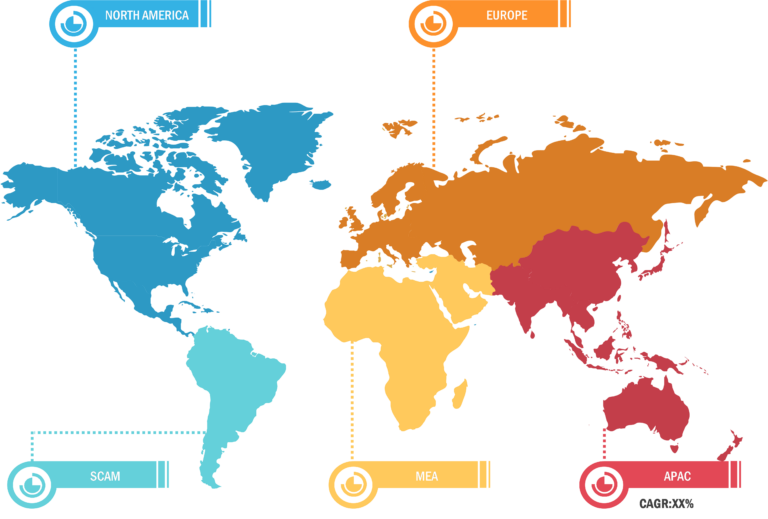

Europe GNSS Chip Market

Europe comprises economies such as Germany, France, the UK, and Italy. Norway, Finland, Sweden, the Netherlands, Denmark, Switzerland, and the UK have made a vital contribution to the tech strength of the region, and they are anticipated to nurture the GNSS chips market growth in the coming years.

With many sectors of the European economy already relying upon satellite navigation services, the European Union (EU) fully comprehends the considerable potential of global navigation satellite system (GNSS) solutions to contribute to economic and social growth, breakthrough innovations, and globally competitive industry. The entire system of Galileo Initial Services was completed in 2020 and is offering global coverage to more than 100 million devices already, including Galileo. This number is set to rise exponentially in the coming years. The Galileo High Accuracy Service (HAS) supports users who require sub-meter accuracy and is accessible to all global users. These services can power new applications and opportunities and drive navigation-enabled innovation in the EU and worldwide. Future growth perspectives are promising, as multi-GNSS applications are increasing, and user uptake in Central and Eastern Europe is expected to increase, which further fuels the GNSS chip market share of Europe.

The UK is the only country in Europe that has used armed UAVs in lethal operations. Also, France is set to become the second country to use medium-altitude long-endurance (MALE) drones. Thus, UAV manufacturers integrate GNSS chips for various navigation and surveying applications. Rising demand is increasing the adoption of UAVs in the region, leading manufacturers to invest in GNSS chips. Several European countries have initiated projects to develop advanced UAVs, as the attainment of technology from abroad goes contrary to European industrial interests as it compromises the EU’s industrial autonomy. “Eurodrone Project” is one of the major projects in the region backed by the European Defence Agency; the project targets to provide a European MALE UAV by 2025. Germany, France, Italy, and Spain are among the countries that are at the forefront of these developments.

Segmental Overview

The GNSS chip market analysis has been carried out by considering the following segments: device, application, and vertical. Based on device, the market is segmented into smartphones, tablets, personal navigation devices, in-vehicle systems, and others. Based on application, the market is segmented into navigation & location-based services, mapping, surveying, telematics, timing and synchronization, and others. Further, the GNNS chip market, by vertical, is segmented into consumer electronics, automotive & transportation, military & defense, and others.

The consumer electronics segment held the largest GNSS chip market share in 2022 and the others segment is expected to register the highest CAGR during the forecast period.

Market Analysis: Competitive Landscape and Key Developments

- In February 2024, u-blox introduced two new LTE-M cellular module series—the SARA-R52 and LEXI-R52—designed for industrial applications. These modules are based on the u-blox UBX-R52 cellular chip and are tailored for integrated and concurrent positioning and wireless communication needs. The modules include SpotNow, uCPU, and uSCM, which offer features such as 10m accuracy, automatic connectivity management, and low-power consumption. The SARA-R520M10 combo module offers simultaneous GNSS and cellular connectivity, while the LEXI-R52 is designed for ultra-small applications such as wearables. The R52 series offers 23 dBm RF output power, ensuring stable connectivity in challenging coverage conditions.

- In November 2022, OriginGPS launched ORG600-MK0, a new sub-1m precision dual-frequency GNSS module, which is built with MediaTek’s chipset.