Real-Time Location Systems Market

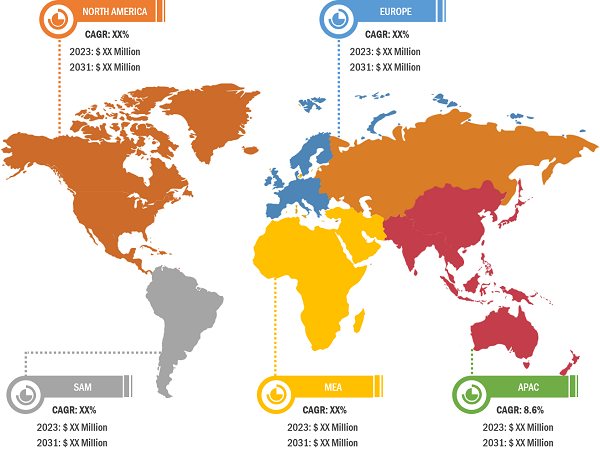

The real-time location systems market size is segmented into four major regions—North America, Europe, Asia Pacific, and Rest of the World. In 2022, APAC led the real-time location systems market with a substantial revenue share, followed by North America and Europe.

The 5G network is ∼100 times faster than the 4G network, making real-time data acquisition easier. As the 5G network provides strong connectivity and high-speed data transfer, its demand is increasing across the world. According to Groupe Speciale Mobile Association (GSMA), 5G penetration across the world is expected to reach 54% by 2030 from 17% in 2022. North America has the highest 5G penetration, with 39% in 2022; it is expected to reach 91% by 2030. 5G penetration in Asia Pacific (except China) and Europe is expected to increase from 4% and 11% in 2022 to 41% and 87% by 2030, respectively. As 5G is the critical new-generation network technology that can enable innovation and support digital transformation, its demand is increasing across the world. Therefore, the governments of various countries are investing in 5G infrastructure. In July 2021, the government of France announced its plan to invest about US$ 2.06 billion (EUR 1.7 billion) in its 5G market by 2025 via public and private investments. Through this, the government aims to accelerate the development of 5G in the country. Similarly, in January 2021, the government of South Korea announced that they would increase the coverage of the next-generation mobile networks, particularly 5G, to 85 cities this year from the current seven major cities. It invested around US$ 115.89 million (127.9 billion won) in 2021 to encourage the use of private 5G networks. Growing investments in 5G will help improve connectivity and acquire real-time data, including real-time location tracking, which can be used for various applications, from navigation to emergency services. Therefore, the emergence of 5G network is expected to create lucrative opportunities for the real-time location systems market during the forecast period.

The Europe real-time location systems market is projected to grow significantly in the coming years owing to the growing oil and gas exploration activities. The use of RTLS in the oil & gas industry will help track asset and personnel location, which can improve the plant’s operational efficiency, raising its demand in the region. In addition, other industries such as manufacturing and automotive are also adopting RTLS solutions, as it provides alerts and notifications in danger, data representation in a geospatial facility map, and asset tracking to reduce the need for manual and labor-intensive processes. Moreover, the growing transportation & logistics sector in countries such as the UK, Germany, France, and Spain is anticipated to enhance the demand for RTLS solutions for inventory and warehouse management, transportation management, and inbound and outbound logistics management, propelling the real-time location systems market growth in Europe.

Real-Time Location Systems Market: COVID-19 Pandemic Overview

The demand for real-time locating systems (RTLS) increased in sectors such as healthcare and logistics, as these solutions improved operational efficiencies and contributed to safety during the COVID-19 pandemic. However, their demand dropped in sectors such as retail, manufacturing, and transportation as these businesses faced significant disruptions, leading to decreased investments in the adoption of RTLS technology. In the healthcare sector, real-time locating systems played a crucial role in optimizing resource allocation, enhancing patient care, and improving operational efficiency. Stanley Black & Decker, a prominent US-based RTLS manufacturer, had to make difficult decisions to adapt to the changing economic conditions amid the pandemic. Its actions included plant shutdown and operational shifts as part of broader business transformations to achieve cost savings and strengthen core operations. While these actions resulted in job losses, they also created opportunities in other aspects, reflecting the dynamic nature of the market. Thus, the COVID-19 pandemic had a mixed overall impact on the real-time location systems market growth.

Real-Time Location Systems Market: Technology Overview

By technology, the real-time location systems market size is segmented into radio frequency identification (RFID), Wi-Fi, ultra-wideband (UWB), Bluetooth low energy (BLE), ultrasound, infrared (IR), global positioning systems (GPS), and others. The Bluetooth low energy (BLE) segment held the largest real-time location systems market share in 2022 and is expected to retain its dominance during the forecast period.

Real-Time Location Systems Market: Competitive Landscape and Key Developments

Aruba Networks, AiRISTA Flow Inc, Qorvo Inc, Impinj Inc, Siemens AG, Zebra Technologies Corp, Sonitor Technologies AS, Stanley Black & Decker Inc, TeleTracking Technologies Inc, and Ubisense Ltd. are a few key real-time location systems market players profiled in the study.

- In January 2023, Enloe Medical Center, based in Chico, California, expanded its Aruba network by adding Aruba Edge Connect SD-WAN gateways and Aruba Location Services. This expansion allows Enloe to enhance patient care by doubling branch networking capacity, ensuring reliable connectivity, managing connected devices, and tracking vital healthcare equipment. The deployment also enables significant IT time savings through advanced network automation.

- In January 2023, Quectel Wireless Solutions announced the launch of its ultra-wideband (UWB) automotive grade AU30Q module. Based on Qorvo’s UWB chipset, the module enables precise real-time outdoor and indoor localization and reliable wireless communication. The embedded antenna improves location capabilities and enhances security, making it ideal for keyless entry and in-car passenger detection applications. This offering strengthens Quectel’s position in the automotive field and expands its portfolio in wireless and GNSS technologies.