Welded Steel Tubes Market

According to a new comprehensive report from The Insight Partners, the global welded steel tubes market is observing healthy growth owing to the growing demand for these tubes in the construction and automotive sectors worldwide.

The report runs an in-depth analysis of market trends, key players, and future opportunities. The growth of the automotive industry has been notable, particularly in major countries such as the US, China, Germany, India, and Japan. The increasing sales and production of automotive vehicles worldwide is a major driving factor for the welded steel tubes market.

Overview of Report Findings

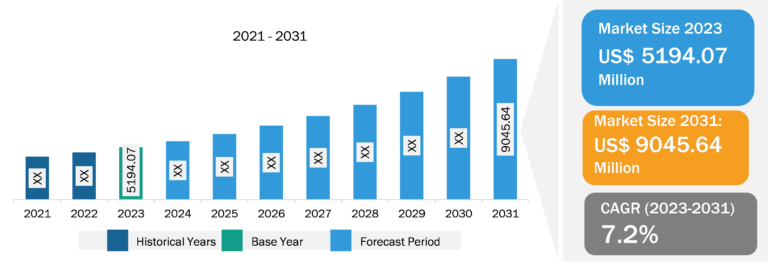

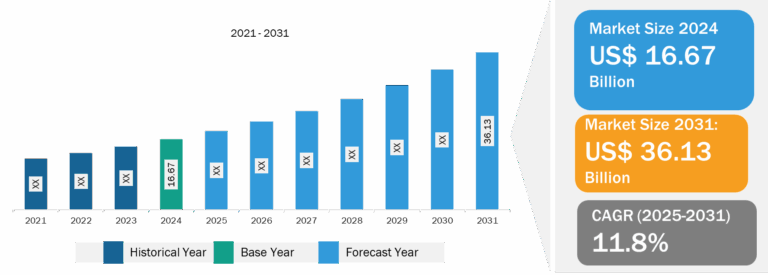

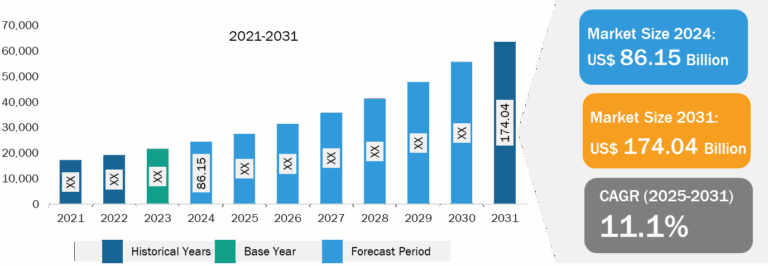

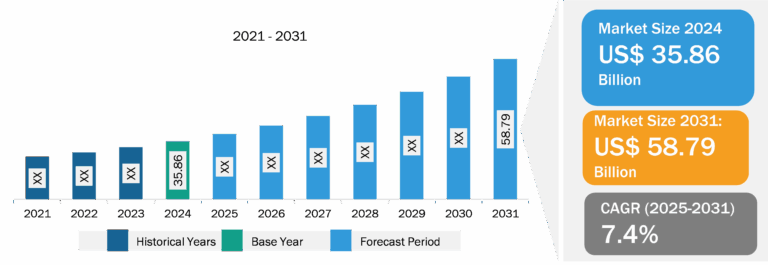

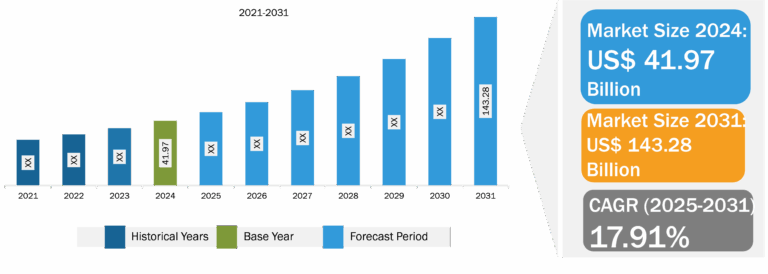

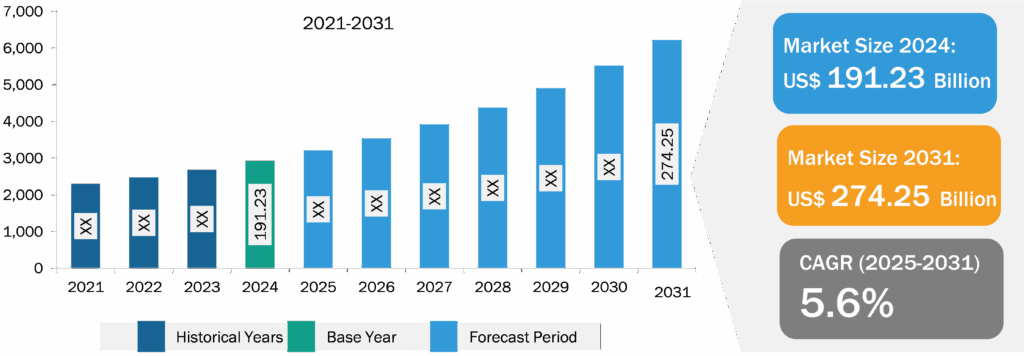

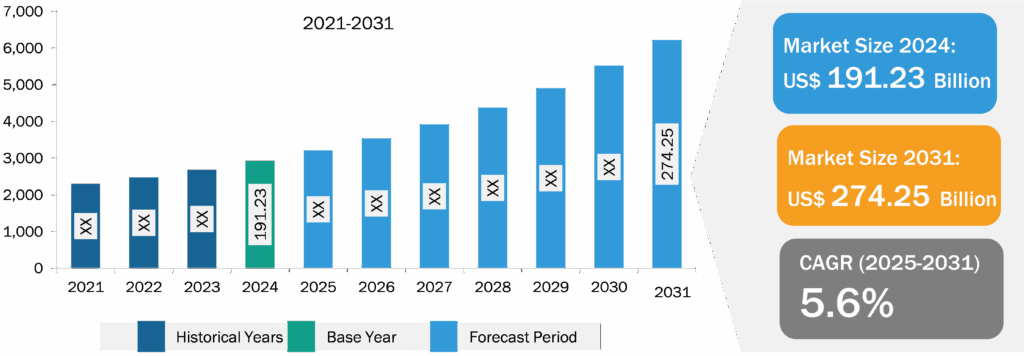

- Market Size: The welded steel tubes market size is projected to reach US$ 274.25 billion by 2031 from US$ 191.23 billion in 2024. The market is expected to register a CAGR of 5.6% during 2025–2031. Welded steel tubes are shaped in the form of hollow cylinders formed by welding metal strips or sheets. These tubes are made using a variety of processes, such as electric resistance welding (ERW), which involves heating the edges of a steel strip and then pressing them together to form a tube. Welded steel tubes have found various applications owing to their strength, durability, and cost-efficiency. Steel is a material with high tensile strength, making welded steel tubes ideal for structurally demanding applications. Tubes made of stainless steel or coated with galvanization are corrosion resistant, making them suitable for use in harsh environments such as chemical plants, water treatment facilities, and outdoor infrastructure.

- Rise in Investment in Construction Industry Worldwide: The construction industry is growing rapidly in various countries across the globe, with a rise in government investments and an increase in demand for various construction projects. Countries such as the US, China, Mexico, Brazil, and India have the most significant construction businesses in the world. According to the Associated General Contractors of America (AGC), the US construction industry is growing with an investment of ~US$ 1.4 trillion per year. In construction, welded steel tubes are used in plumbing, heating, cooling, and fire sprinkler systems. They are corrosion-resistant, durable, and can withstand high pressure and temperature. Welded steel tubes are also used in the construction of buildings, bridges, and other large infrastructure projects. They provide strong, load-bearing elements in structural frames, supporting roofs, walls, and floors. The long-term construction sector is growing rapidly owing to the increasing government investment in infrastructure development. For instance, ~US$ 1.2 trillion in funding was passed by the Bipartisan Infrastructure Law in the US, and US$ 828.8 billion was passed by the EU infrastructure development fund in Europe. Steel tubes are commonly used as columns and beams in commercial infrastructure and industrial buildings. High tensile welded steel offers greater strength and the ability to withstand both compression and tension, making it ideal for vertical and horizontal load-bearing applications.

- Increase in Importance of Welded Steel Tubes in Oil & Gas Industry: The oil and gas sector heavily relies on welded steel tubes owing to their high tensile strength, durability, and resistance to corrosion, which are critical in the challenging environments of oil exploration, production, and transportation. Welded steel tubes are used to construct pipelines that transport crude oil, natural gas, and other liquids over long distances. The strength and resistance of steel tubes to high pressures make them ideal for these applications. They can withstand the extreme pressures and environmental conditions encountered in both land and subsea pipelines. There is an increase in investment in the construction and expansion of oil and gas pipelines across the globe. For instance, in January 2025, Canada’s Alberta government partnered with Enbridge Inc., a US-based pipeline company, to expand the province’s oil and gas pipeline capacity. Alberta government exports more than 4.3 million barrels per day of crude oil to the US. Further, in July 2024, Enbridge Inc., an energy delivery company in Canada, planned to invest US$ 700 million in Mexico to build new crude oil and natural gas pipelines. The crude oil and gas pipeline, named the Canyon Oil Pipeline System, will have a capacity of 200,000 barrels per day. Welded steel tubes play a vital role in the oil and gas industry, particularly in the construction of pipelines that transport crude oil, natural gas, and other liquids over long distances. These pipes must withstand high internal pressures, mechanical stresses, and corrosive environments. High-quality carbon or alloy steel welded tubes are designed to meet these demanding requirements effectively.

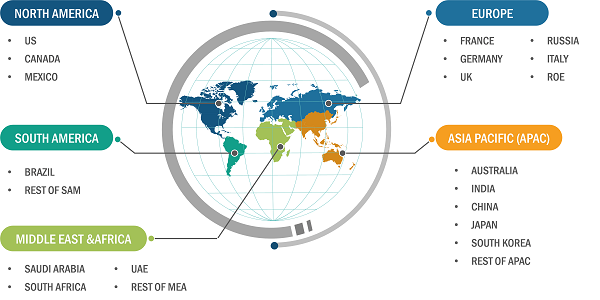

- Geographical Insights: In 2024, Asia Pacific led the market with a substantial revenue share, followed by Europe and North America, respectively. Asia Pacific is expected to register the highest CAGR during the forecast period as well.

Market Segmentation

- Based on steel grade, the welded steel tubes market is segmented into carbon base grades, boron grades, alloy grades, HSLA, AHSS, and others. The carbon base grades segment held the largest market share in 2024.

- By application, the market is divided into exhaust, automotive, appliances, medical devices, HVAC, burner, conveyor belts, and others. The automotive segment held the largest share of the market in 2024.

- Based on type, the market is divided into LSAW, SSAW, and ERW. The ERW segment held the largest share of the market in 2024.

- Based on coating type, the market is divided into clear coat and non-coated. The non-coated held a larger share of the market in 2024.

Competitive Strategy and Development

- Key Players: Major companies operating in the welded steel tubes market include COREMARK Metals; Phillips Tube Group; ArcelorMittal; Markin Tubing; Pennsylvania Steel Company, Inc.; Hofmann Industries, Inc; AMETEK Inc.; Infra-Metals Co.; Vest LLC; and RathGibsonn.

- Trending Topics: Precision ERW (Electric Resistance Welded) tubes, Structural hollow sections, Stainless steel welded tubes, Green steel production, etc.

Global Headlines on Welded Steel Tubes Market

- ArcelorMittal Acquired 28.4% Equity Share in Vallourec

- Pennsylvania Steel Company Inc Acquired Besco Steel Supply

- ArcelorMittal Launched Low Carbon Welded Steel Tubes

Conclusion

Asia Pacific accounted for the largest market share in 2023, owing to the increasing demand for welded steel tubes in the growing construction sector. The Asia Pacific construction sector was valued at US$ 4.4 trillion in 2023, representing 46% of the global construction sector output. The construction sector in Asia Pacific is driven by the increasing private and public sector investments in infrastructure developments. Due to their high load-bearing capacity, welded steel tubes are widely used in building frameworks, including columns, beams, and trusses. Welded steel tubes are used in the construction of bridges, road barriers, and other infrastructure, resisting stress and environmental factors. Further, according to the Asian Development Bank (ADB), the infrastructure development sector investment in Asia Pacific will reach US$ 1.7 trillion per year by 2030.

The North America welded steel tubes market is segmented into the US, Canada, and Mexico. In terms of revenue, in 2023, the US held the largest share of the market. Construction is one of the exponentially growing industries in North America. Government bodies in the US, Canada, and Mexico are investing substantially in developing residential and non-residential infrastructures, including housing units, airports, hospitals, hotels, office buildings, and universities. According to an Associated Builders and Contractors analysis of data by the US Census Bureau, national total construction spending increased by 4.6% in September 2024 on a year-on-year basis compared to September 2023. With the burgeoning number of infrastructural projects, the demand for welded steel pipes used in engineering fields, such as building structures, steel frames, and supports, is also growing. Europe’s welded steel tube market is growing at a moderate pace owing to the increasing investment in the construction sector with government initiatives and funding. In the European Union, under the Cohesion Policy, the construction sector investments are likely to reach almost US$ 80.54 billion during 2021–2027. These investments are targeted to improve energy efficiency and construction sector growth. The construction sector was responsible for 9% of the European Union’s GDP in 2023. According to the European Commission, the total investment in the construction sector reached US$ 1,760.54 billion in 2023 and is growing at a rapid pace.

Countries such as Brazil, Argentina, and Chile are making significant investments in infrastructure projects, including roads, bridges, and urban development. The oil and gas sector, particularly in countries such as Brazil, Peru, and Chile, also plays a vital role in fueling welded steel tube market growth. Governments of countries in South America are investing heavily in infrastructure projects to enhance transportation networks, including roads, railways, bridges, and ports. Large-scale public projects also include energy production (especially renewable energy) and water treatment facilities, which drive the demand for welded steel tubes.