Well Intervention Market

According to a new comprehensive report from The Insight Partners, the global well intervention market is observing healthy growth owing to the rising oil and gas demands across different regions.

The report runs an in-depth analysis of market trends, key players, and future opportunities. Well intervention, or well work, is a set of repair and maintenance operations carried out during the active life of oil and gas wells to extend their lives.

Overview of Report Findings

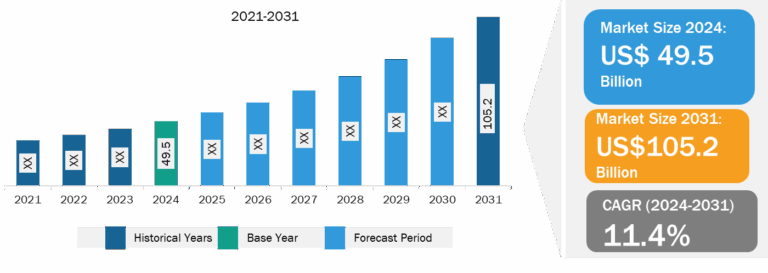

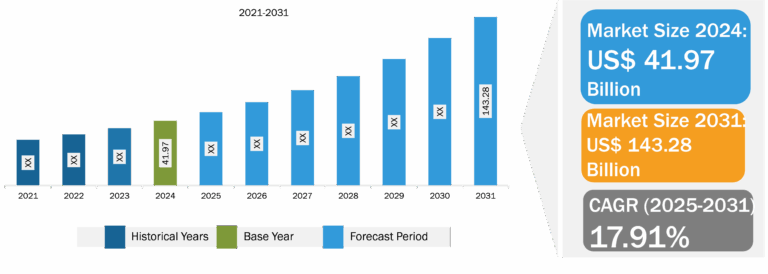

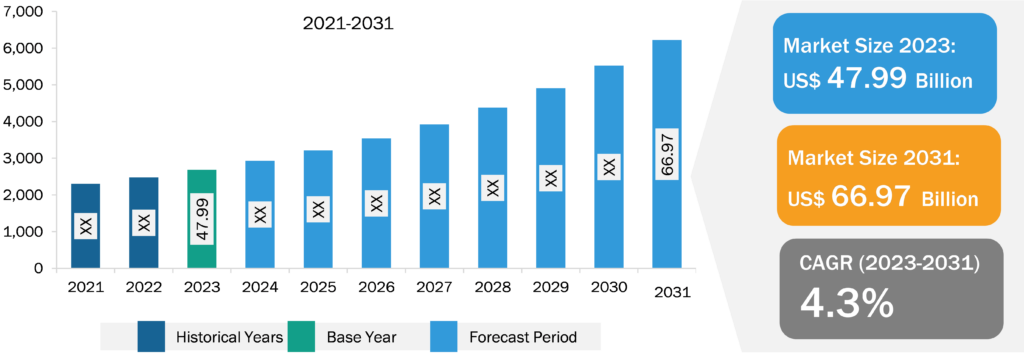

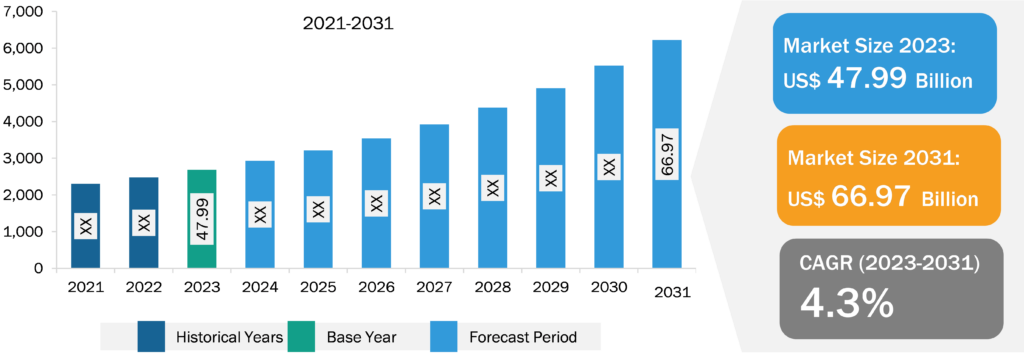

- Market Growth: The well intervention market is expected to reach US$ 66,967.81 million by 2031 from US$ 47,998.48 million in 2023; it is expected to record a CAGR of 4.3% during the forecast period. Government policies and initiatives supporting the oil & gas industry favor the growth of the well intervention market. In June 2023, the government of Norway announced that it had approved oil companies to develop 19 oil & gas fields in the country. The oil & gas sector is recognized as a crucial part of the US economy. However, in recent years, the sector has come under inspection based on its contribution to environmental pollution. Various policies and norms have been introduced in combination with other measures applied to boost alternative energy production and establish natural gas infrastructure. The rise in onshore drilling activities in the oil & gas industry has a positive impact on the well intervention market. The burgeoning number of onshore oil & gas projects owing to financial aid in terms of incentives for major projects and tax reductions drive the well intervention market growth.

- Developing Offshore Oil and Gas Industries: A few of the key developments that took place in recent times in the offshore oil and gas industries across the world are mentioned below:

- In October 2022, the government of Italy announced plans to double the gas production from its existing natural gas production capacity. This plan included the construction of new offshore gas fields across the country.

- In May 2023, China announced the completion of the construction of a new offshore drilling rig with a capacity of 12,000 ton. The country is pushing its offshore drilling activities to cut down the dependency on oil and gas imports. In June 2023, China announced its intentions to undertake deeper drilling operations into offshore oil and gas platforms to lower import dependency.

- In July 2022, the Philippines announced a plan to redevelop its 30-year-old Cadlao Oil Field in order to boost its offshore oil production in the coming years.

- In May 2022, the Hoang Long joint operating company (a venture of two different joint operating companies) in Vietnam secured a jack-up drilling rig for their planned offshore development wells in the Cuu Long basin.

- In June 2023, the Abu Dhabi National Oil Company (ADNOC) Drilling announced signing a US$ 220-million deal to buy 2 new jack-up rigs for its offshore drilling.

- In January 2023, Masirah Oil, a subsidiary of Singapore-based Rex International, announced the completion of an offshore drilling campaign in Oman’s Block 50.

- In October 2023, KCA Deutag—a leading drilling, engineering, and technology partner—announced its first locally made rig in Oman during a ceremony of Petroleum Development Oman (PDO).

- In November 2023, Shell Egypt announced the completion of drilling of the Mina West well in the North East El-Amriya block in the Mediterranean Sea as the 1st well in its three-well exploration campaign.

The planning of new offshore plan construction projects, discovery of new offshore oil & gas field locations, rise in investments in offshore locations, and refurbishment of existing offshore oil and gas rigs are a few crucial factors contributing to the growth of the offshore oil and gas industries, which subsequently bolster the well intervention market.

- Increasing Oil and Gas Demands: According to information provided by the International Energy Agency in October 2024, global oil demand is projected to increase by 900,000 barrels per day (kb/d) in 2024 and by 1 million barrels per day in 2025. China’s demand for crude oil reached a record high at 16 mb/d in March 2023. The Russian Federation’s invasion of Ukraine has threatened the global energy supply with an upsurge in oil and gas prices. In May 2022, the European Council announced a partial ban on Russian oil imports. According to the IEA, European countries imported 23% of their oil from Russia in 2021. Sourcing oil from more far-flung locations is expected to keep prices high. Elevated crude oil prices compel oil and gas companies to focus on extracting oil more profitably and ramping up the production levels with advanced techniques such as well intervention.

- Integration of Simulation Technologies: Well intervention using simulation technologies involves the use of specialized software programs or physical models that are carefully created to replicate a variety of operations inside the well. These operations span the drilling, completion, and production phases of a well’s life cycle. The primary purpose of these simulators is to provide a realistic, reliable, and safe environment for training, strategic planning, and improving intervention activities. Simulation software and programs can replicate various well intervention methods, including wireline services, coiled tubing services, hydraulic workover, snubbing, and fishing services. Their capabilities are extended to mimic the behavior of an oil and gas well and its adjacent formation under various operational scenarios. These scenarios include fluctuations in well pressure and temperature, changes in well geometry, and changes in reservoir properties. In addition, the simulators can accurately reproduce the responses of various intervention tools and devices such as pumps, valves, and sensors. This capability allows operators to practice precise operation and placement of well intervention tools in a controlled and safe environment.

- Geographical Insights: In 2023, North America led the market with a substantial revenue share, followed by Asia Pacific and Europe, respectively. Asia Pacific is expected to register the highest CAGR during the forecast period.

Market Segmentation

- Based on service, the well intervention market is segmented into logging and bottomhole survey, tubing/packer failure and repair, and stimulation. The logging and bottomhole survey segment held the largest market share in 2023.

- By application, the market is divided into onshore and offshore. The onshore segment held a larger share of the market in 2023.

- Based on intervention, the market is divided into light, medium, and heavy. The light segment held the largest share of the market in 2023.

- Based on well type, the market is divided into horizontal and vertical. The vertical held ta larger share of the market in 2023.

Competitive Strategy and Development

- Key Players: A few of the major companies operating in the well intervention market are Halliburton Co, Baker Hughes Co, Weatherford International Plc, Expro Group Holdings NV, Oceaneering International Inc, Archer Ltd, Schlumberger NV, Forum Energy Technologies Inc, Helix Energy Solutions Group Inc, and Trican Well Service Ltd.

- Trending Topics: Well Intervention, Well Completion, Oil & Gas Well Intervention Services, etc.

Global Headlines on Well Intervention Market

- Expro acquired Coretrax

- Baker Hughes completed the acquisition of Altus Intervention

- Baker Hughes acquired AccessESP

- Expro Group Holdings secured a 10-year Production Solutions contract

Conclusion

North America led the global well intervention market in 2023. It is among the largest crude oil and natural gas producers in the world. The US was the largest oil producer globally in 2023, as it accounted for more than 20% of the global production levels that year. The country’s oil & gas sector records significant year-on-year growth owing to the discovery of new rigs. In addition, natural gas production in the US has increased significantly in recent years as improvements in drilling and well intervention technologies have made it commercially possible to recover oil trapped in mature oil wells. The awareness and acceptance of such modern technologies for enhancing oil recovery are expected to benefit the well intervention market in North America. Moreover, the discovery of new offshore oil and gas rig locations in the Gulf of Mexico is likely to provide new opportunities for the market during the forecast period. For more information and to access the f