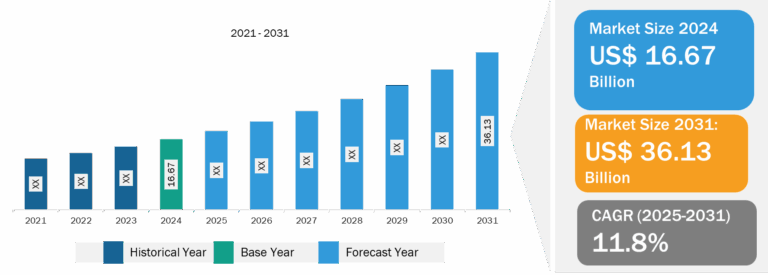

Extracorporeal CO2 Removal Devices Market

Extracorporeal CO2 removal devices are an efficient therapy for patients with hypercapnic respiratory failure. They can enable doctors and healthcare professionals to improve lung protective ventilation. Extracorporeal CO2 removal devices can remove enough CO2 to reduce alveolar minute ventilation by 50%, significantly reducing the partial pressure of carbon dioxide (PaCO2). Therefore, various advantages of extracorporeal CO2 removal devices are expected to increase the overall market development. Factors such as high COPD and other respiratory disease burdens and increasing product approvals are facilitating the expansion of the extracorporeal CO2 removal devices market size. However, the risk of complications during extracorporeal CO2 removal therapy hamper the growth of the extracorporeal CO2 removal devices market. In addition, new advanced technologies are expected to bring new trends in the extracorporeal CO2 removal devices market in the coming years.

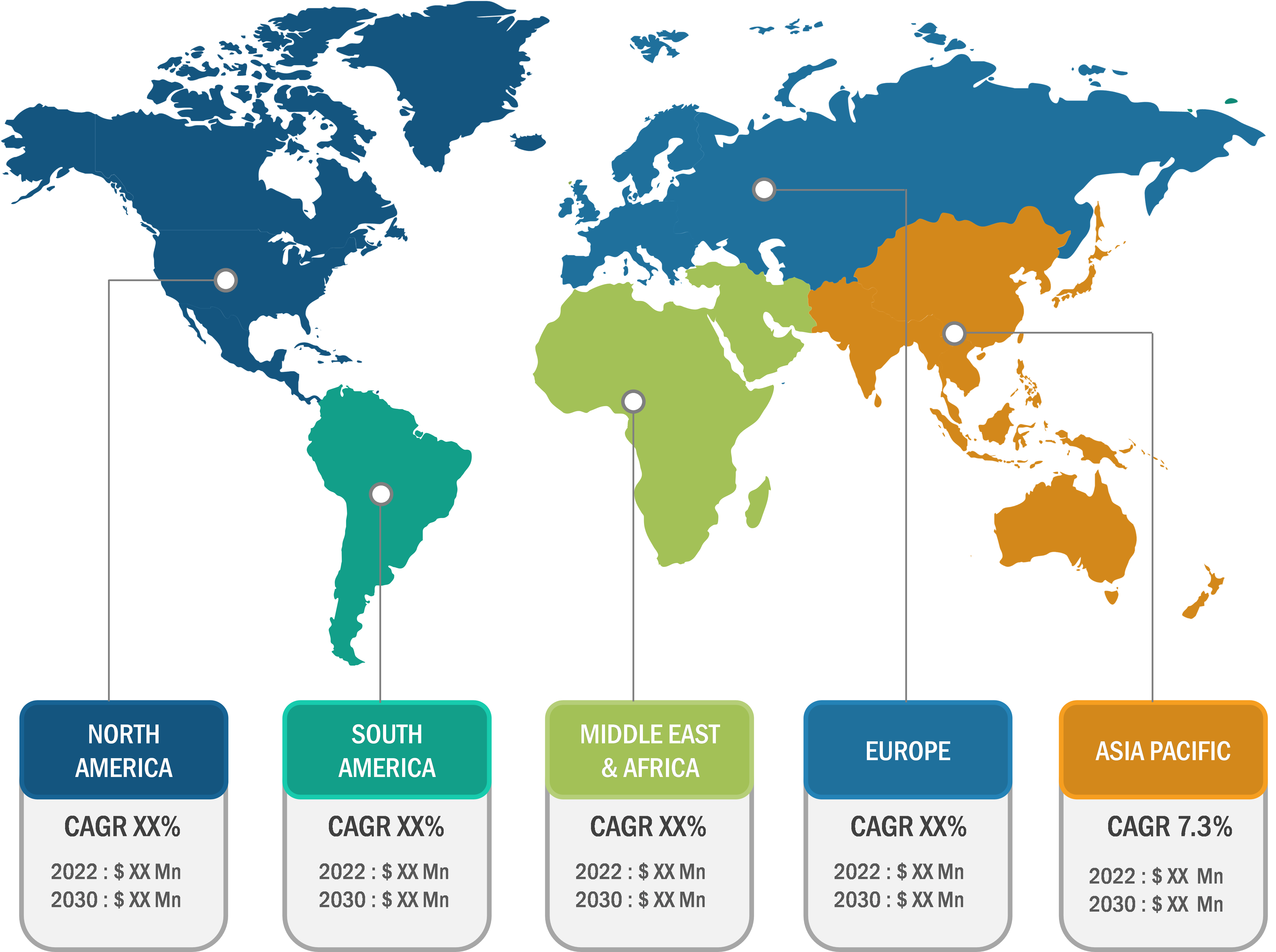

North America accounted for a major share of the global extracorporeal CO2 removal devices market in 2022 due to the improved healthcare infrastructure and high adoption of extracorporeal CO2 removal devices, especially during the COVID-19 pandemic in the US and Canada. A notable growth of the extracorporeal CO2 removal devices market is further anticipated in the region during the forecast period due to the increasing incidence of chronic respiratory diseases and the preference for safe and rapid minimally invasive ventilators.

Asia Pacific is expected to register the fastest CAGR in the global extracorporeal CO2 removal devices market during 2022–2030. The market growth in the region is ascribed to a large patient pool, growing awareness of acute respiratory failure, and increasing government healthcare spending in developing countries such as India and Japan. Further, multinational companies look forward to investing in developing countries such as China, thereby boosting the market growth in the region.

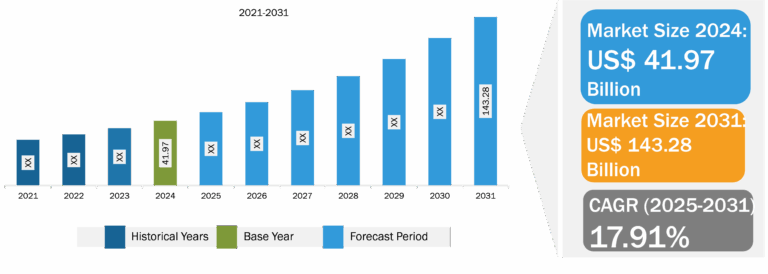

In terms of application, the extracorporeal CO2 removal devices market is segmented into acute respiratory distress syndrome, chronic obstructive pulmonary disease, and others. The acute respiratory distress syndrome segment held the largest market share in 2022. The chronic obstructive pulmonary disease segment is anticipated to register the highest CAGR during the forecast period. Increasing awareness of ARDS and its early detection has resulted in more patients being diagnosed and treated, resulting in greater demand for extracorporeal CO2 removal devices tailored for ARDS management. As a result, healthcare providers have become more confident in incorporating extracorporeal CO2 removal devices into their ARDS treatment protocols.

Extracorporeal CO2 removal devices allow a reduction in respiratory rate and tidal volume, resulting in a prolonged expiratory time that is better adapted to the high expiratory time constant of the respiratory system. According to the British Lung Association, there are around 1.2 million people in the UK living with diagnosed COPD. Therefore, the increasing prevalence of COPD is predicted to accelerate the extracorporeal CO2 removal devices market.

Strict Mandates Related to Extracorporeal CO2 Removal Devices Restrain Market Growth

Extracorporeal CO2 removal devices are sophisticated medical devices with complex components, including specialized gas exchange membranes, blood pumps, monitors, and control systems. Extracorporeal CO2 removal devices must meet strict quality and safety standards to ensure patient safety and regulatory compliance. Manufacturers must invest in regulatory compliance activities, such as obtaining permits and certifications, which can be costly and time-consuming. As extracorporeal CO2 removal technology evolves, healthcare facilities may need to upgrade their equipment to maintain compatibility with the latest advances and safety standards. Due to these factors, the demand for extracorporeal CO2 removal devices is limited.

Extracorporeal CO2 Removal Devices Market: Product Overview

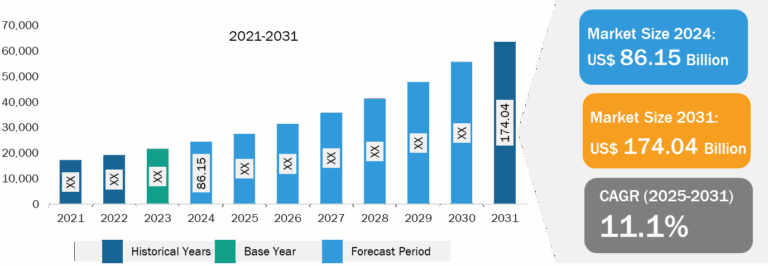

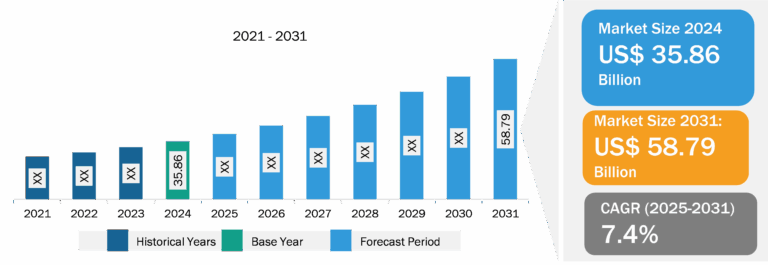

Based on product, the extracorporeal CO2 removal devices market is divided into extracorporeal CO2 devices and consumables. The extracorporeal CO2 devices segment held a larger market share in 2022. The consumables segment is anticipated to register a higher CAGR of 7.6% during the forecast period.

Due to technical simplification, extracorporeal CO2 removal devices require a few personnel and logistics, thereby increasing patient preference. This led the extracorporeal CO2 removal devices segment to secure its market position.

The process of extracorporeal CO2 removal requires a fresh set of consumables for every patient, owing to which there is a high demand for consumables in various COPD and ARDS-related procedures. Thus, the extracorporeal CO2 removal devices market for the consumables segment is expected to continue to grow during the forecast period.

Extracorporeal CO2 Removal Devices Market: Competitive Landscape and Key Developments

Getinge, ALung Technologies, Inc.; Estor, NovaLung GmbH, Hemodec, Baxter Healthcare, Eurosets, LivaNova, Medtronic, and Xenios AG are among the key companies operating in the extracorporeal CO2 removal devices market. Leading players are implementing strategies such as expansions, new product launches, and acquisitions (companies or new clientele) to tap prevailing business opportunities.

- In October 2022, Alung Technologies evaluated the safety and effectiveness of using the Hemolung RAS for low-flow extracorporeal CO2 removal (ECCO2R) as an alternative or adjunct to invasive mechanical ventilation for patients requiring respiratory support due to acute exacerbations of COPD.

- In March 2022, Respira Labs, a US-based respiratory health technology company, launched Sylvee. This AI-powered wearable lung monitor uses acoustic resonance to assess lung function and identify lung volume fluctuations. It can help detect and treat COPD, asthma, and COVID-19.

- In May 2021, ALung Technologies, Inc. received FDA clearance for its next-generation Hemolung RAS extracorporeal CO2 removal system, designed to provide respiratory support to patients with acute respiratory failure.

- In May 2020, ALung Technologies, Inc. announced the commercial development of the next-generation artificial lung called the Hemolung Respiratory Assist System (RAS).