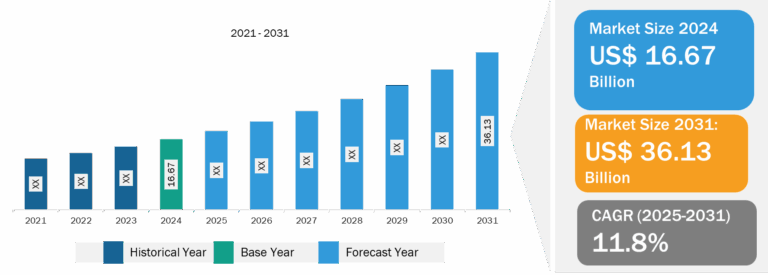

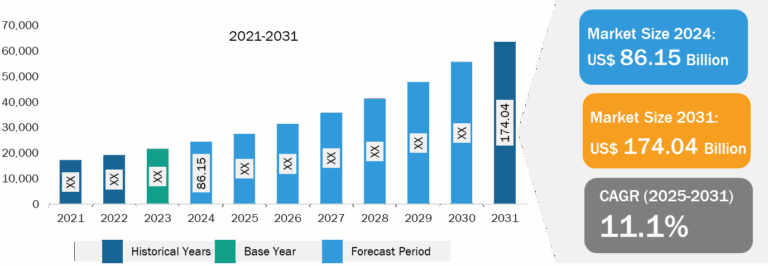

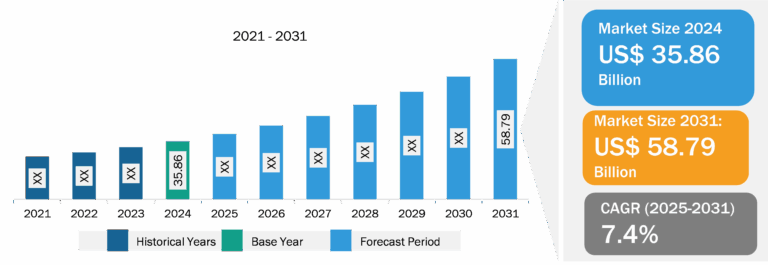

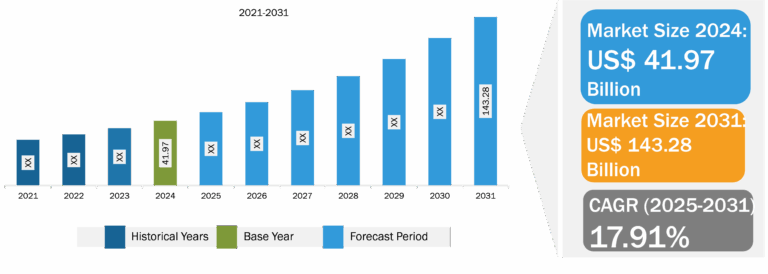

ENT Devices Market

The increasing number of ENT diseases or disorders and strategic initiatives in ENT devices largely drive the ENT devices market size. However, the high cost associated with ENT devices hinders the ENT devices market growth.

Increasing Product Development Activities are Fueling ENT Devices Market Growth

The overall success rate of ENT devices is largely driven by their portability, convenience, and effectiveness. These advantages accelerate the demand for ENT devices, owing to which a growing number of product launches, approvals, and developments are in place to meet the anticipated demand in the years to come. A few of the major developments and approvals are listed below:

- In December 2023, Advanced Bionics received approval from the Food and Drug Administration (FDA) for Marvel CI, which is a cochlear implant sound processor product. Advanced Bionics expanded its feature offerings—such as remote programming through patient’s smartphone, linked two-ear solutions with a CROS device, and target cochlear implant (CI).

- In June 2023, Sonova Holding AG launched Sennheiser All-Day Clear in the US. The introduction of the Sennheiser All-Day Clear family expands the company’s branded solutions to people with early-stage hearing loss, ranging from prevention to situational assistance.

- In August 2023, Cochlear Limited launched the next-generation Cochlear Osia System that can carry out an MRI at 3.0T. This system is designed to improve hearing outcomes for people with mixed hearing loss, conductive hearing loss, and single-sided sensorineural deafness (SSD). The OSI300 Implant is an active bone conduction system that allows patients to undergo MRI scans at 1.5T and 3.0T without having to undergo surgery.

- In July 2022, Zsquare received FDA 510K clearance to market its first product, the Zsquare ENT-Flex Rhinolaryngoscope. The company proposed to launch a pilot program in the US hospitals and physician practice offices. The Zsquare ENT-Flex Rhinolaryngoscope is indicated for use in diagnostic ENT procedures via nose and throat and is the only scalable platform capable of transmitting high-resolution images in flexible, single-use endoscopes.

- In March 2022, Zsquare raised US$ 15 million in a financing round led by private equity firm Chartered Group to establish its single-use ear, nose, and throat (ENT) endoscope. The company planned to introduce the disruptive ENT endoscope after receiving the US FDA clearance. Zsquare aims to use the funds in R&D activities to expand the potential use of its ENT products in other indications.

- In October 2022, Lexie Hearing launched the Lexie B2 hearing aids, powered by Bose, adjoining a third hearing aid model to its audiologist-quality hearing aid products. Lexie B2 hearing aids are receiver-in-canal hearing aids that provide a more natural and clear sound experience to the user, featuring the world’s first self-tuning system that combines with the Lexie app. The device is the first fully rechargeable hearing aid compatible with the Lexie app.

Thus, such increasing advancements by various market players and growing product approvals are likely to catalyze the global ENT devices market during the forecast period.

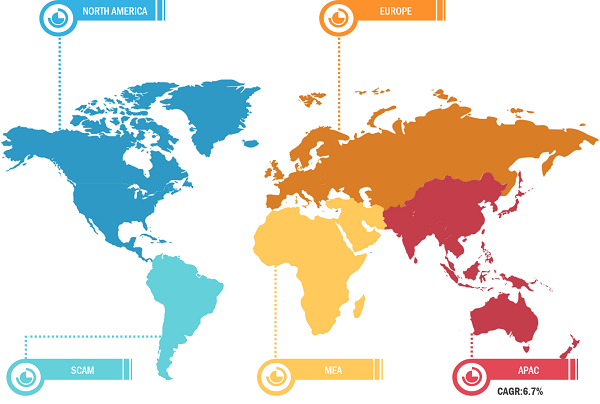

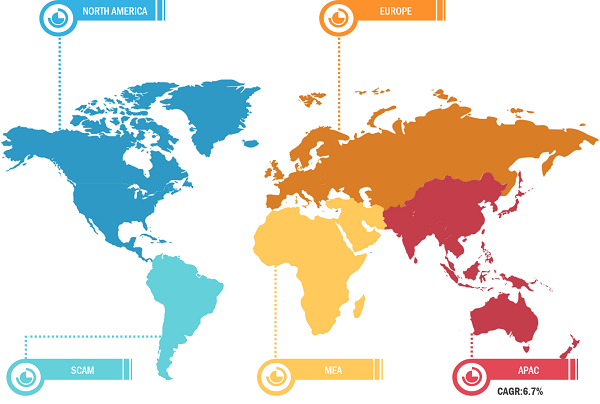

North America held the largest share of the global ENT devices market in 2022 owing to the increasing technological advancements, rising number of ENT diseases or disorders, growing geriatric population, and several key market players involved in new and existing product developments. Asia Pacific is predicted to register the highest CAGR during 2022–2030. The US held the largest share of the ENT devices market in North America in 2022. The high prevalence of ENT diseases and disorders, product launches, and reimbursement scenario for ENT devices are among the factors driving the growth of the ENT devices market in the US. As per the National Institute on Deafness and Other Communication Disorders, ~30 million people, or 13% of the US population aged 12 years and above, experienced hearing loss in one or both ears in 2021. As per the same source, ~28.8 million people in the US could benefit from the use of hearing aids. The country has a presence of leading global market players. Furthermore, FDA approval for OTC products is expected to create ample opportunities in the market. In October 2023, Audien Hearing launched the world’s first FDA-compliant hearing aid sold over-the-counter (OTC)—ATOM ONE—for less than US$ 100. The ATOM ONE would allow millions of people suffering from hearing loss to walk in and purchase an economical device suiting their or their loved ones’ needs. Therefore, the increasing prevalence of hearing impairment among large populations, new product launches, and availability of OTC products at economical pricing favor the market growth in the US.

ENT Devices Market: Competitive Landscape and Key Developments

Innovia Medical, Sony Electronics, Cochlear Limited, Karl Storz SE & Co. KG, Medtronic PLC, Stryker Corporation, Smith & Nephew PLC, Johnson & Johnson MedTech, Olympus Corporation, and Advanced Bionics are a few key companies operating in the ENT devices market. Market players adopt product innovation strategies to meet evolving customer demands, thereby maintaining their brand names in the ENT devices market.

A few recent developments in the global ENT devices market are mentioned below:

- In February 2023, Innovia Medical launched the Summit Medical ENT product range in the UK. The Summit Medical ENT product line features various premium essentials, including Grommets and Ventilation Tubes, Rhino Rocket, AbsorbENT Nasal and Sinus Packs, and Denver Splint.

- In October 2022, Sony Electronics introduced its first over-the-counter hearing aids in the market. The company is re-imagining the hearing device space, focusing on innovation, accessibility, and personalization. The unique products were developed in partnership with WS Audiology. The first two products to debut from the partnership included the CRE–C10 and the CRE–E10 self-fitting OTC hearing aids. Sony’s goal with these devices is to break down the barriers faced by individuals with signs of mild to moderate hearing loss.