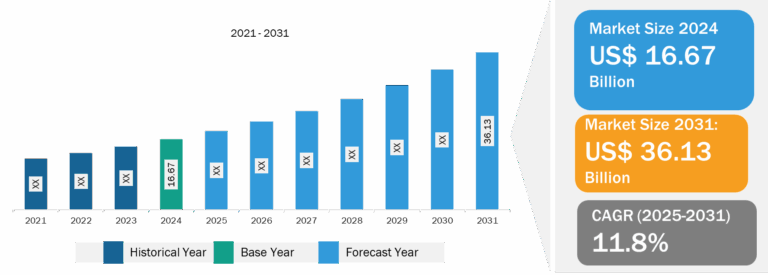

Australia Lung Cancer Screening Market

Market players are adopting organic and inorganic growth strategies to expand their footprint in the Australia lung cancer screening market by accounting largest share. In June 2022, Royal Philips announced it has teamed up with Biodesix, Inc. to incorporate the results of Biodesix’s Nodify Lung blood-based lung nodule risk assessment testing into Philips Lung Cancer Orchestrator lung cancer patient management system. The incorporation of proteomics data – along with the radiologic and patient history data currently used to determine treatment decisions can help create diagnostic efficiency for cancer care centers in the management of a growing number of lung nodule cases via the contextual launch of Biodesix Nodify Lung application within Lung Cancer Orchestrator.

Based on cancer type, the Australia lung cancer screening market is bifurcated into non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC). The non-small cell lung cancer (NSCLC) segment held the largest share of the market in 2022 and small cell lung cancer (SCLC) is anticipated to register the highest CAGR in the market during the forecast period. Non-small cell lung cancer (NSCLC) occurs when abnormal cells proliferate in the lung tissues. There are three primary forms of NSCLC cancer—adenocarcinoma, squamous cell carcinoma, and large cell carcinoma. Adenosquamous carcinoma and sarcomatoid carcinoma are other subtypes of NSCLC, which are substantially less frequent. NSCLC develops more slowly than small cell lung cancer. It usually spreads to other parts of the patient’s body by the time it is diagnosed. Therefore, early diagnosis and treatment are crucial. According to National Foundation for Cancer Research, NSCLC accounts for nearly 9 out of every 10 diagnoses. As per the same source, large-cell undifferentiated carcinoma lung cancer accounts for approximately 10–15% of all NSCLC diagnoses. It can begin in any part of the lung and is known to grow and spread quickly. The aforementioned factors are responsible for segmental growth thereby accounting largest market share for NSCLC market growth during 2022-2030 responsible for influential market growth of Australia lung cancer screening.

Likewise, Small cell lung cancer (SCLC) usually initiates in the bronchi or the airways, which lead from the trachea and enter the lungs and then branch off progressively into tiny air sacs called alveoli. After affecting the bronchi, SCLC quickly proliferates and spreads to other body parts, including the lymph nodes. According to National Foundation for Cancer Research, this type of lung cancer represents less than 20% of lung cancers and is commonly caused by tobacco smoking. SCLC is categorized into small cell carcinoma and combined small cell carcinoma. These two categories differ in the small cells when scanned under a microscope. Small cell carcinoma is the prevalent type of SCLC and appears flat under a microscope, resembling oats. Combined small cell carcinoma refers to a tumor comprising small cell carcinoma cells and a small number of NSCLC cells. The aforementioned factors are responsible for accounting maximum CAGR for SCLC segmental growth during the forecast period from 2022-2030 of Australia lung cancer screening.

Australia Lung Cancer Screening Market: End User Overview

The Australia lung cancer screening market, based on end user, is segregated as hospitals, diagnostic centers, and others. The hospitals segment held the largest share of the Australia lung cancer screening market in 2022. Hospitals are the fastest-growing end users of the lung cancer screening market. Hospitals are the primary healthcare centers patients seek for their first aid and treatment. The number of patients visiting hospitals is more than other healthcare centers. These centers offer various services and good-quality treatment. The treatment fee is reimbursed; also, medicines are available quickly in these healthcare centers.

The cost of medical facilities has seen a spike in the past few decades. Advanced diagnostic technologies have paved the way for early and improved detection of disease as well as supported research for disease treatment. Increasing affordability and awareness among people is expected to continue to spur the medical services. It is evident in many countries, as it contributes significantly toward GDP growth.

Hospitals are complex organizations that provide healthcare services such as disease screening, diagnosis, and treatment with the help of modernized equipment. The increasing number of hospital admissions, coupled with high prevalence of lung cancer, is projected to drive the growth of the hospital segment in the Australia lung cancer screening market during the forecast period. Moreover, Australia is witnessing a huge demand for advanced hospital settings to cope with the increasing patient pool and rising public health concerns. The aforementioned factors are responsible for influential segmental growth during the forecast period ultimately responsible for Australia lung cancer screening market growth and size from 2022-2030.

Australia Lung Cancer Screening Market: Competitive Landscape and Key Developments

Intelerad Medical Systems Incorporated, Nuance Communications Inc, GE HealthCare Technologies Inc, Medtronic Plc, Canon Medical Systems Corp, Koninklijke Philips NV, Siemens AG, Aetna Inc, bioAffinity Technologies, Inc., LungLife AI, Inc., and Lung Screen Australia Pty Ltd among others are among the key companies operating in the Australia lung cancer screening market. Leading players adopt strategies such as the launch of new products, expansion and diversification of their market presence, and expansion of new customer base for tapping prevailing business opportunities.

- In May 2021, Genetron Holdings Limited announced a strategic partnership with Siemens Healthineers at the China Medical Equipment Fair. This partnership aims to promote the large-scale application of Genetron’s S5 platform and lung cancer 8-gene IVD assay in Chinese hospitals to provide non-small cell lung cancer (NSCLC) patients with efficient and accurate personalized diagnosis and treatment guidance.

- In November 2021, GE Healthcare and Optellum collaborated to advance precision diagnosis and treatment of lung cancer. Together, the companies are seeking to address one of the largest challenges in diagnosing lung cancer, helping providers to determine the malignancy of a lung nodule: a suspicious lesion that may be benign or cancerous.

- In August 2022, Intelerad Medical Systems announced its acquisition of PenRad Technologies, Inc. (PenRad), a software provider for enhancing breast imaging and lung screening productivity. The acquisition will expand Intelerad’s product offerings for mammography and lung analytics, optimizing workflow for radiologists and boosting patient health outcomes.