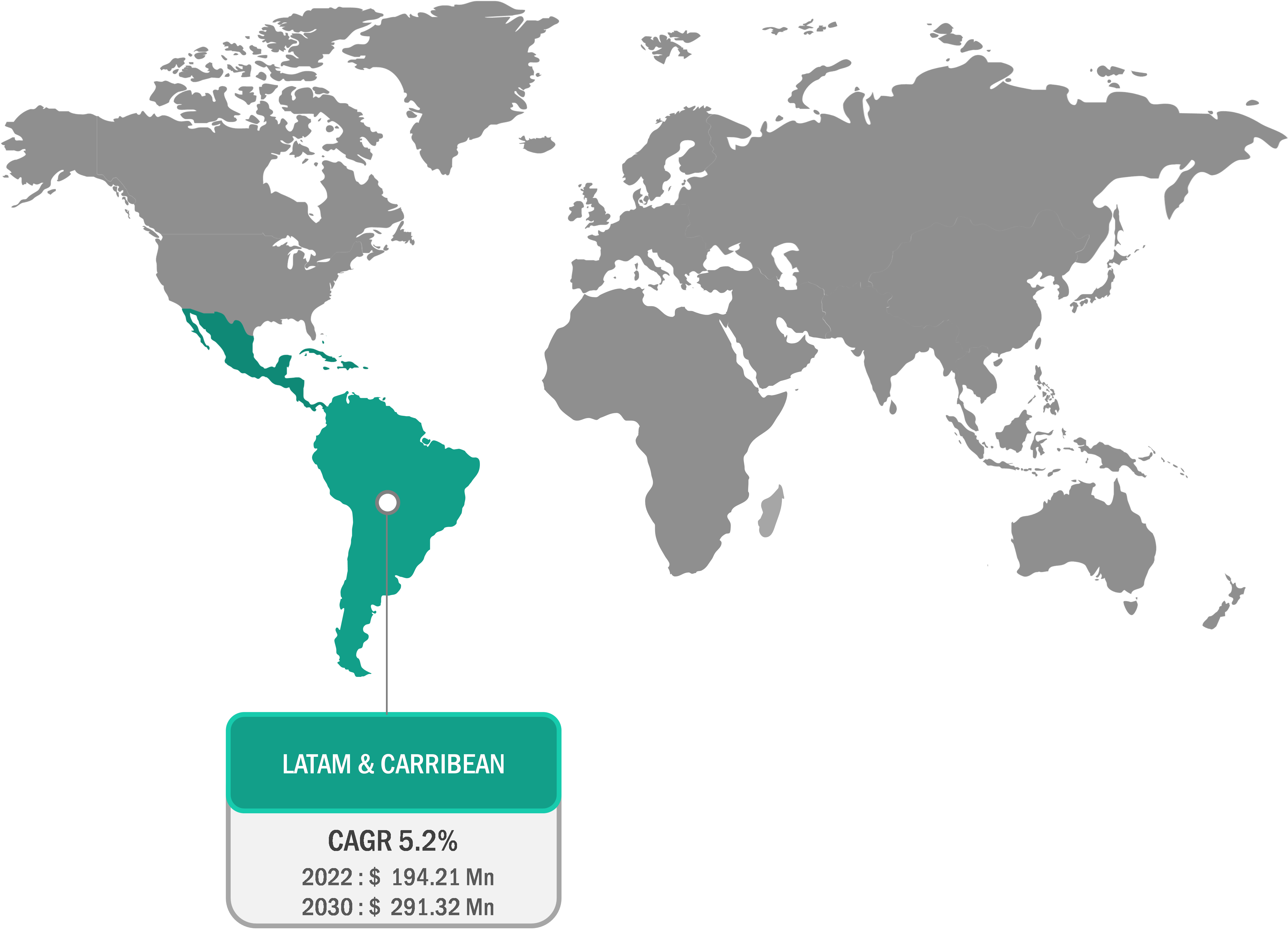

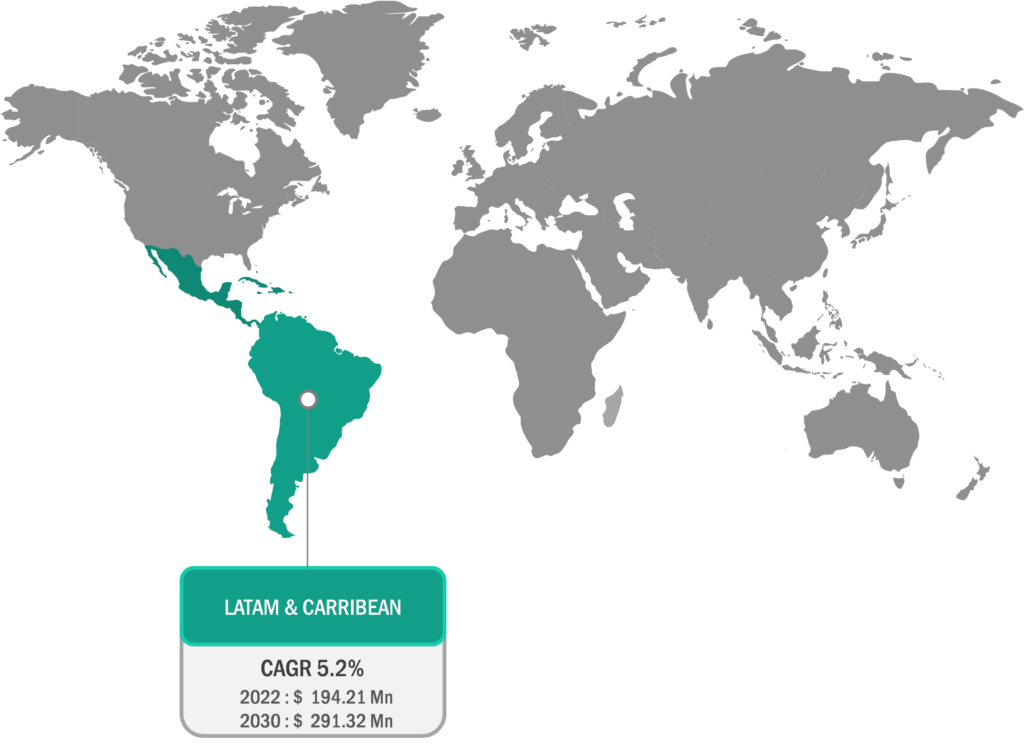

LATAM & Caribbean Disposable Surgical Gloves Market

Growing Consumption and Distribution of Disposable Surgical Gloves

In Latin America, the growing awareness of sanitization and prevention of infections has increased the import of medical consumables and disposables. Countries in Latin America have increased the per capita consumption of rubber gloves. During the COVID-19 pandemic, the import of disposable surgical gloves increased significantly. According to the Chequeado, Argentina’s open-access platform, Buenos Aires Province imported 12 million disposable gloves (disposable surgical gloves) worth US$ 54 million from China in 2020. Similarly, in 2020, according to Wilson Center data, Venezuela imported 100,000 protective suits and surgical gloves from China.

The medical industry growth further escalated due to increasing medical tourism, aesthetic procedures, and the growing number of healthcare facility centers, leading to increasing demand for disposable surgical gloves. Thus, companies are witnessing regional growth opportunities and expanding their distribution network in Latin America. In March 2020, Protective Industrial Products, Inc. expanded its distribution in Latin American countries. The company made its decision after the success of its expansion in Mexico.

Similarly, Sri Trang Gloves Public Company Limited (STGT), Thailand, expanded its footprint in Latin America. STGT has continuously increased its distribution of rubber gloves since 2020. The company has generated revenue from producing and distributing rubber gloves in Latin America by 10%, 11.2%, and 14% in 2020, 2021, and 2022, respectively. The countries in Latin America have a higher potential for growth opportunities for rubber glove usage. The growth opportunities result from developing public health and sanitation systems and the increased purchasing power of countries in the region, leading to market growth.

Key Market Trend

Rising Medical Tourism

Latin America is among the fastest-growing regions for the medical industry. The growing medical tourism, increasing investments for developing healthcare infrastructure, and growing number of hospitals and clinics are leading to the demand for medical consumables, including disposable surgical gloves. According to the Pacific Prime Latin America article published in July 2023, Latin America has over 19,000 hospitals. Brazil is the leading country in the region, surpassing the number of hospitals in the US; in 2023, the country had a count of 6,642 hospitals. The medical industry has drastically transformed and adopted minimally invasive surgeries in recent years. Countries such as Brazil, Mexico, Costa Rica, Argentina, Colombia, and Panama have well-established medical tourism in Latin America, offering medical care at cheaper rates under medical tourism plans. Brazil is well-known for aesthetic and cosmetic procedures, and Mexico is well-known for surgical procedures. The countries have attracted the maximum number of patients from the US and Canada, as Latin American countries offer more convenience and have improved medical capabilities. The Pacific Prime Latin America article published in July 2023 also revealed that medical procedures in Mexico and Costa Rica could save up to 36–89% and 44–89%, respectively, to the patients compared to the costs in the US.

Similarly, countries such as Chile, Peru, Cuba, and the Caribbean Islands are witnessing good growth in their medical tourism. The growing medical tourism trend in Latin America is expected to be similar in the coming years. It will likely boost demand for disposable surgical gloves, leading to market growth. Moreover, the COVID-19 pandemic has widely helped change the healthcare landscape in the region; it has evolved the medical industry and is expected to show significant growth in the future.

LATAM & Caribbean Disposable Surgical Gloves Market: Segmental Overview

The “LATAM & Caribbean Disposable Surgical Gloves Market” is segmented based on type, sterility, form, distribution channel, end user, and region. Based on type, the disposable surgical gloves market is segmented as latex, nitrile, vinyl, neoprene, natural rubber, polyisoprene, and others. The nitrile gloves segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 5.1% during 2022–2030. Based on the form, the LATAM & Caribbean disposable surgical gloves market is bifurcated into powder and powder-free. The powder-free segment held a larger market share in 2022 and is anticipated to register a higher CAGR of 5.1% during the forecast period. The LATAM & Caribbean disposable surgical gloves market, based on end user is hospitals, veterinary, dental, and others. The hospitals segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 5.0% during the forecast period. By distribution channel, the market is classified into online and offline. The offline segment will account highest share for the LATAM & Caribbean disposable surgical gloves market. Based on region, the LATAM & Caribbean disposable surgical gloves market is segmented into countries such as Brazil, Argentina, Caribbean, Cuba, Dominican Republic, Haiti, Puerto Rico, Rest of Caribbean, and Rest of LATAM.

LATAM & Caribbean Disposable Surgical Gloves Market: Competitive Landscape and Key Developments

Owens & Minor Inc, HARPS Holdings Bhd, Top Glove Corp Bhd, Ansell Ltd, B Braun SE, Cardinal Health Inc, Ametro SaRL, Bahamas Medical & Surgical Supplies Ltd, Lighthouse Medical Supplies Ltd, and Hextar Healthcare Bhd. are among the leading companies operating in the LATAM & Caribbean disposable surgical gloves market. These manufacturing companies are focusing on expanding and diversifying their market presence and acquiring a novel customer base, tapping prevailing business opportunities in the LATAM & Caribbean disposable surgical gloves market.

Market players are launching new products to the market. Below are a few instances:

- In March 2022, Owens & Minor Inc announced the complete acquisition of Apria, Inc. for approximately US$ 1.6 billion. The acquisition helped the company to expand the experience for the patient, provider, and payor for diabetes, ostomy, incontinence, wound care, home respiratory, obstructive sleep apnea, and negative pressure wound therapy products.

- In December 2022, HARPS Holdings Bhd announced the complete acquisition of Semperit Technische Produkte GmbH (Semperit) for EUR115 million (RM540 million). The acquisition has helped to acquire the medical examination and surgical gloves business of Sempermed, a part of Semperit. In addition, the acquisition has helped HARPS to expand geographically and strengthen its product portfolio.