Feed Premix Market

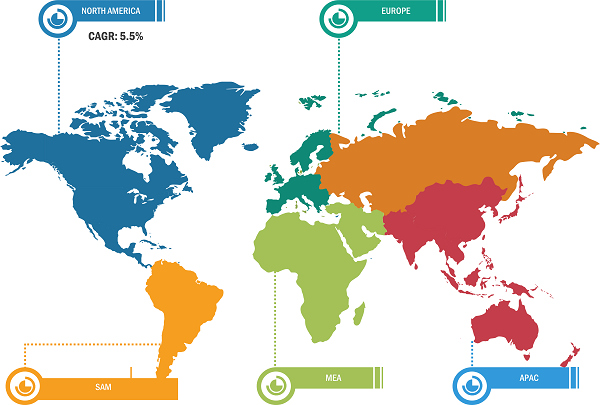

The Asia Pacific feed premix market is expected to grow during the forecast period due to the rising animal feed production and the growing livestock industry. Asia Pacific is the largest producer of animal feed globally. According to Alltech Global, the region produced over 305 million metric tons of animal feed in 2020. Further, the region houses a few major animal stock farming countries, accelerating the demand for animal feed ingredients such as feed premixes in the region. The region has witnessed increasing feed mills and feed production, particularly in Japan and India. India houses the largest livestock population. Thus, there is a huge opportunity for feed premix in the India market. Moreover, Asia Pacific accounts for the largest human population among all five regions and contains ~60% of the global population. Hence, the region is witnessing strong demand for meat and dairy products, boosting the requirement for livestock production and subsequently favoring the demand for animal feed. The mass consumption of animal feed in the region and growing practices of feeding nutritious feed to livestock drive the feed premix market in the region.

Growing Demand for Feed Premix from Developing Countries Propel Feed Premix Market Growth During Forecast Period

The demand for feed premixes is increasing among developing countries in Asia Pacific and South & Central America, such as India, Vietnam, Indonesia, and Ecuador. According to the FAO Report “World Agriculture: Towards 2015/2030,” the population of developing countries in Asia Pacific is increasing and expected to consume meat at an annual rate of 2.4% by 2030. This has surged the demand for high-quality feed additives, concentrates, and premixes to enhance meat weight and nutritional quality. According to the Organization for Economic Co-operation and Development (OECD), in 2017, poultry meat consumption was 2.32 kg, which increased to 2.58 kg in 2021 in India. Similarly, according to the United States Department of Agriculture, from 2017 to 2022, the cattle population in India has risen from 301.4 million to 306.7 million. This growth can be attributed to government initiatives that have complemented the cattle industry and developments in the compound feed industry. Moreover, according to the Alltech report 2022, layer feed production increased by 28% in the Philippines. Thus, the increasing meat consumption and the growing livestock industry in developing countries boost the feed premix market.

Feed Premix Market: Segmental Overview

Based on type, the feed premix market is segmented into vitamins, minerals, amino acids, antibiotics, antioxidants, blends, and others. The antioxidants segment is expected to register a significant CAGR during the forecast period. Antioxidant supplementation in animal nutrition may be a more effective strategy to improve oxidative stability, sensory qualities, and the antioxidant nutritional content of animal products while being more economical. Due to these factors, the demand for antioxidant feed premixes is high among livestock owners and animal feed manufacturing companies.

Based on livestock, the feed premix market is segmented into poultry, ruminants, swine, aquaculture, and others. The poultry segment held the largest share of the market in 2022. Poultry is one of the most popular sources of animal protein due to its low-fat, low-calorie, and lean protein content. This factor boosts the demand for poultry animals. Thus, poultry farmers are paying more attention to the dietary requirements of poultry animals to maintain quality production. Hence, the demand for poultry feed premix is high. Premixes are essential for improved feed conversion ratio; hence, they are a significant part of large-scale poultry rearing. They also help prevent diseases and improve feed utilization. These factors are expected to boost the segment’s share.

Impact of COVID-19 Pandemic on Feed Premix Market

Various industries faced unprecedented challenges during the COVID-19 pandemic in 2020. Moreover, feed premix manufacturers and animal feed industries reported significant challenges in continuing production, procuring raw materials, and distributing products due to supply chain constraints caused by lockdowns and trade and travel restrictions. Further, the shortage of workforce and limited supply of raw materials led to halts in operations and processes across the world. The disrupted manufacturing operations eventually caused price hikes in the feed premix market. These factors negatively impacted the feed premix market growth during the COVID-19 pandemic.

Feed Premix Market: Competitive Landscape

Danish Agro AMBA, Agrifirm Group BV, Nutreco NV, Archer-Daniels-Midland Co, Cargill Inc, Koninklijke DSM NV, Dansk Landbrugs Grovvareselskab amba, NuSana BV, De Heus Voeders BV, and Kemin Industries Inc are among the major players operating in the feed premix market. Companies in this market emphasize strategies such as R&D investments and new product launches. Such strategic initiatives by key market players boost the demand for feed premix and drive the market.