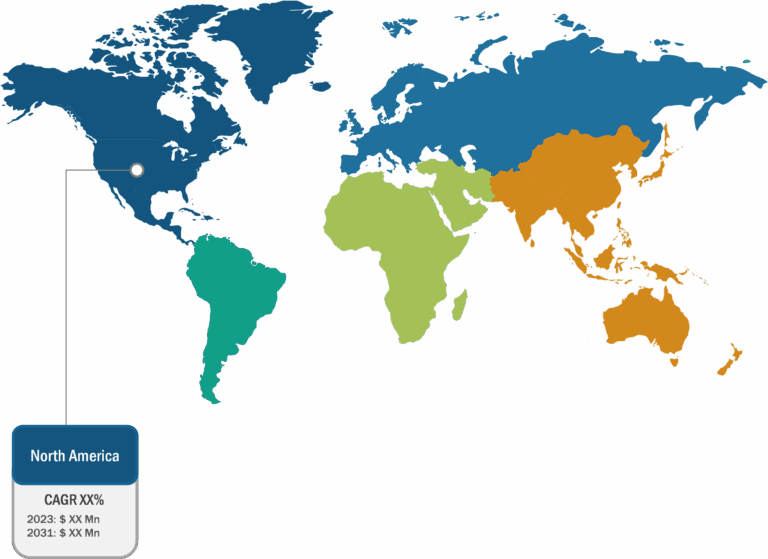

Asia Pacific is the fastest-growing market for viral vector manufacturing. In 2022, North America held the largest global market size. The developments in medical infrastructure, the prevalence of cancer and genetic disorders, and the increasing expenditure on healthcare services across the US are the key viral vector manufacturing market trends, driving the growth of the market in the country. For instance, according to the American Cancer Society estimates, in 2022, ~1.9 million new cancer cases were diagnosed and more than 609,000 cancer deaths were reported in the US. Thus, the use of viral vectors in clinical trials, vaccine development, and biomedical research for cancer treatment and other diseases will substantially impact the viral vector manufacturing market growth.

Increasing Clinical Studies and Development of Viral Vector Therapeutics Drives the Growth of Viral Vector Manufacturing Market

Recent developments in cell and gene therapies have made it feasible to treat various illnesses, including congenital disorders and cancer. According to the study “Gene therapy clinical trials, where do we go?” published in September 2022 in Elsevier Journal, the first gene therapy product, Gendicine, was approved for head and neck cancer after ~686 clinical trials by the Chinese State Food and Drug Administration (SFDA). In 2012, the clinical trials were doubled with the approval of Glybera by the European Medicines Agency (EMA), which indicated lipoprotein lipase deficiency. Similarly, in 2017, the FDA approved two chimeric antigen receptor (CAR) products—Kymriah and Yescarta. Furthermore, in 2019, Zolgensma (the most expensive drug to date), an adeno-associated viral vector (AAV) applied while performing gene therapies to treat pediatric spinal muscular atrophy, was approved by FDA.

Similarly, the US Food and Drug Administration (FDA) has approved many viral vector-based gene therapies over recent years. According to the FDA Office of Tissues and Advanced Therapies (OTAT), as of August 2023, more than 30 viral vector therapy products have been approved by the FDA. Similarly, according to Evaluate Pharma, as of February 2023, ~120 viral-vector therapeutics are in Phase II trials. Thus, a significant increase in approved gene therapy products and viral vector-based gene therapies each year fuels the viral vector manufacturing market growth.

Complex Viral-Vector Development Process Hampers the Growth of Viral Vector Manufacturing Market

Developing viral vectors is a complex process involving challenges in viral vector production and quality control measures. The production of viral vectors requires specialized equipment and facilities with adherence to good manufacturing practices (GMP) practices and other regulatory standards to ensure the final product’s purity, safety, and efficacy. This can pose significant challenges for manufacturers, especially smaller companies or new entrants, owing to limited resources and expertise to meet these requirements. Furthermore, large-scale viral-vector manufacturing faces various other challenges, such as the incompatibility of production systems, which may impact different stages of viral vector development. According to Patheon (service brand of Thermo Fisher Scientific), commercialization of viral vectors requires regulatory considerations to mitigate unnecessary risks such as compressed timelines, assay challenges and variability, raw materials using tumorigenic cell lines, and limited batches available at commercial scale. Thus, the complex viral vector development process hinders the growth of the viral vector manufacturing market forecast.

Viral Vector Manufacturing Market: Segmental Overview

Based on the global viral vector manufacturing market analysis, the market is segmented on the basis of type, disease indication, application, and end user. Based on type, the market is divided into adenoviral vectors, adeno-associated viral vectors, lentiviral vectors, retroviral vectors, and others. The adeno-associated viral vectors segment held the largest viral vector manufacturing market share in 2022. The lentiviral vectors segment is anticipated to register the highest CAGR during 2022–2030.

By disease indication, the market is segmented into cancer, genetic disorders, infectious disease, and others. The cancer segment held the largest market share in 2022. Based on the viral vector manufacturing market forecast, the genetic disorders segment is anticipated to register the highest CAGR from 2022 to 2030.

In terms of application, the viral vector manufacturing market is differentiated into therapeutics development, vaccine development, and research. In 2022, the vaccine development segment held the largest viral vector manufacturing market size, and the therapeutics development segment is anticipated to register the highest CAGR during 2022–2030.

Based on end user, the market is segmented into pharmaceutical & biotechnology companies, research institutes, and CDMOs & CROs. In 2022, the pharmaceutical & biotechnology companies segment held the largest viral vector manufacturing market share and is anticipated to register the highest CAGR during 2022–2030.

Geographically, the viral vector manufacturing market report is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Viral Vector Manufacturing Market: Competitive Landscape and Key Developments

Charles River Laboratories, Merck KGaA, Biovian Oy, Global Life Sciences Solutions USA LLC, Lonza Group Ltd, Creative Biogene, VIVEbiotech SL, Genezen Laboratories Inc, GenScript Biotech Corporation, and AGC Biologics are a few key companies operating in the viral vector manufacturing market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the viral vector manufacturing market.

A few of the recent developments in the global viral vector manufacturing market are mentioned below:

- In July 2023, Biovian Oy announced an expansion of its manufacturing facility in Turku, Finland. The company announced a major investment of over €50 million (~US$ 55) for a facility with an area of 69,000 sq.ft. The facility houses advanced technologies and cutting-edge equipment to support the development and manufacturing of advanced therapy medicinal products, such as adenoviral and AAV therapies. The manufacturing facility also features dedicated Class A to D cleanroom areas for bulk drug materials and final drug product manufacturing.

- In May 2023, AGC Biologics, the leading biopharmaceutical contract development and manufacturing organization (CDMO) in the world, launched two viral vector platforms: BravoAAV and ProntoLVV. AGC Biologics’ innovative platforms provide quick, effective, and repeatable clinical and commercial GMP production and release by utilizing their combined 30 years of experience in the development, manufacturing, and analyses of lentiviral vector (LVV) and AAVs. The CDMO can offer GMP products in nine months because of its patented methodology and capsid-specific platform approaches, which can shorten development times.

- In March 2023, Catalent announced the expansion of its UpTempo platform process for the development and CGMP manufacturing of AAVs. Catalent is a global pioneer in facilitating the discovery and provision of better patient medicines. The platform now comprises an in-house, clonal HEK293 cell line and commercial plasmids to facilitate a strong supply chain for the research and production of gene therapies and accelerate the duration of first-in-human clinical assessment.

- In March 2023, Vector Biolabs announced the completion of a facility expansion. The newly constructed facility has office space, warehouses, QC labs, and a cleanroom manufacturing suite. With the extra capacity, vector will be able to continue providing its fast response times even as field demand grows and expand its offering to include new product characterization and quality control services.

- In August 2022, Merck became one of the first CDMOs and technology developers to offer a complete viral vector manufacturing offering, including AAV, Lentiviral, CDMO, CTO, and process development, with the introduction of the VirusExpress 293 AAV Production Platform. Due to this new platform, biopharmaceutical businesses can now accelerate clinical manufacturing while minimizing costs and time associated with process development.