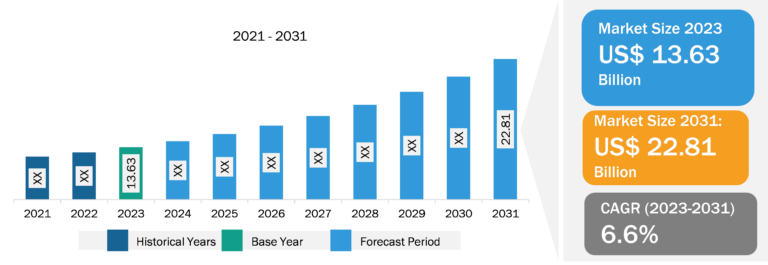

Botulinum Toxin Market

Rising Popularity of Noninvasive Aesthetics Procedures is Driving the Botulinum Toxin Market

Noninvasive procedures of facial rejuvenation using injections of botulinum toxin, calcium hydroxylapatite, and hyaluronic acid, among others. These procedures have minimal side effects, and they help reduce cellulite, wrinkles, facial lines, and unwanted fat. The concept of natural rejuvenation is based on a comprehensive, multilayered, three-dimensional approach that combines multiple techniques and active ingredients in procedures such as volume enlargement, skin relaxation, reshaping, volume repositioning, skin tightening, and surface renewal, depending on specific needs of patients. The most often used non-surgical face procedures are chemical peels, laser skin resurfacing, soft tissue fillers, and Botox. Unlike surgical procedures that are associated with greater risks, minimally invasive procedures benefit patients through faster recovery, lesser scarring, limited stress, and better patient satisfaction. Moreover, changing consumer views about wellness, beauty, and good aging results in a better understanding and acceptance of aesthetics worldwide. According to the International Society of Aesthetic Plastic Surgery (ISAPS), the number of nonsurgical procedures increased by 19.9% in 2021 compared to 2020. The total number of nonsurgical procedures was 17.5 million in 2021. Thus, an upsurge in the adoption of noninvasive aesthetic procedures is driving the growth of the botulinum toxin market.

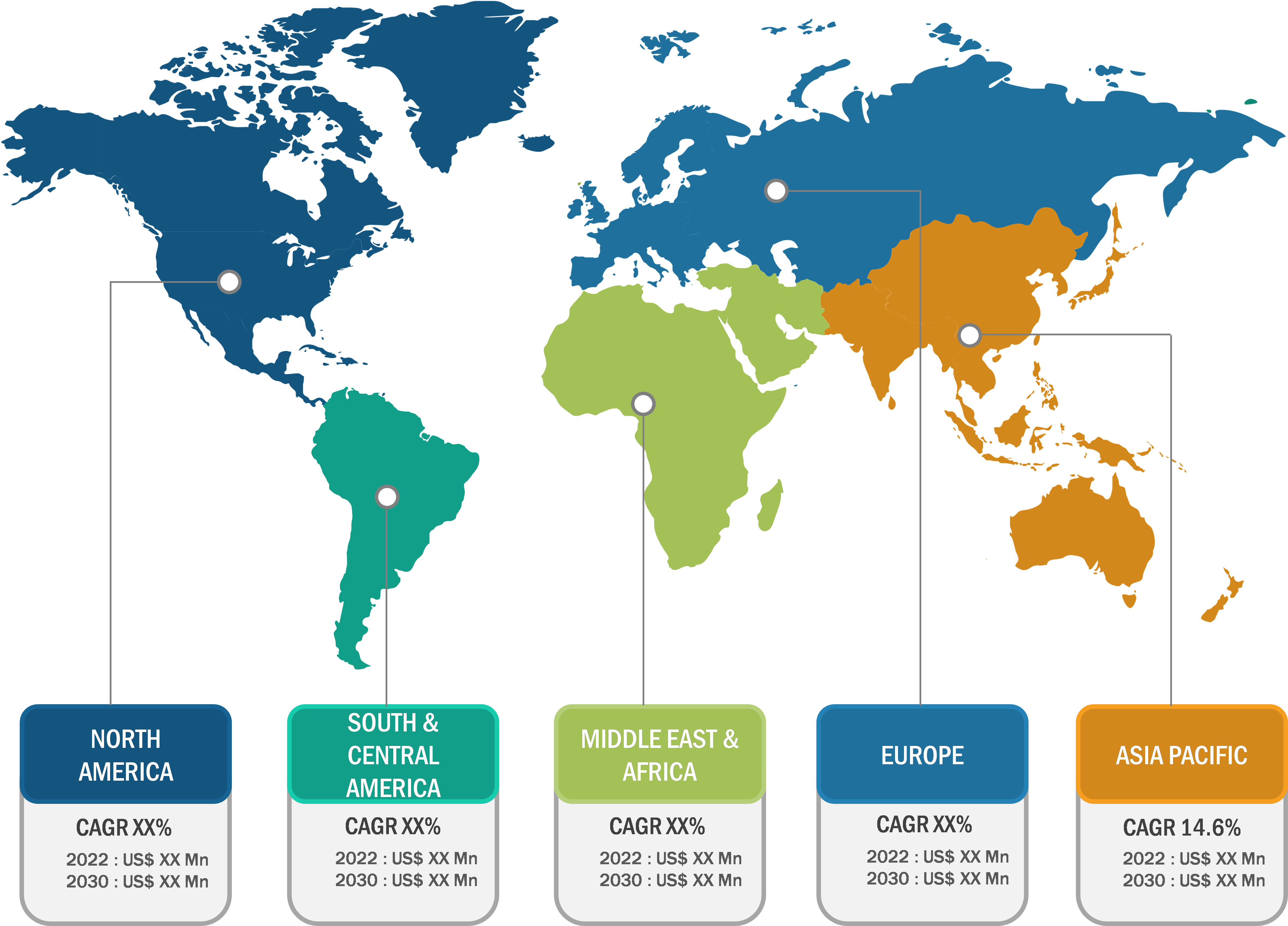

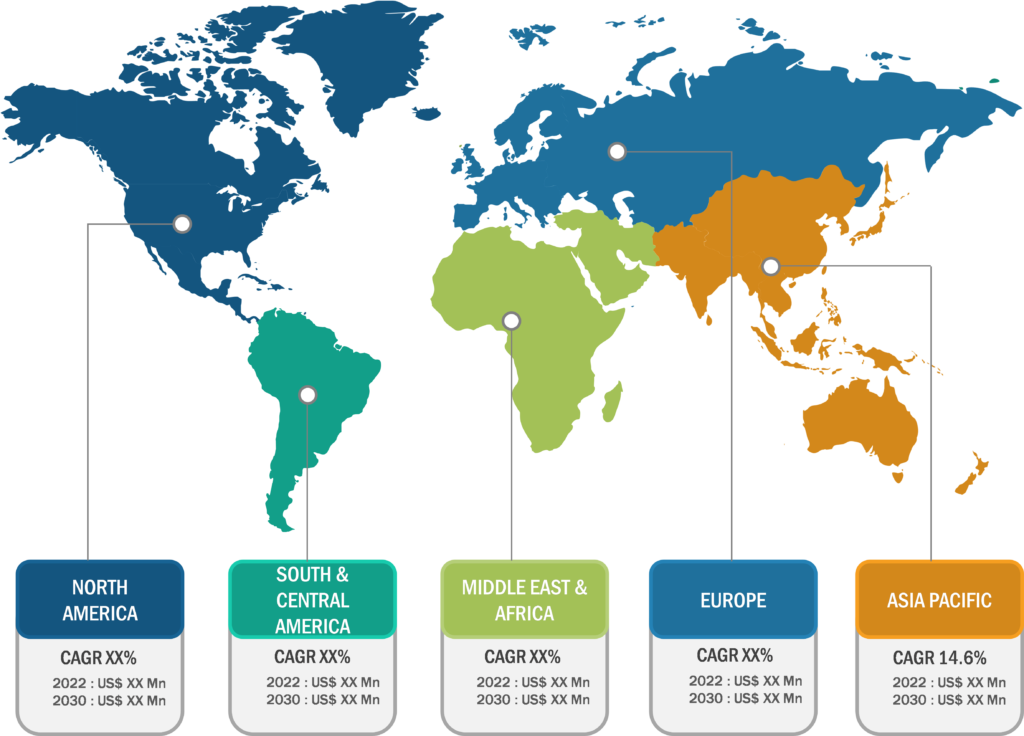

Botulinum Toxin Market: Regional Overview

Based on geography, the botulinum toxin market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2023, North America held the largest market share. The market growth in North America can be mainly associated with the economically stable population and increasing numbers of nonsurgical or minimally invasive cosmetic procedures performed in the abovementioned countries. Facial wrinkle reduction with botulinum toxin injections is the most performed cosmetic procedure in the US. It is one of the most common entry-level procedures for clinicians willing to incorporate aesthetic treatments into their practice. According to the ISAPS, nearly 2.5 million botulinum toxin procedures were performed in the US in 2021. BOTOX Cosmetic/Vistabel by Allergan, Dysport/Azzalure by Galderma and Ipsen, Xeomin/Bocouture by Merz, and Jeuveau by Evolus (manufactured only by Daewoong for the US) are among the commercially available botulinum toxin products in the country. The US FDA has approved BOTOX Cosmetic for people from the age group of 18–65.

The botulinum toxin market in Asia Pacific is expected to register the highest CAGR during the forecast period. The number of people suffering from headache or migraine has been rising every year, and botulinum toxin has been proven effective in reducing the frequency and severity of headaches in patients with chronic migraine. Moreover, the rising awareness of cosmetic procedures such as skin rejuvenation to improve aesthetic appeal and an increase in healthcare expenditure help to boost the growth of the botulinum toxin market in the region.

The aesthetic industry in Japan has witnessed massive growth in the past. The industry is well-developed and has access to a wide range of aesthetic products. The Japanese aesthetic industry is highly regulated, and hence, only licensed medical doctors perform aesthetic procedures. The botulinum toxin market in the country is mainly driven by the increasing number of consumers willing to invest in altering and maintaining their looks. According to the ISAPS, in 2021, 458,749 botulinum toxin procedures were performed across the country. The country ranks 3rd among all the countries performing nonsurgical aesthetic procedures in the world, with a share of 6.3% of the total procedures performed in the world.

Various international companies have obtained approvals for their products that treat muscle spasticity. Thus, Japanese firms have taken strategic initiatives to secure their positions in the market. In June 2021, Teijin Pharma Limited and Merz Therapeutics, a business of the Merz Group, together announced that Japan’s Ministry of Health, Labor and Welfare (MHLW) approved their Xeomin (incobotulinumtoxinA).

Botulinum Toxin Market: Competitive Landscape and Key Developments

Apart from factors driving the market, the botulinum toxin market report emphasizes prominent players operating in the market; these include AbbVie Inc, Merz Pharma, Medytox, Ipsen Pharma, Galderma, Revance Therapeutics Inc, Lanzhou Institute of Biological Products Co Ltd, Evolus Inc, Hugel Inc, and Aquavit. Market players focus on expanding and diversifying their businesses and acquiring novel customer bases, which allows them to explore attractive business opportunities prevailing in the botulinum toxin market. As per company press releases, a few recent developments are as follows:

• In January 2024, Medytox, Inc. announced the formation of Luvantas, Inc. as its wholly-owned North American subsidiary. Luvantas is a new medical aesthetics company committed to bringing innovative solutions to the North American market. It is working with Medytox to seek approval its the upcoming NivobotulinumtoxinA to introduce it into the US and Canada.

• In October 2022, Hugel resubmitted the Biologics License Application (BLA) to the US FDA for its botulinum toxin called Botulax for the treatment of glabellar lines. Hugel received a Complete Response Letter (CRL) from the US FDA in March 2022 after submitting the BLA for Botulax (50 and 100 units) to advance into the US market. The company sent supplemental documents and data based on requests set out in the CRL and resubmitted the BLA to the US FDA. After the approval, Hugel entered into the US market in the first half of 2023..

• In February 2022, Merz Therapeutics invested up to US$ 3 million to expand its strategic partnership with Vensica Therapeutics, Israel. This investment followed the strategic license and collaboration agreement signed in 2021. Merz thus executeded its contractual agreement option to participate in Vensica’s Series C financing round and invest in the start-up.