Robotic Assisted Surgery Systems Market

Growing preference for robotically assisted treatments, rising inclination toward minimally invasive surgeries, and the increasing number of product launches are the key factors driving the robotic assisted surgery systems market progress. However, the stringent regulatory processes and high cost of devices hinder the robotic assisted surgery systems market growth.

Rising Preference for Robotically Assisted Procedures Drives Robotic Assisted Surgery Systems Market Growth

The increasing adoption of robotic assisted surgery system in surgical practices is reshaping the landscape of modern medicine. Various robotic assisted procedures, ranging from urological and gynecological surgeries to orthopedic and neurosurgical interventions, have demonstrated significantly better patient outcomes, surgical precision, and overall clinical efficacy. Moreover, demand for minimally invasive surgical techniques, coupled with the need for enhanced precision and improved patient recovery times, has heightened surgeons’ and patients’ interest in robotic assisted surgery systems. Robotic systems provide surgeons with access to advanced capabilities such as three-dimensional visualization, dexterity, and the ability to perform complex maneuvers with greater accuracy, particularly in confined spaces or delicate anatomical areas. Moreover, robotics and other advanced technologies result in reduced trauma, minimum blood loss, and shorter hospital stays, offering significant advantages for both patients and healthcare providers.

Robotic surgeries are increasingly being adopted across diverse medical specialties, including cardiothoracic, colorectal, and general surgery, which reflects a broader recognition of the clinical benefits associated with robotic assisted procedures. This can be attributed to the piling of clinical evidence supporting the efficacy and safety of robotically assisted surgeries, patients’ inclination toward less invasive options, and improvements in postoperative outcomes. As a result, a large number of healthcare facilities and surgical teams are seeking to integrate robotic surgical systems into their practice standards. For instance, according to Intuitive Surgical Operations, Inc., in 2023, approximately 8,042 Da Vinci System installed globally

Manufacturers in the robotic assisted surgery systems market are continuously advancing robotic platforms by integrating artificial intelligence, enhanced data analytics, predictive modeling, and augmented reality features, paving the way for further improvements in surgical precision, intraoperative decision-making, and patient safety. For instance, in September 2023, the new Canady Robotic AI Surgical System has been introduced by US Medical Innovations (USMI) and the Jerome Canady Research Institute for Advanced and Biological Technological Sciences (JCRI-ABTS). The new system provides 3D navigation guided surgical planning along with AI-powered software applications.

On the other hand, the high cost of robotic assisted surgery systems is a significant factor limiting the adoption of these systems and thereby hampers the growth of market. For instance, the Da Vinci Robotic System has an average cost of $17,995, a minimum price of $5,500, and a maximum price of $26,274.74. The advantages of sophisticated surgical techniques may be limited in developing nations by the high cost of robotic assisted surgery systems, which can severely impede their accessibility. For instance, in India a basic da Vinci system costs is ranges between US$ 120.00 Mn to US$ 130.00 Mn

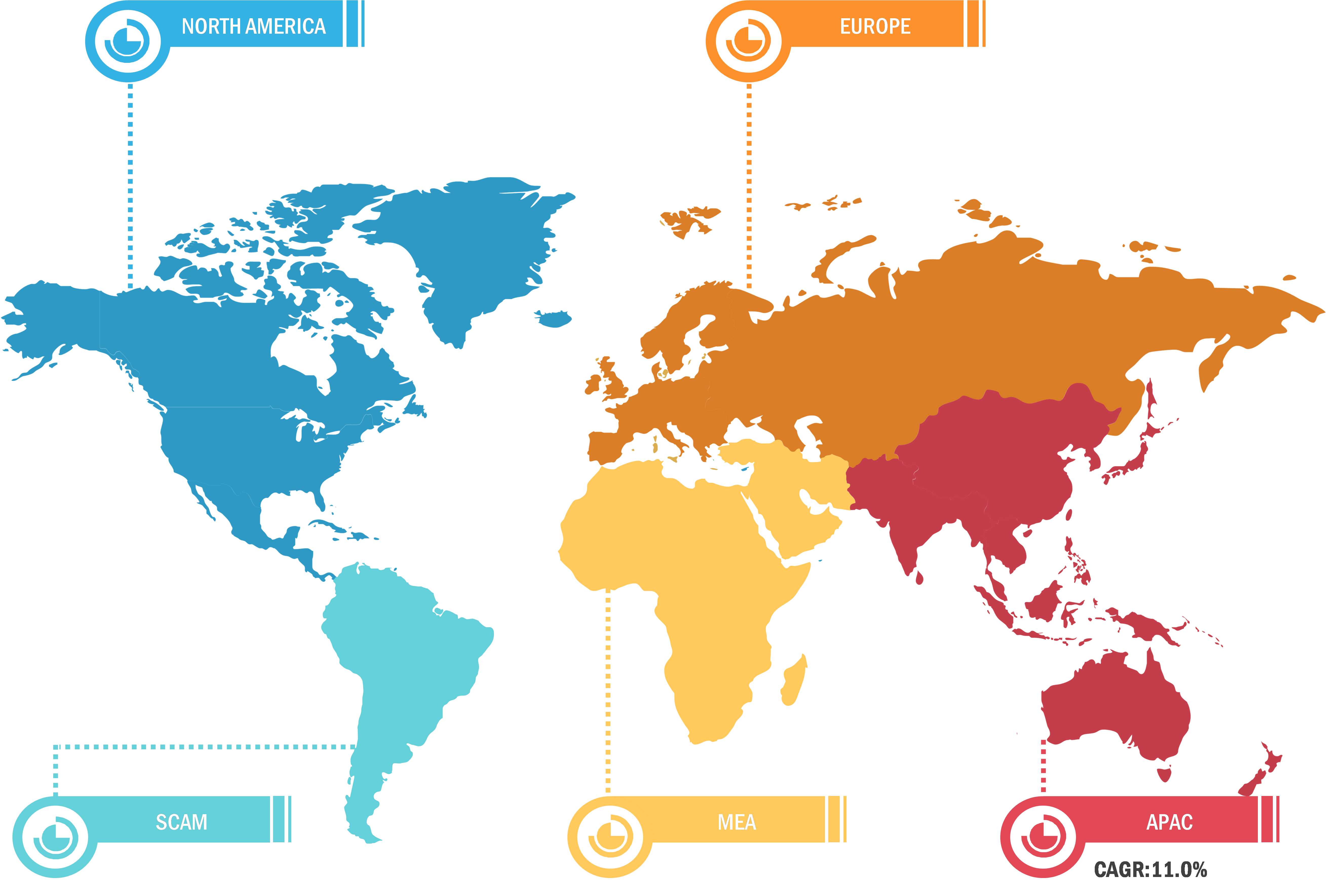

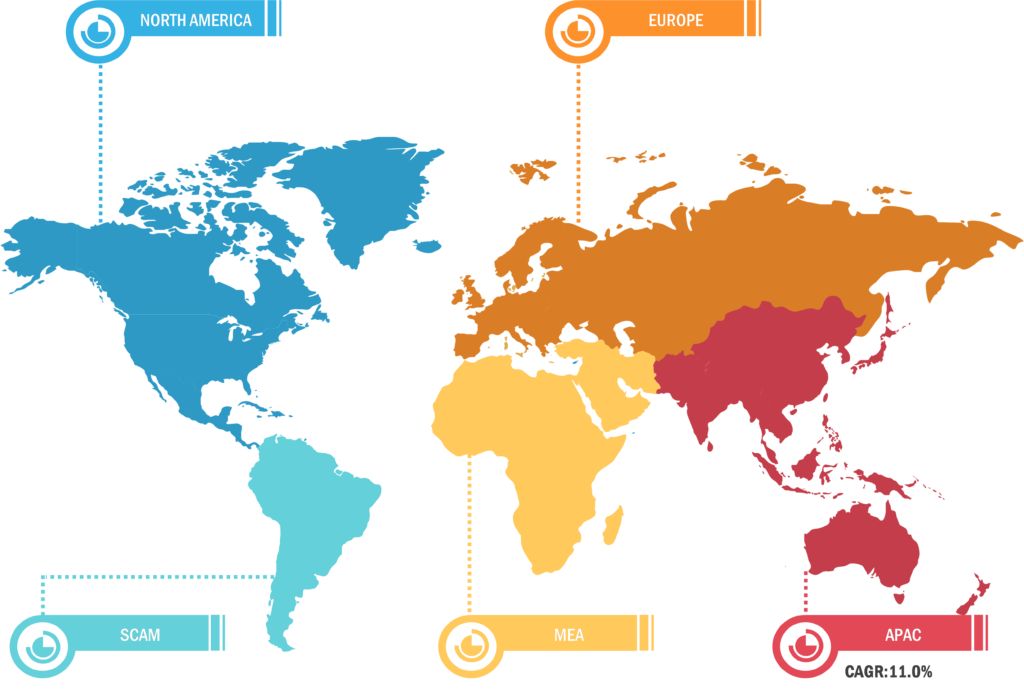

Based on geography, the robotic assisted surgery systems market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is the most significant contributor to the growth of this market. The market progress in this region is attributed to the growing use of automated surgical instruments and the adoption of next-generation healthcare systems in the US. Furthermore, the lack of surgeons and medical professionals in the US compared to the patient population is projected to benefit the market for robot-assisted surgical systems. The increased prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disease propels the demand for robot-assisted surgical systems in the US.

The growing popularity of minimally invasive procedures as opposed to conventional operations favors the robotic assisted surgery systems market. In December 2022, Hugo extended the clinical trials of its robotic assisted surgery (RAS) systems in the US by enrolling their first patient, according to Medtronic plc. Further, in 2022,a doctor at Duke University Hospital in Durham, North Carolina, carried out the robotic assisted prostatectomy procedure.

The Asia Pacific robotic assisted surgical systems market is expected to grow at the fastest CAGR during 2022–2030 owing to the growing patient population and rising use of sophisticated automated surgical instruments. Additionally, expanding contemporary healthcare facilities and increasing public awareness of the advantages of cutting-edge medical technologies are anticipated to benefit the market growth in this region in the future. Governments of countries in Asia Pacific are making attempts to establish sophisticated healthcare infrastructure, which is drawing international businesses to invest in the establishment of automated instrument development facilities in this region. China holds the largest share of the robot-assisted surgical systems market in Asia Pacific, and India is expected to record the highest CAGR during 2022–2030. Companies in the surgical robotics business in China have shortened their time to market by taking advantage of a special approval pathway that expedites regulatory approval for innovative medical products. Moreover, an increasingly large number of medtech firms specializing in surgical robotics are emerging in the country. In recent years, JianJia Robots and Hurwa entered the Chinese market to develop surgical robotics solutions alongside TINAVI, a domestic company specializing in orthopedic surgical robots. Beijing reimburses TINAVI robot-assisted surgeries for the spine, hip, and knee.

Robotic Assisted Surgery Systems Market: Competitive Landscape and Key Developments

Intuitive Surgical Inc.; Stryker Corporation; Johnson & Johnson Inc.; SRI International Inc.; Accuray Incorporated; Renishaw PLC; Medtronic PLC; Brainlab; Smith & Nephew PLC; Globus Medical; and Zimmer Biomet are a few of the key companies operating in the robotic assisted surgery systems market. Market players adopt product innovation strategies to meet evolving customer demands, thereby maintaining their brand image in the robotic assisted surgery systems market.

A few recent developments by robotic assisted surgery systems market players are mentioned below:

- In November 2022, SS Innovations, an Indian medical robotic technology company, partnered with Avra Medical Robotics, an American company listed on the Nasdaq. Through this partnership, the former focused on developing SSI Mantra, the first surgical robot entirely “Made in India.” It is a highly developed surgical robotic system with more capabilities and applications than other systems on the market.

- In November 2022, Accelus received the US Food and Drug Administration (FDA) approval for a software update for the Remi Robotic Navigation System, which allows surgeons performing lumbar spine fixation to place pedicle screws with robotic assistance. Accelus is a private medical technology company that focuses on the adoption of minimally invasive surgery (MIS) as the standard of care in the spine.

- In April 2022, Amplitude Surgical and eCential Robotics announced a long-term collaboration to create a joint robotic knee surgery solution.

- In October 2021, Medtronic Canada ULC introduced the Mazor X System for robotically guided spine surgeries.