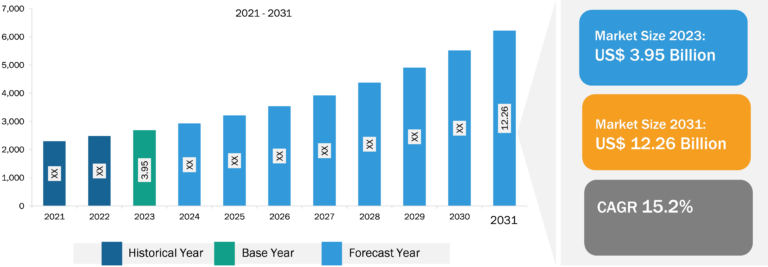

Public Safety Software Market

Surge in Investments in Public Safety to Fuel Public Safety Software Market Growth During Forecast Period

With more resources available, public safety agencies can explore and implement more advanced software solutions such as predictive policing software, which analyzes past crime data to predict future crime hotspots, allowing for preventative measures. Other software solutions such as criminal justice management systems help manage arrests, investigations, prosecutions, and corrections. In addition, combating new challenges such as cybercrime and mass-casualty incidents requires sophisticated software solutions. The availability of funding allows agencies to invest in technologies addressing these emerging threats.

Many cities in several countries are taking the initiative to invest in public safety.

• In January 2024, the mayor and police chief of Lima announced a significant investment in public safety.

• In January 2024, Second Front Systems, a public-benefit software vendor offering mission-critical software solutions to government bodies, raised a new strategic investment from Booz Allen Ventures, which is the corporate venture capital arm of Booz Allen Hamilton. This investment further strengthens Second Front’s list of prominent investors, which includes NEA; Moore Strategic Ventures, LLC; and AEI Industrial Partners (with a venture capital platform AEI HorizonX).

• In November 2023, the mayor of Minneapolis announced the city’s plan to spend US$ 1 million over the next 2 years for the NYU School of Law’s policing project to assess prevailing challenges that affect the city’s efforts to plan violence prevention services and workforce development programs.

Thus, increasing investments in public safety initiatives boost the public safety software market size.

Public Safety Software Market: Industry Overview

The public safety software market analysis has been carried out by considering the following segments: deployment type, solution type, and end user. Based on deployment type, the market is bifurcated into cloud and on-premises. Based on solution type, the market is segmented into computer-aided dispatch systems, mobile police software solutions, incident management solutions, court management solutions, jail management solutions, record management solutions, and others. Based on end user, the public safety software market is segmented into law enforcement agencies, courts, prosecutors, fire departments, and others. In terms of geography, the public safety software market is segmented into North America, Europe, APAC, the MEA, and SAM. In terms of revenue, North America dominated the public safety software market share.

The European Union Agency for Law Enforcement Cooperation assists law enforcement agencies in EU member countries to increase public safety throughout the region. Nearly 100 criminal analysts work with Europol, and many of them are among the best-trained in all of Europe. It, therefore, possesses one of the EU’s most concentrated analytical capacities. Analysts use state-of-the-art tools to assist national authorities in their everyday investigations. Law enforcement agencies from different EU countries must cooperate to combat terrorism and cross-border crimes in the EU. In the past, authorities would occasionally work together, either bilaterally or multilaterally.

The crime rate in Europe is increasing at an alarming rate, which is pushing governments and law enforcement agencies to invest in modern technologies that can improve public safety. These include software for computer-aided dispatch, case management, record management, and criminal intelligence analysis. In addition, Europe has seen a rise in the frequency and severity of natural disasters in recent years. This has led to a greater demand for software that can help manage emergency response and recovery efforts. Thus, the rising crime rates and natural disasters would result into the increase in the public safety software market share.

Public Safety Software Market: Competitive Landscape and Key Developments

CENTRALSQUARE, Hexagon AB, Motorola Solutions Inc., Microsoft Corp, Tyler Technologies Inc., Zetron Inc., Omnigo Software LLC, ProPhoenix Inc, SmartCOP Inc, and Mark43 Inc are among the key players profiled in the public safety software market report. Contributions and market initiatives of the key players in Asia Pacific, such as Hexagon AB and CENTRALSQUARE, are benefiting the overall public safety software market. Several other essential market players were analyzed for a holistic view of the market and its ecosystem. The report provides detailed market insights, which help the key players strategize their market growth. The public safety software market report provides detailed market insights, which help the key players strategize their market growth.

• In October 2023, Tyler Technologies, Inc. signed an agreement with the Naperville Police Department in Illinois to provide its Enterprise Public Safety, Public Safety Analytics, and Enforcement Mobile software solutions.

• As announced by Motorola Solutions, in January 2023, the Public Safety Threat Alliance (PSTA) became a member of the Joint Cyber Defense Collaborative (JCDC), the premier cybersecurity public–private partnership established by the Cybersecurity and Infrastructure Security Agency (CISA).