Parenteral Nutrition Market

Surge in Cases of Malnutrition and Premature Births Drives Parenteral Nutrition Market

Malnutrition includes being undernourished, overweight or obese, having inadequate vitamins or minerals, and having a non-communicable disease due to a bad diet. As per World Health Organization (WHO) data, ~1.9 billion adults were overweight or obese, whereas 462 million were underweight in 2021. Additionally, 39 million children under the age of 5 were overweight, 149 million had stunted growth and development as a result of a chronic lack of nutrient-rich food in their diets, and 45 million were wasted (too thin for height). Furthermore, ~45% of deaths among children aged less than 5 are associated with undernutrition. As per the July 2022 data of the United Nations International Children’s Emergency Fund (UNICEF), the prevalence of undernourishment reached 9.3% in 2020 from 8.0% in 2019; it further jumped to 9.8% in 2021. As per a study titled “A multi-centre survey on hospital malnutrition,” published in 2021, ~33% of hospital patients in the US were either malnourished or at nutritional risk, and approximately 11–45% of patients in hospitals and home care settings in England suffered from malnutrition. Nutritional support delivered through parenteral methods, depending on the need, is an important and appropriate way of treating most malnutrition cases.

Preterm birth refers to a baby being born at a significantly early stage, i.e., before the completion of 37 weeks of pregnancy. As per the WHO data published in 2023, ~13.4 million preterm births (more than 1 in 10 births) were reported worldwide in 2020. Additionally, most preterm births (more than 60%) occurred in southern Asia and sub-Saharan Africa in 2021, which is becoming a global concern. On average, 12% of babies in low-income countries are born too early, compared to 9% in high-income countries. According to the Centers for Disease Control and Prevention (CDC) data, preterm birth in the US accounted for 10% of all births in 2020 and reached 10.5% in 2021, recording a yearly rise of 4%. Per the same source, the rate of preterm birth among African American women (14.8%) was ~50% higher than the rate reported among white or Hispanic women (9.5% and 10.2%, respectively). A large number of premature babies suffer from low weight and undeveloped immunity, which puts their lives at risk. Parenteral nutrition is preferred in preterm infants due to sucking or swallowing difficulties as a complication of an immature birth or due to neuromuscular, heart, or other disorders. When estimated energy and nutritional requirements cannot be safely met by enteral route right after birth, parenteral nutrition (PN) is part of the routine nutrition care for premature neonates and infants. Thus, the huge burden of malnutrition in children and adults and the high number of preterm births drive the demand for parenteral nutrition formulae and products, which drives the parenteral nutrition market growth.

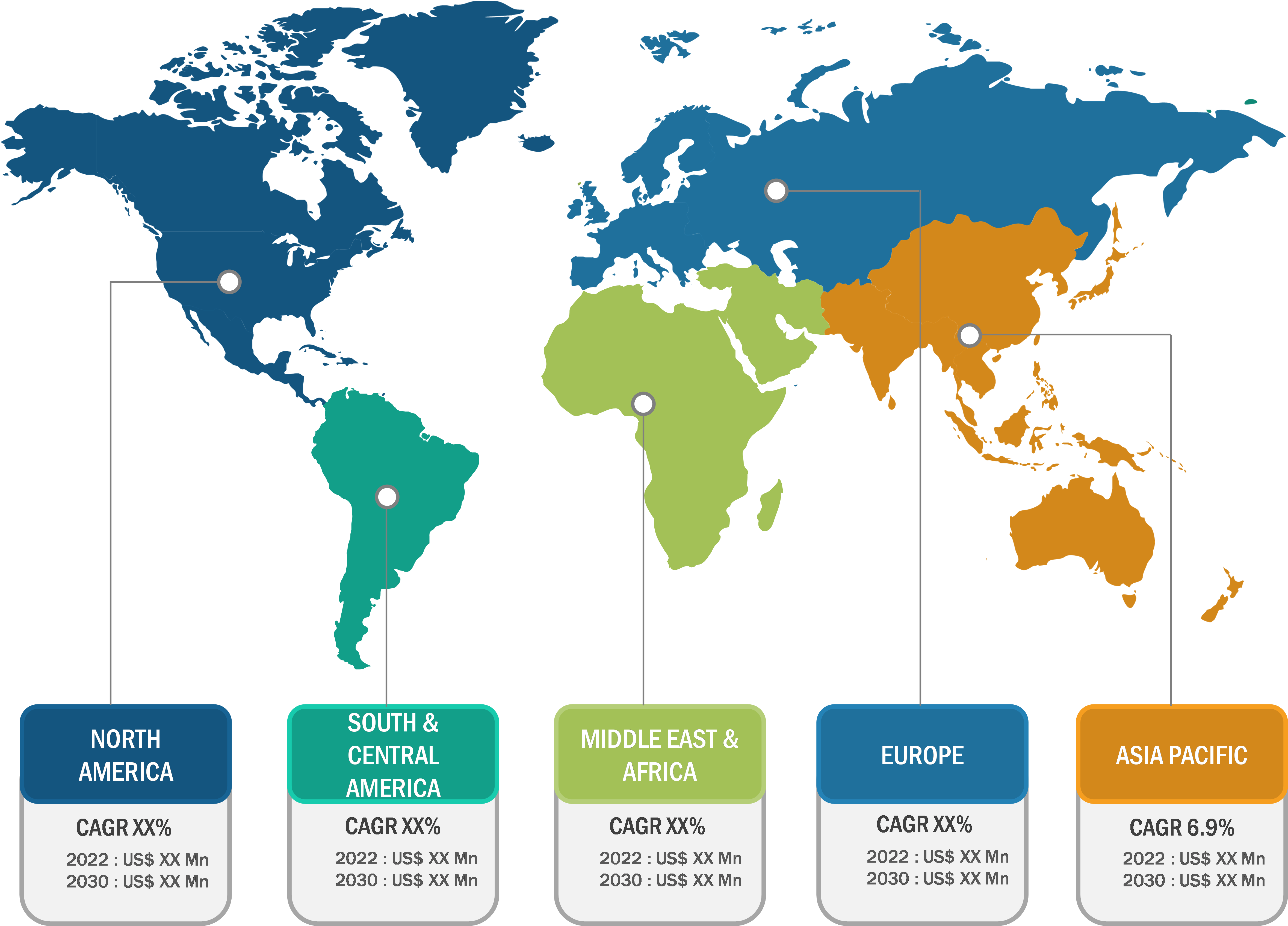

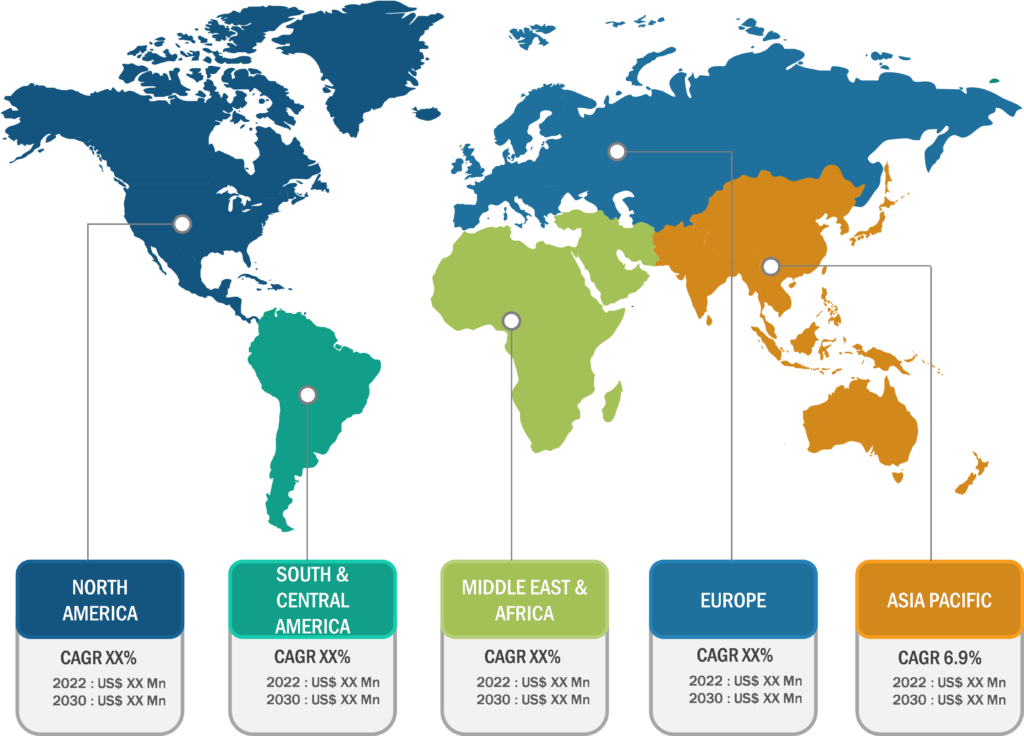

Parenteral Nutrition Market: Regional Overview

In terms of geography, the parenteral nutrition market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, in terms of revenue, North America held the largest share of the parenteral nutrition market share. Further, the market in Asia Pacific is expected to register the highest CAGR during the forecast period. The market growth in North America is ascribed to the rising prevalence of chronic diseases, growing strategic developments by market players, and increasing preference for parenteral nutrition. Also, an upsurge in awareness among individuals about the benefits of medical nutrition, such as tube feeding, in the treatment of chronic health conditions contributes to the market growth. Asia Pacific is expected to register the highest CAGR during 2022–2030. The parenteral nutrition market in Asia Pacific is expected to grow owing to the growing presence of major market players across the region and the increasing prevalence of chronic diseases.

Parenteral Nutrition Market: Competitive Landscape and Key Developments

ICU Medical Inc, Grifols SA, Pfizer Inc, Otsuka Pharmaceuticals Co Ltd, Baxter International Inc, B Braun SE, Fresenius Kabi AG, Sichuan Kelun-Biotech Biopharmaceutical Co Ltd, Vifor Pharma Management AG, and Aculife Healthcare Pvt Ltd are a few of the leading companies operating in the parenteral nutrition market. Market players focus on expanding and diversifying their businesses, and acquiring novel customer bases, which allows them to experience attractive business opportunities prevailing in the parenteral nutrition market.

In March 2022, Fresenius Kabi AG announced the receiving of FDA approval for its SMOFlipid Lipid Injectable Emulsion. The injection is intended for pediatric patients, including term and preterm neonates in the US. The product is the first and only four-oil lipid emulsion for parenteral nutrition patients of every age. The SMOFlipid can be used in all facility centers.

In August 2021, the US Food and Drug Administration (FDA) approved Korsuva injectable for the treatment of moderate to severe pruritus in hemodialysis patients, according to an announcement made by Vifor Pharma and Cara Therapeutics.

In November 2020, Otsuka Pharmaceuticals Co Ltd launched “ENEFLUID Injection,” the amino acid, glucose, electrolyte, fat, and water-soluble vitamin injection. This product is the first peripheral parenteral nutrition solution in Japan that combines fat and water-soluble vitamins, along with glucose, electrolytes, and amino acids in a dual-chamber bag.