Hybrid Composites Market

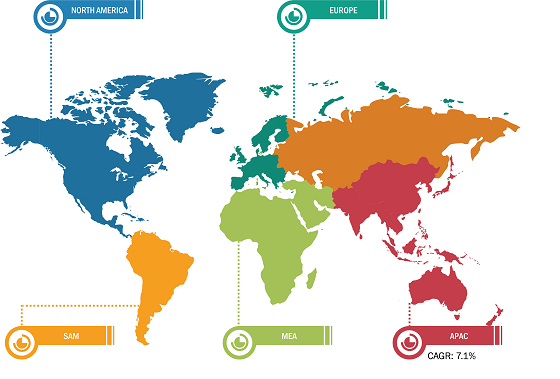

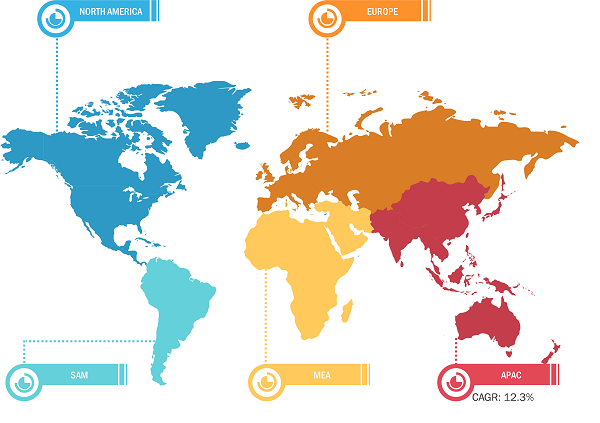

In 2022, Asia Pacific held the largest share of the global hybrid composites market. The strong presence of the automotive, aerospace, electronics, wind energy, etc. industries in the region is mainly driving the hybrid composites market growth in Asia Pacific. According to a report published by the China Passenger Car Association, in 2022, Tesla Inc delivered 83,135 made-in-China electric vehicles, indicating growth in sales of electric vehicles from 2021. As per the International Organization of Motor Vehicle Manufacturers report, in 2021, the countries in Asia Pacific produced ~46.73 million units of motor vehicles. Hence, the demand for battery electric vehicles is increasing in Asia Pacific. Hybrid composites are used in various automotive parts to reduce tooling costs and improve design flexibility for manufacturers while enhancing fuel efficiency and overall driving experience for the consumer by reducing noise and vibration. The benefits of hybrid composites and the growing automotive industry are propelling the hybrid composites market growth. Further, Asia Pacific is experiencing demand for sustainable energy sources, which has propelled the growth of wind energy projects in the region. According to the report by International Energy Agency, China registered 70% of the world’s wind generation growth in 2021. As per the 14th Five-Year Plan published by China in June 2022, the country is expected to account for a target of 33% of electricity generation from renewables by 2025, including an 18% target for wind and solar technologies. Hence, the growing wind energy sector is boosting the demand for hybrid composites. In the wind energy sector, hybrid composites are used in electrical transmission and distribution applications such as insulators, arresters, and pole line hardware.

Rise in Adoption of Biocomposites

Bio-based polymer matrices are environment-friendly and are the subject of extensive research in various fields. Bio-based matrices are also lightweight and exhibit long-term sustainability, which drives their use in commercial applications. Further, the easy availability of natural raw materials for the production of bio-based resin is fueling its supply and demand. Bio-based matrices and biocomposites are employed in several secondary applications in aerospace, automobiles, packaging, electronics, and construction sectors. Owing to the rising concern and awareness about the social and environmental impacts of conventional building materials, manufacturers of composites are shifting toward environment-friendly raw materials. Thus, the growing adoption of bio-based matrices or resins sourced from carbohydrates, vegetable fats and oils, starch, bacteria, and other biological materials, over petroleum-derived plastic matrices is expected to emerge as an important trend in the hybrid composites market during the forecast period.

Hybrid Composites Market: Segmental Overview

Based on fiber type, the hybrid composites market is segmented into carbon/aramid, carbon/glass, high-modulus polypropylene (HMPP)/carbon, ultra high molecular weight polyethylene (UHMWPE)/carbon, and others. The carbon/aramid segment held the largest hybrid composites market share in 2022. The carbon/ aramid hybrid composites find applications in a wide range of industries, including aerospace, automotive, sports equipment, and defense, where lightweight, durable, and high-strength materials are essential for success. In the aerospace industry, these hybrid composites are being utilized to construct lightweight yet robust components for aircraft and spacecraft.

Based on resin, the hybrid composites market is bifurcated into thermoset and thermoplastic. The thermoset segment held a larger hybrid composites market share in 2022. Thermoset hybrid composites are easy to produce as the liquid resin is easy to handle. Various types of thermoset resins, including polyesters, vinyl esters, epoxy, and polyurethane, are available in the market. Polyesters can be molded by any process used for thermosetting resins. These resins are available at low cost and offer easy handling; good mechanical, electrical, and chemical properties; and dimensional stability.

Based on application, the hybrid composites market is segmented into automotive, aerospace, marine, wind energy, sporting goods, and others. The automotive segment held the largest hybrid composites market share in 2022. Hybrid composites have surpassed steel in terms of demand from the automotive industry due to their unique features such as corrosion resistance and high impact strength. Hybrid composites are used in car manufacturing to reduce vehicle weight and meet mileage standards.

Impact of COVID-19 Pandemic on Hybrid Composites Market

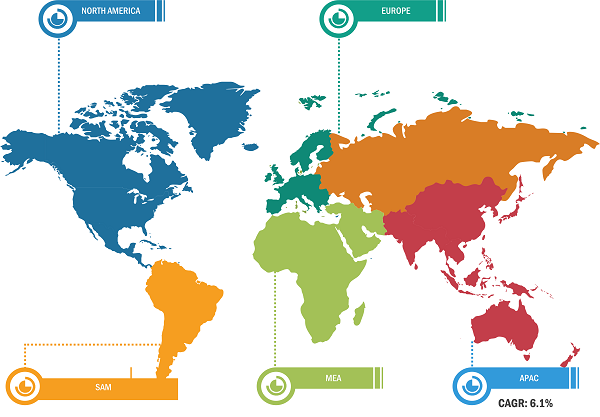

Governments of various countries across the world imposed country-wide lockdowns that directly impacted the growth of the industrial sector. In China, movement restrictions and related labor shortages reduced industrial activities across various industries. The automotive, aerospace, marine, wind energy, sporting goods, and other end-use industries were disrupted by the pandemic, which negatively impacted the demand for hybrid composites. China is a leading automotive producer and consumer. A decline in vehicle demand in Asia Pacific has negatively impacted the growth of the automotive industry. In addition, reduced aircraft production in the region hindered the demand for hybrid composites. The economic slowdown and reduced investment in projects led to a drop in hybrid composites demand in Europe. The pandemic negatively impacted the automotive industry in the region. As the industry is one of the major end users of hybrid composites, reduced automotive production adversely impacted the hybrid composites market growth.

Further, with the resumption of operations in various industries in 2021, demand for hybrid composites improved. As a result, businesses in the hybrid composites market started witnessing significant recovery in different regions.

Global Hybrid Composites Market: Competitive Landscape and Key Developments

Hexcel Corp, Lanxess AG, SGL Carbon SE, Gurit Holding AG, Avient Corp, Teijin Ltd, Solvay SA, PGTEX China Co Ltd, Toray Industries Inc, and Mitsubishi Chemical Holdings Corp are among the key players operating in the hybrid composites market.

• In 2022, Lanxess AG launched sustainable product variants to its Tepex brand composite range.

• In 2022, Avient Corporation acquired DSM Protective Materials (Dyneema brand) and also announced its plan to explore sale options for its Avient Distribution business.

• In 2021, Solvay SA completed the installation of its new thermoplastic composites (TPC) manufacturing facility.