Hip Implants Market

According to our new research study on “Hip Implants Market Forecast to 2030 – Global Analysis – by Product Type, Material, and End User,” the market is expected to grow from US$ 6,816.6 million in 2022 to US$ 9,425.4 million by 2030; it is anticipated to record a CAGR of 4.1% from 2022 to 2030.

The increasing number of hip injuries and related diseases and strategic initiatives in hip implants largely drive the hip implants market size. However, the high cost of hip implants hinders the growth of the hip implant market.

Increasing Product Development Activities are Foreseen to Trend Hip Implants Market Growth

Hip implants’ portability, convenience, and effectiveness lead to a high overall success rate. These advantages result in accelerating the demand for hip implants in the coming years, owing to which a growing number of product launches, approvals, and developments are in place to meet the expected demand in the years to come. A few of the major developments and approvals are listed below:

- Smith & Nephew launched OR3O Dual Mobility System in August 2023 for primary and revision hip arthroplasty in India. OR3O incorporates Smith & Nephew’s latest advanced bearing surface, OXINIUM DH, for its liner and proprietary OXINIUM on XLPE for its femoral head and polyethylene inserts. This eliminates both the modular CoCr liner and/or CoCr head ball from the construct—reducing wear and corrosion risks associated with the alloy.

- In August 2022, Exatech commercially launched a novel total hip arthroplasty system consisting of Spartan Stem and Logical Cup system. The Spartan Hip Stem reflects contemporary patient needs and the newest advancements in surgical approach. The Logical Cup is an advanced, modular acetabular system designed to meet the demands of highly active patients while also enabling an efficient surgical process in hospitals and ambulatory surgical centers.

- In September 2020, Smith & Nephew launched REDAPT System in China to revise total hip arthroplasty (rTHA) after receiving approval from the National Medical Products Administration (NMPA). The REDAPT System is designed to assist surgeons in overcoming the challenges of rTHA, including the fixation in various bone types, the advancement of joint stability, predictable stem position, and surgical efficiency.

- In March 2022, Stryker’s Joint Replacement Division introduced the Insignia Hip Stem, which is engineered to optimize patient fit and also focus on surgeon’s ease for implantation in muscle-sparing approaches of total hip, at the American Academy of Orthopaedic Surgeons (AAOS) 2022 Annual Meeting in Chicago. Insignia is compatible with Mako SmartRobotics using Total Hip 4.1 software, which allows surgeons to utilize data from a 3D CT-based plan to capture each patient’s unique anatomy.

Thus, such increasing advancements by various market players and growing product approvals will likely catalyze the global hip implants market during the forecast period.

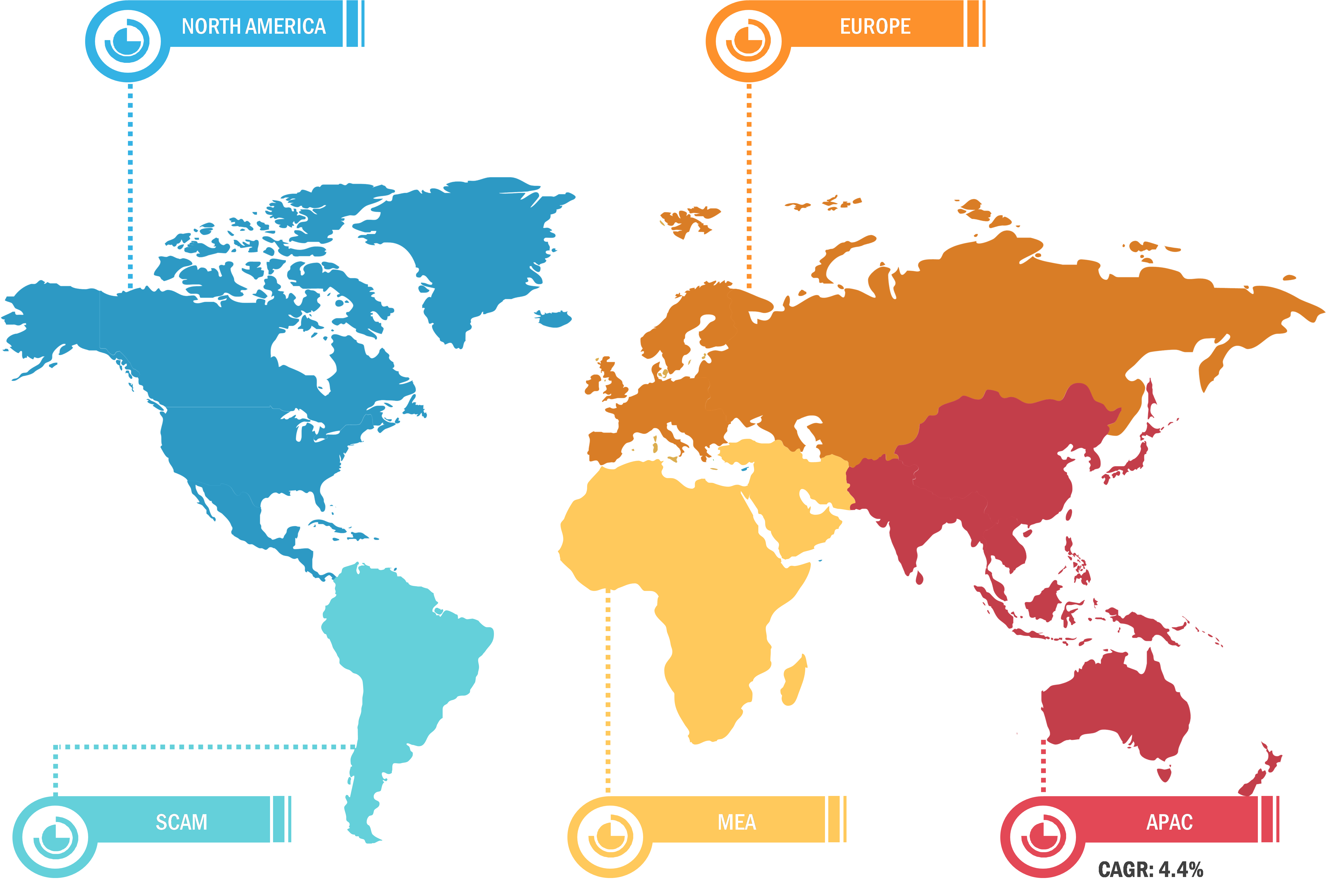

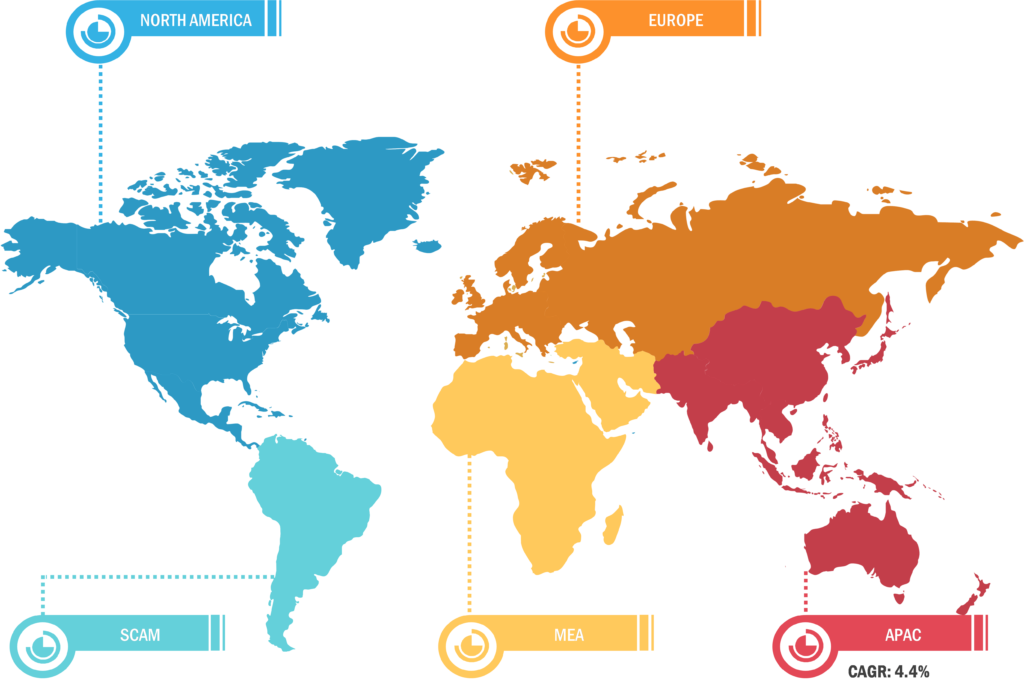

North America held the largest share of the global hip implants market in 2022 owing to the increasing technological advancements, number of hip injuries, rising geriatric population, and key market players involved in new and existing product developments. However, Asia Pacific is predicted to register the highest CAGR from 2022 to 2030. The US held North America’s largest share of the hip implants market in 2022. The increasing incidence of hip implants, product launches, and the growing number of sports hip injuries mainly drive the growth of the hip implants market in the US. According to the article “Hip Fracture Care and National Systems,” published by Wolters Kluwer Health, Inc, about 250,000 to 300,000 people in the US are hospitalized for hip fractures annually. By 2040, it is estimated that medical professionals will attend nearly 500,000 patients with hip injuries. As per the American Academy of Orthopaedic Surgeons, people aged 65 years and above are prone to hip fractures due to household or community falls in the US. According to the article “Hip Overview,” published in National Library Medicine, approximately US$ 40,000 is spent by patients in the first year after a hip fracture, and the cost of hip fracture care annually in the US is over US$ 17 billion. Thus, the growing prevalence of hip fractures and hip injuries in the US and increasing spending on treatment of these injuries is fueling the growth of the hip implant market in the US.

Hip Implants Market: Competitive Landscape and Key Developments

Smith & Nephew, Exactech, Zimmer Biomet, Stryker Corporation, DJO Surgical (Enovis), Medacta, Conformis, DePuy Orthopaedics, MicroPort Orthopedics, and Symbios are a few key companies operating in the hip implants market. Market players adopt product innovation strategies to meet evolving customer demands, maintaining their brand names in the hip implants market.

A few recent developments in the global hip implants market are mentioned below:

- Smith & Nephew launched OR3O Dual Mobility System in September 2022 for primary and revision hip arthroplasty in Japan. This advanced bearing surface, OXINIUM DH, is utilized for its linear and proprietary OXINIUM on XLPE for its polyethylene inserts and femoral head.

- In August 2021, Zimmer Biomet Holdings, Inc. received 510(k) clearance from US Food and Drug Administration (FDA) for the ROSA Hip System for robotically assisted direct anterior total hip replacement. ROSA Hip is the fourth robotic system introduced by Zimmer Biomet. It adds to the company’s comprehensive ROSA Robotics portfolio—ROSA Partial Knee System for partial knee arthroplasty (which includes the ROSA Knee System for total knee arthroplasty) and ROSA ONE for neurosurgical and spine procedures.