High-End Rum Market

In 2022, Europe dominated the global high-end rum market. The Europe high-end rum market is thriving because of increasing urbanization and changing consumer preferences. The market in Europe is significantly growing owing to its drinking culture and favorable climatic conditions. Several nations across the region are popular for the production and consumption of high-end rum. In recent years, the country has witnessed a growing number of rum enthusiasts among the younger demographic. The rising trend of rum premiumization is one of the major factors boosting the demand for high-end rum. Manufacturers are using advanced aging techniques and more sophisticated distillation methods to produce high-end rum. The luxury status associated with high-end rum attracts consumers in the region. Thus, the high-end rum market is significantly growing in the region. Thus, the premiumization of rum is contributing to the growing high-end rum market size globally.

Consumers in the region are increasingly exploring different flavored rum, including spiced flavored high-end rum. According to the Wine and Spirit Trade Association, in 2019, product sales in off-trade increased by 6% in the UK compared to 2018. Sweet flavors have gained significant popularity among consumers in Germany. Similarly, consumers in Germany are seeking spiced rum. The growing trend of exploring flavored rum is projected to create growth opportunities for high-end rum in the region. Thus, constantly rising strategic initiatives by key market players such as The Coleman Co. Inc. and Weber Inc. are positively influencing the high-end rum market growth.

Rum Premiumization Drives High-End Rum Market

Traditionally, rum has been popular among a broad demographic. Initially, rum was known for its mass production, simple flavor profile, and ideal for blending into cocktails. However, over time, rum manufacturers began to explore advanced aging techniques and more sophisticated distillation methods. This resulted in the development of rums with more complex and nuanced flavor profiles comparable to other premium spirits such as whiskey and cognac.

The impact of digital marketing and social media has also played an important role. Premium rum brands that effectively use social platforms have showcased the versatility and luxury associated with products, attracting consumers. Several brands, such as Diplomático, Rum Zacapa, and Richard Seale, have emerged as key players in premium rum for the quality of their products and their innovative marketing strategies. Additionally, the high-end rum market trends include rising trend of homemade cocktail among consumers.

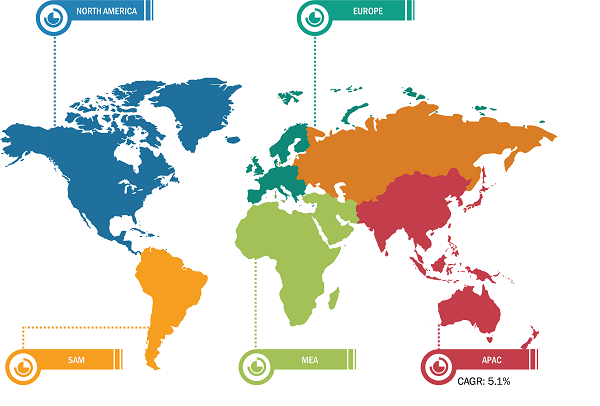

Globally, premium rum is gaining traction in several key international markets. In the US, Europe, and Asia Pacific, there is an increase in demand for premium and ultra-premium rums. Premium, matured, and high-quality rums are becoming more popular as consumers seek distinctive flavors and novel experiences in rum consumption. Younger consumers, especially those between the ages of 25 and 40, are keen to invest in premium rums that offer a unique history and distinctive flavor profile. Thus, key players are launching innovative products to cater to the increasing demand. For instance, in February 2021, Diageo introduced the Captain Morgan Sherry Oak Finish, a premium variety of rum matured in sherry casks aimed at discerning rum connoisseurs. Thus, rum premiumization drives the high-end rum market.

High-End Rum Market: Segmental Overview

The high-end rum market study has been carried out by considering the following segments: Product Type, Category, Nature, Distribution Channel, and Geography. Based on Product type, the high-end rum market is segmented into white, dark, and gold. The gold segment holds the largest high-end rum market share. Gold rum, also known as “amber” rum, is medium-bodied rum that is generally aged. Gold rum gains a dark color from aging in wooden barrels. Gold rums have more flavor and are stronger in taste than light rum or white rum and it is considered as midway between light rum and the darker varieties. Gold rum is used in the dark cocktail. Examples of gold rums include 1 Barrel, Abuelo, Appleton Special, Barcelo Dorado, Brugal Añejo, and Bermudez Ron Dorado. Based on category, the high-end rum market is segmented into super premium, ultra-premium, and prestige & prestige plus. The super premium segment holds the largest high-end rum market share. Rum that falls under the price range of US$ 30–44.99 is known as super-premium rum. The brands such as Grey Goose or Amaro Montenegro provide super-premium rum.

The sales of super premium rums are increasing significantly with several initiatives taken by key market players. Based on nature, the high-end rum market is bifurcated into plain and flavored. The plain segment holds the largest market share. Generally, white rum is considered plain rum. Plain rum is only made up of sugarcane molasses through fermentation and distillation. Consumers opt for plain rum as they prefer the traditional taste of rum without adding any external flavor. The plain rum contains minimum ingredients. These factors are expected to drive the market for the segment during the forecast period. Moreover, rum is available in various flavors, including vanilla, fruity flavors (pineapple, citrus, and raspberry), and spice flavors (cinnamon and clove). The shifting trend toward flavored and spiced rums drives manufacturers to focus on expanding their product offerings in the flavored category. Flavored rum has various flavors and spices mixed into rum to create an exceptionally unique taste. Spiced rum, developed initially to meet medical needs, is gaining popularity. Based on distribution channel, the high-end rum market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment holds the largest market share. The specialty stores segment includes liquor stores. Liquor stores are widely preferred distribution channels for the sale of high-end rum due to their ability to ensure the availability of an extensive range of products, offer attractive deals and discounts, and provide high-end customer service. These stores usually have trained staff that helps customers find the right product. Owing to the availability of a variety of products in one place, customers can enjoy a one-stop shopping experience.

High-End Rum Market: Competitive Landscape

Cayman Spirits Co, Sovereign Brands LLC, Cognac Ferrand SASU, Pernod Ricard SA, Distilleries Arehucas SA, Mount Gay Distilleries Ltd, Davide Campari Milano NV, Brown-Forman Corp, Westerhall Estate Ltd, and Diageo Plc are among the prominent players profiled in the high-end rum market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The high-end rum market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.