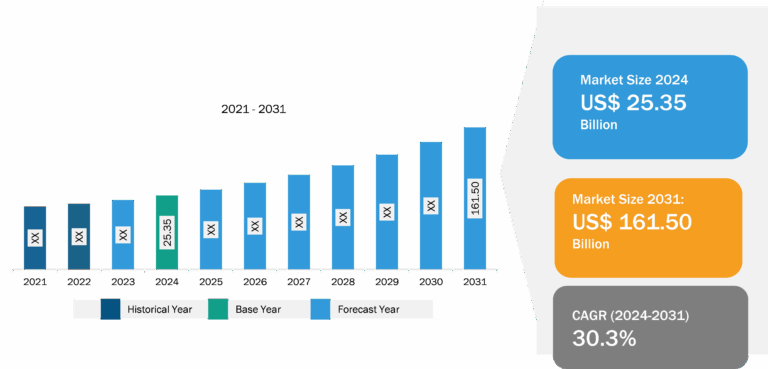

Data Center Cooling Market

Rising Investments in Data Centers Fuel Data Center Cooling Market Growth

Pressure to decarbonize data centers, climate change, unpredictable weather events, and the use of powerful computers are a few factors encouraging organizations to invest in cooling and energy-efficient technologies for data centers. The escalating demand for data center cooling solutions is fueled by the need for effective cooling technologies to maintain optimal operating conditions as these centers expand to accommodate increasing workloads and storage demands. The demand for data centers is increasing, prompting investments in companies that operate them. A few of such investments are listed below.

- In January 2024, Vantage Data Centers, a global provider of hyperscale data center campuses, announced a US$ 6.4 billion equity investment led by investment channels managed by DigitalBridge Group, Inc., the leading global alternative asset manager dedicated to investing in digital infrastructure, and Silver Lake—the global leader in technology investing. This substantial investment reflects the escalating demand for hyperscale data center campuses, which drives the need for advanced cooling solutions to maintain optimal operating conditions.

- In the initial five months of 2024, the global investment in data centers amounted to US$ 22 billion, continuing the momentum from the significant activity observed in 2023, when global investment in data centers reached a noteworthy US$ 36 billion, making it the second-largest investment year in the past decade. Linklaters, the global law firm, conducted an analysis that highlighted the US and Europe as the leading jurisdictions in this emerging trend.

- In June 2024, Google pledged to add US$ 2.3 billion to its three data center campuses located in Central Ohio. With established campuses in New Albany and Lancaster and the ongoing construction of another in Columbus, this recent investment supplements the US$ 4.4 billion already allocated in the state since 2019.

All these investments in data centers worldwide reflect the increasing demand for data center campuses, which drives the need for advanced data center cooling solutions to maintain optimal operating conditions. Thus, rising investments in data centers fuel the data center cooling market growth.

Data Center Cooling Market: Industry Overview

The data center cooling market is segmented into component, cooling type, data center type, and industry vertical. In terms of component, the market is segmented into chillers, air conditioning systems, heat exchangers, cooling towers, air handling units, humidifiers, and others. By cooling type, the market is categorized into room-based cooling, rack-based cooling, and row-based cooling. Based on data center type, the data center cooling market is segmented into enterprise data center, colocation data center, wholesale data center, and hyperscale data center. In terms of industry vertical, the market is categorized into BFSI, manufacturing, IT & telecom, media & entertainment, retail, government & defense, healthcare, energy, and others.

In terms of revenue, North America dominated the data center cooling market share, followed by Europe and APAC. The data center cooling market in North America is segmented into the US, Canada, and Mexico. The US is anticipated to hold the largest data center cooling market share by 2031. Data centers in the US rely on a variety of cooling solutions to manage the substantial heat generated by the operation of millions of servers. The industry has traditionally used air cooling methods, but there is a growing emphasis on more efficient and sustainable cooling technologies such as brazed plate heat exchangers, precision cooling units, direct air cooling, and liquid cooling technologies. Companies such as Alfa Laval, Schneider Electric, Munters, USystems, and STULZ are at the forefront of providing advanced cooling solutions for data centers. As the demand for effective data center cooling solutions continues to rise, the industry is exploring innovative technologies such as smart cooling systems using AI and machine learning (ML), geothermal cooling methods, and evaporative cooling to enhance sustainability and energy efficiency. For instance, GIGABYTE Technology, Giga Computing, a subsidiary of GIGABYTE, an industry leader in AI & HPC servers and an integrator for direct liquid cooling (DLC) & Immersion cooling technology, announced a range of advanced cooling products, a few of which were showcased at the SC23 event.

Data Center Cooling Market: Competitive Landscape and Key Developments

Asetek, Inc.; Fujitsu Ltd; Mitsubishi Corp; Rittal GmbH & Co KG; Schneider Electric SE; Stulz SpA; Trane Technologies Plc; Vertiv Group Corp.; Black Box Corporation; Carrier Global Corp; Aspen Systems, LLC.; Daikin Industries Ltd; Delta Electronics Inc; Danfoss AS; Alfa Laval AB; Hewlett Packard Enterprise Development LP; Boyd Corp; Evapco Inc; Motivair Corporation; and Madison Industries are among the leading players profiled in the data center cooling market report. Several other essential market players were analyzed for a holistic view of the market and its ecosystem. The data center cooling market report provides detailed market insights, which help the key players strategize their market growth. As per the company press releases, a few recent key developments are mentioned below:

- Mitsubishi Heavy Industries, Ltd. (MHI) developed a new 40kVA-class 12ft container-type data center with an immersion/air-cooled hybrid cooling system capable of simultaneously housing servers utilizing three types of cooling methods: immersion cooling (25kVA), air cooling (8kVA), and water cooling (8kVA). The newly developed data center was the successor to the container-type immersion cooling data center that has been under development since 2021. Servers with different cooling methods for a variety of applications (by power density) can be mounted in the unit simultaneously, accommodating a diverse range of servers and other devices for edge computing to process data at the periphery (edge) of computer networks.

(Source: Mitsubishi Heavy Industries, Ltd, Press Release, October 2023)

- STULZ, the global mission-critical air conditioning specialist, announced the launch of CyberCool CMU—an innovative new coolant management and distribution unit (CDU) that is designed to maximize heat exchange efficiency in liquid cooling solutions.

(Source: STULZ, Press Release, March 2024)