Satellite Data Services Market

According to a new comprehensive report from The Insight Partners, the global satellite data services market is observing significant growth owing to increasing government investments in the space industry, rising integration of artificial intelligence in satellite applications, and growing use of satellite data services in urban planning.

The report runs an in-depth analysis of market trends, key players, and future opportunities. The rise in demand from numerous industries such as agriculture, defense, energy & power, and mining; and technological innovation are a few of the significant factors driving the satellite data services market.

Overview of Report Findings

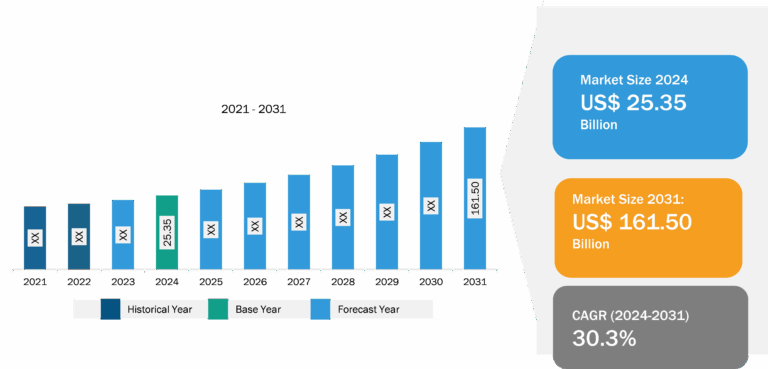

- Market Growth: The satellite data services market size was valued at US$ 10.49 billion in 2024 and is expected to reach US$ 24.55 billion by 2031; it is estimated to record a CAGR of 16.2% from 2024 to 2031. The growing use of satellite data services in urban planning and agricultural monitoring fuels the global demand for satellite data services. Additionally, the privatization of the space industry and the development of small satellites for educational purposes and scientific research are a few factors expected to create opportunities for the satellite data services market growth during the forecast period. Moreover, an increase in research and development activities, growing awareness related to high-resolution data, and the development of nanosatellites, contributed to the satellite data services market growth.

- Technological Innovations: Artificial intelligence (AI) technologies have made remarkable progress and continue to demonstrate their importance as foundations for scientific research and real-world applications. AI significantly contributes to the growth of the satellite data services market by improving data processing, analysis, and interpretation. Satellite data includes massive amounts of high-resolution photos and sensor data from orbit. This data can be easily used for making effective decisions and managed by advanced technologies such as AI and machine learning. AI particularly includes machine learning and deep learning algorithms that help automate and accelerate the processing of these huge datasets, allowing for more rapid and accurate extraction of actionable insights. For instance, AI technology is highly capable of detecting patterns in satellite imagery for numerous applications, including agricultural yield prediction, climate monitoring, urban planning, and disaster response. The growing demand for managing huge satellite data encourages market players to develop and integrate AI in satellite applications for effective data management.

- Growing Use of Satellite Data Services in Urban Planning: The rapid development and growth of urban areas are increasing pressure on the environment, particularly green spaces and urban parks. Green spaces, such as streetscapes, lawns, public park areas, gardens, crops, and forests, are required to improve urban environments and give a better quality of life for residents. Satellite image data provides detailed analysis for creating or updating geographic information system (GIS) maps, detecting significant changes in urban land cover and land use, and allowing for frequent coverage and overlaying of different environmentally safe and sustainable areas for urban development. High-resolution stereo satellite sensors, such as GeoEye-1, Pleiades Neo satellite constellation, WorldView-2, WorldView-3, and WorldView-4, can give a wide range of geospatial data for vegetation and green space study, allowing for the construction of sustainable cities.

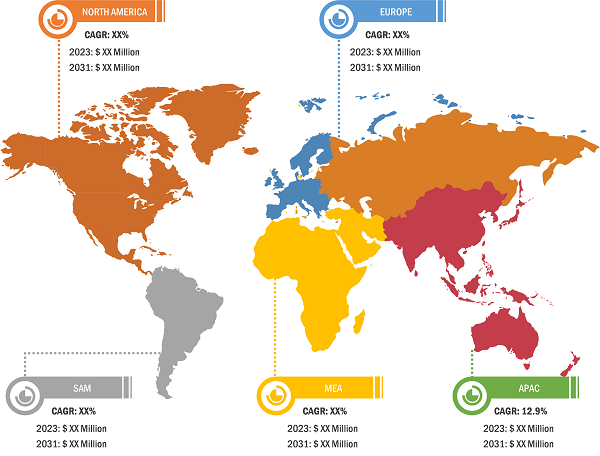

- Geographical Insights: In 2024, North America led the market with a substantial revenue share, followed by Europe and Asia Pacific. Moreover, Asia Pacific is anticipated to record the highest CAGR in the market during the forecast period.

Market Segmentation

- Based on services, the satellite data services market is divided into image data and data analytics. The image data segment dominated the market in 2024.

- The image data segment is divided into spatial, spectral, radiometric, and temporal. The spectral segment dominated the market in 2024.

- The data analytics segment is sub-segmented into image data processing, digital models, feature extraction, and classification. The image data processing segment dominated the market in 2024.

- Based on vertical, the satellite data services market is segmented into energy and power, defense and security, engineering and infrastructure, insurance, environmental, mining, agriculture, and others. The defense and security segment held the largest share of the satellite data services market in 2024.

- The satellite data services market is segmented into five major regions: North America, Europe, APAC, Middle East and Africa, and South and Central America. North America dominated the satellite data services market in 2024.

Competitive Strategy and Development

- Key Players: A few major companies operating in the satellite data services market include Airbus SE, Maxar Technologies Holdings Inc, L3Harris Technologies Inc, ICEYE Oy, Imagesat International (I.S.I) Ltd., LAND INFO Worldwide Mapping, LLC, Planet Labs PBC, Satellite Imaging Corp, SATPALDA, Ursa Space Systems Inc, Earth-i Ltd, and Ceinsys Tech Ltd.

- Trending Topics: Satellite-Based Earth Observation and Earth Observation Market, among others.

Global Headlines

- “The first of the two Airbus-built new generation SpainSat satellites, SpainSat NG-I, has been successfully launched on a Falcon 9 rocket from Cape Canaveral in the U.S. Operated by Hisdesat for the Spanish Armed Forces, Europe’s most advanced secure communications satellite operating in UHF, Ka, and X band, will enter into service in geostationary orbit from the second half of 2025, following initial testing and commissioning.”

- “Al Yah Satellite Communications Company PJSC (Yahsat), the UAE’s flagship satellite solutions provider, announced that it has contracted Airbus Defence and Space, a leading satellite manufacturer, for its new geostationary telecommunications satellites, Al Yah 4 (“AY4”) and Al Yah 5 (“AY5”). Airbus will design and build the AY4 and AY5 satellites based on the Eurostar Neo platform, with each having flexible payloads and benefitting from the strong heritage of the Eurostar family. The flexible multi-band payloads can be fully reconfigured while in orbit, capable of adjusting the coverage area, capacity, and frequency “on the fly” to meet evolving mission scenarios.”

Conclusion

Continuous improvements in satellite technology, including high-resolution imagery, data processing, and artificial intelligence (AI), are significantly enhancing the capabilities of satellite data, driving the satellite data services market in North America. The development of advanced satellite technologies, such as low earth orbit (LEO) and medium earth orbit (MEO) constellations, has significantly enhanced the speed, coverage, and reliability of satellite-based internet and data services. Such product developments have made satellite data services more appealing to both consumers and businesses across North America. Europe continues to lead the way in satellite data services, delivering critical insights on climate change, weather forecasting, and sustainable development while also contributing to global Earth observation efforts. The region focuses on customized services that highlight the evolving role of satellite data in decision-making, emphasizing Europe’s leadership in advanced satellite solutions. Over the years, the space sector in APAC has focused on driving growth via launching satellites for communication, navigation, Earth observation, and interplanetary missions. The rise in the space sector demands satellite data services such as communication, imagery, and navigation. Moreover, the region has been actively developing technology to prevent and mitigate the resulting damage of disasters. All these factors are anticipated to boost the growth of satellite data services market growth during the forecast period.

The report from The Insight Partners, therefore, provides several stakeholders—including component/material suppliers, satellite data services manufacturers, retailers and authorized distributors, and end users —with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.