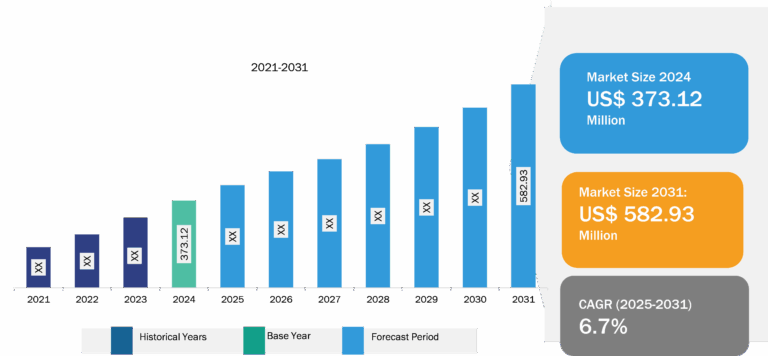

EMC Testing Market

Increasing Deployment of EMC in Consumer Electronics Drives the EMC Testing Market Growth

Computers, cellphones, tablets, and laptops, among other electronic devices, are extensively used for applications such as communication, entertainment, and official work. The increasing popularity of voice-assisted personal infotainment systems, rising demand for electronic appliances in automobiles, surging use of smartphones, growing knowledge regarding the impact of artificial intelligence, and deployment of 5G cellular networks are contributing to the elevated sales of consumer electronics. The importance of ensuring EMC is growing significantly with the escalating use of electronic gadgets such as computers, mobile phones, and navigation systems. Factors such as the high potential for emissions owing to variable supply voltages, higher clock frequencies, quicker slew rates, and increased package density, along with a high need for smaller, lighter, cheaper, and low-power devices, are bolstering the demand for EMC shielding. Reliable EMI protection contributes considerably to machines’ reliability, adding value to them. Thus, rising demand for consumer electronics fuels the EMC testing market growth.

EMC Testing Market: Segment Overview

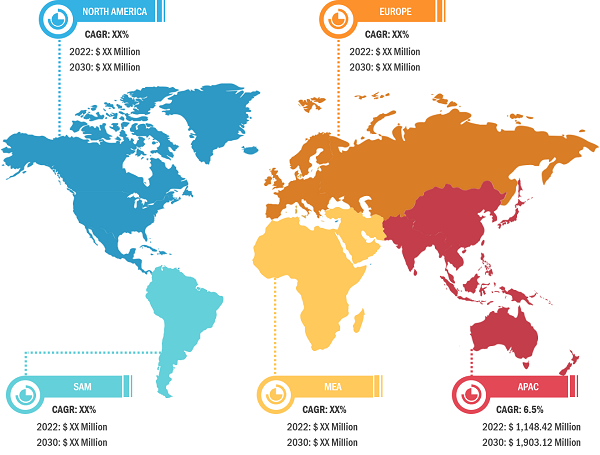

The EMC testing market is segmented on the basis of offering, service type, end-use, and geography. Based on deployment, the EMC testing market is divided into hardware & software, and services. Based on service type, the EMC testing market is categorized into testing services, inspection services, certification services, and others. Based on end-use, the EMC testing market is categorized into consumer appliances and electronics, automotive, it and telecommunications, others. Geographically, the EMC testing market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

EMC Testing Market Regional Analysis:

North America captures a noteworthy share of the global EMC testing market. Favorable economic and social conditions for the development and adoption of modern technologies, including supportive government policies, vast industrialization, developed infrastructure, and robust electronics industry, are driving the EMC testing market in North America. The consumer electronics industry is booming in the region due to the high adoption of devices such as smartphones, tablets, personal computers, HVAC systems, washing machines, and television sets. For instance, according to The White House report of August 2023, the electronics manufacturing sector invested US$ 1.8 billion for the capacity expansion of computer and electronic products in 2022. The growing capacity expansion of computer and electronic products is increasing the adoption of EMC testing to identify the issues that affect the performance of electronic devices and systems. It also helps electronics manufacturers modify product designs by improving the reliability and performance of electronic devices and systems, which is expected to drive the EMC testing market during the forecast period. Moreover, the continuous progress in the adoption of 5G networks is creating strong opportunities for EMC testing market players. According to Ericsson’s mobility report, North America has the second-largest penetration of 5G devices after Asia Pacific. Several network providers have already rolled out 5G services focusing on fixed wireless access (FWA) and mobile broadband. North America reached 35% of 5G subscription penetration in 2022 and is projected to have the highest 5G penetration of 91% by the end of 2028, which increases the demand for EMC testing in the telecommunication sector for achieving modulation, frequency band requirements, and field strength.

Automobile ownership is a widespread trend in North America. Automotive giants such as Ford, Tesla, General Motors, and Fiat, which are among the world’s largest automobile producers, are based in the US. However, the frequently increasing prices of oil and gasoline and the high density of passenger cars have encouraged the use of electric vehicles (EVs). According to the Edison Electric Institute, over 26.4 million EV models are available on the road, and 5.6 million annual EV sales are expected in the US automobile market by 2030. Moreover, in June 2022, the EV sector received an investment of over US$ 3.4 billion, including more than US$ 3 billion for charging infrastructure. Similarly, according to the International Energy Agency (IEA), in April 2023, EV manufacturers announced investments totaling at least US$ 52 billion in EV supply chains in North America. These factors are increasing the adoption of EMC testing for effectively controlling the performances of engines or batteries.

EMC Testing Market: Competitive Landscape and Key Developments

Ametek Inc, Element Materials Technology Group Ltd, Bureau Veritas SA, Eurofins Scientific SE, Intertek Group Plc, TÜV NORD Group., Rohde & Schwarz GmbH & Co KG, SGS SA, TUV SUD AG, and UL, LLC are among the key EMC testing market players profiled during the EMC testing market study. Various other companies are introducing new product offerings to contribute to the EMC testing market size proliferation. Several other important EMC testing market players were also analyzed during this market research to get a holistic view of the global EMC testing market and its ecosystem. The leading EMC testing system market players focus on feature upgrades, expansion and diversification, collaboration, and acquisition strategies, which enable them to grab new business opportunities.

- In June 2023, AMETEK CTS, a division of the AMETEK corporation, announced plans to open a new Service Centre in Bergkamen, Germany, in response to rising demand for specialist calibration and support services for EMC compliance instrumentation. The new facility, which is more than triple the size of the current location, will not only increase efficiency and capacity for calibration and support operations but also include an in-house EMC test laboratory and dedicated spaces for the popular educational seminars.

- In July 2023, Element signed a new contract with aviation technology group, Safran. The growing partnership is a result of Element’s additional investment in its aerospace laboratories across the world. It currently provides materials testing as well as specialist product testing, supporting Safran’s R&D and production testing needs in Toulouse, France, Berlin, Germany, and other laboratories in Europe, the USA and Asia. Element has been working with Safran for over 10 years and currently test a variety of technology supporting Safran efforts towards a safer and more sustainable aviation.