US Esoteric Testing Market

Esoteric testing comprises testing samples for rare substances or molecules, and it is not performed as a part of routine testing. This segment of diagnostics requires highly skilled professionals along with advanced and complex equipment. They are principally performed in specialized laboratories wherein samples are either referred by physicians or hospitals (inpatient testing) or by patients themselves (outpatient testing). A few of these tests are currently based on the radioimmunoassay technique, which is both expensive and time-consuming. The COVID-19 pandemic provided significant growth prospects for the esoteric testing market in the last couple of years. The RT-PCR test is a common method that is in use for the qualitative identification of SARS-CoV-2 RNA extracted from upper and lower respiratory samples (such as nasopharyngeal or oropharyngeal swabs and sputum) collected from persons suspected of COVID-19. Rising prevalence of chronic diseases and growing awareness of early detection of medical conditions are driving the market growth.

Report Segmentation and Scope:

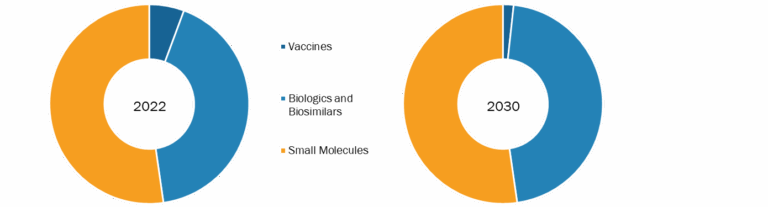

The “US Esoteric Testing market” is segmented on the basis of type, technology, and end user. Based on type, the market is segmented into infectious disease testing, endocrinology testing, oncology testing, toxicology testing, immunology testing, neurology testing, and others. In terms of technology, the US esoteric testing market is divided into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real-time PCR, DNA sequencing, flow cytometry, and others. In terms of end user, the market is categorized into hospitals and laboratories, and independent and reference laboratories.

Rising Prevalence of Chronic Diseases Drives US Esoteric Testing Growth

According to a study published by the American Heart Association in 2021, more than 130 million adults in the US are likely to be suffering from some heart disease by 2035. Cancer Facts and Figures 2022, published in January 2022 by the American Cancer Society, states that the US reported nearly 1.9 million new cancer diagnoses and 609,360 cancer-related deaths in 2022. The rising incidence of cancer and the significant burden of other chronic diseases result in the need for precise diagnoses and treatments. According to the American Thyroid Association estimates, over 12% of the US population is expected to develop a thyroid condition in their lifetime. The surging incidence of hormonal disorders due to the consumption of unhealthy food and the adoption of a sedentary lifestyle has led to endocrinology test uptake in North America. Endocrine tests are performed for the diagnosis of hormonal disorders such as pituitary thyroid adrenal bone, carcinoid and neuroendocrine, and parathyroid tumors, among others.

Esoteric testing allows the analysis of rare molecules or substances, which are not included in routine clinical laboratory tests. These tests are typically performed in medical specialties such as genetics, immunology, microbiology, endocrinology, molecular diagnostics, serology, toxicology, and oncology. The application of molecular genetics or molecular diagnostics is commonly used in identifying the prognosis of the disease process. Examples of molecular diagnostic testing on bone marrow biopsy samples may include but are not limited to, BCR/ABL, NPM1, FLT3, CEBPA, and JAK2. Thus, the growing prevalence of chronic diseases propels the need of esoteric testing for diagnoses, which benefits the US esoteric testing market.

Growing Strategic Initiatives provides opportunitties for market players in the US Esoteric Testing Market

Companies operating in the US esoteric testing market focus on strategic developments such as collaborations, expansions, agreements, partnerships, and new product launches, which help them improve their sales, expand their geographic reach, and enhance their capacities to cater to a larger than existing customer base. A few of the noteworthy developments in the US esoteric testing market are mentioned below.

• In February 2021, Quest Diagnostics collaborated with Grail for its Galleri multi-cancer blood tests. With this collaboration, Quest Diagnostics planned to provide phlebotomy services using the Galleri multi-cancer early-detection blood tests.

• In January 2021, BioReference Laboratories, Inc., an OPKO Health (OPK) company, introduced Scarlet Health. It is an in-home, fully integrated digital platform providing access to on-demand diagnostic services. Scarlet has been designed similarly to tools consumers use daily to confer ease of use, ubiquity, and convenience. The platform delivers an innovative, flexible, mobile alternative to traditional patient service centers or other draw locations when phlebotomy and other specimen collection services are needed.

• In September 2021, LabCorp acquired operating assets and intellectual property (IP) from Myriad Genetics’ autoimmune business unit, including the Vectra rheumatoid arthritis (RA) assay, which is expected to bolster its scientific leadership in rheumatology.

• In 2020, Quest Diagnostics acquired Blueprint Genetics, the outreach laboratory service business of Memorial Hermann Health System. Via this multiyear agreement, Quest plans to offer professional laboratory management services for all 21 hospital laboratories of Memorial Hermann, which provide onsite rapid-response testing. Quest also plans to become the sole chosen provider of laboratory services for the Memorial Hermann Health Plan.

• In 2019, Sonic Healthcare acquired Aurora Diagnostics with a goal to augment its presence in the anatomical pathology specialty in the US.

Therefore, initiatives by companies to venture into new business segments through collaborations and partnerships to remain competitive would create significant growth opportunities in the US Esoteric testing market in the coming years.

US Esoteric Testing Market: Competitive Landscape and Key Developments

Georgia Esoteric & Molecular Laboratory LLC, Laboratory Corp of America Holdings, Quest Diagnostics Inc, National Medical Services Inc, OPKO Health Inc, ARUP Laboratories Inc, bioMONTR Labs, Athena Esoterix LLC, Stanford Hospital & Clinics, and Foundation Medicine Inc are a few of the key companies operating in the US Esoteric Testing market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the US Esoteric Testing market.

A few of the recent developments in the global US Esoteric Testing market are mentioned below.

- In March 2022, Waters Corporation launched the Xevo TQ Absolute system, a highly sensitive and compact benchtop tandem mass spectrometer. This latest mass spectrometer quantifies negatively ionizing compounds with up to 15 times greater sensitivity than its predecessor, with a 45% smaller size. Moreover, it consumes up to 50% less electricity and gas.

- In February 2021, Quest Diagnostics collaborated with Grail for its Galleri multicancer blood tests. Quest Diagnostics had plans to provide phlebotomy services using the Galleri multicancer early-detection blood tests.

- In January 2021, BioReference Laboratories, Inc., an OPKO Health (OPK) company, introduced Scarlet Health. It is an in-home, fully integrated digital platform that provides access to on-demand diagnostic services. Similar to devices that are used on a daily basis, Scarlet has been designed to confer ease of use, ubiquity, and convenience. The platform delivers an innovative, flexible, mobile alternative to traditional patient service centers or other draw locations when phlebotomy and other specimen collection services are needed.

- In September 2021, LabCorp acquired operating assets and intellectual property (IP) from Myriad Genetics’ autoimmune business unit, including the Vectra rheumatoid arthritis (RA) assay. With this acquisition, LabCorp is expected to bolster its scientific leadership in rheumatology.

- In 2020, Quest Diagnostics acquired Blueprint Genetics, an outreach laboratory service business of Memorial Hermann Health System. Via this multiyear acquisition agreement, Quest plans to offer professional laboratory management services for all 21 hospital laboratories of Memorial Hermann, which provide onsite rapid-response testing. Quest also plans to become the sole laboratory service provider for the Memorial Hermann Health Plan.

- In 2019, Sonic Healthcare acquired Aurora Diagnostics to augment its presence in the anatomical pathology specialty in the US.