North America Vacuum Blood Collection Tube Market

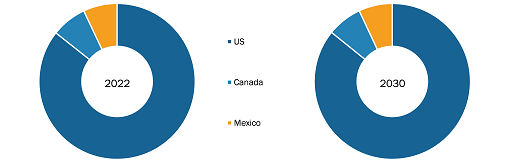

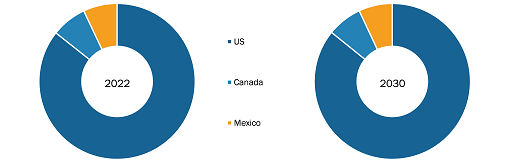

The US held the largest share of the vacuum blood collection tube market in North America. Although the US has a well-developed healthcare sector equipped with highly advanced equipment and instruments, it experiences increasing incidences of chronic diseases and multiple organ dysfunction syndromes or sepsis, which is likely to favor the growth of the vacuum blood collection tube market. According to the report “Chronic Kidney Disease in the United States, 2023” by the Centers for Disease Control and Prevention, 14% of ~35.5 million people suffer from chronic kidney disease (CKD) in the US. Furthermore, 9 in 10 people are not aware that they are suffering from CKD. Hypertension, diabetes, heart disease, and obesity are the causes of CKD. Thus, with the growing incidences of high blood pressure, heart disease, diabetes, and obesity, the demand for blood testing for diagnostics and research purposes increases in the US, which propels the vacuum blood collection tube market growth in North America.

An increase in organ transplant procedures performed across the US can be associated with an upsurge in blood transfer procedures that require blood testing to identify blood groups and tissue types. The American Cancer Society estimates that more than 1.9 million people will be diagnosed with cancer in 2023. Many cancer patients need to undergo blood transfusion procedures as a part of the management of chemotherapy or radiation side effects or to make up for the blood lost during surgeries. According to the United Network for Organ Sharing (UNOS), 42,887 organ transplants were performed in the US in 2022, recording an increase of 3.7% over 2021. The American Red Cross Blood Services reported that someone in the US requires blood for cancer therapies, surgeries, traumatic injuries, and other chronic illness treatments every two seconds. Thus, the demand for vacuum blood collection tubes increases with the increasing demand for blood testing due to rising incidences of kidney and other chronic diseases in the US.

Increasing Number of Surgeries Drives North America Vacuum Blood Collection Tube Market Growth

North America has witnessed an overall increase in the demand for surgical procedures in recent years. This can be attributed to factors such as advancements in medical technology, an aging population, and a greater emphasis on proactive healthcare management. With the rise in the prevalence of heart, liver, kidney, and other chronic diseases, the number of surgeries performed annually has also increased notably. According to the report “Chronic Kidney Disease in the United States, 2023” by the Centers for Disease Control and Prevention, 14% of ~35.5 million people in the US suffer from chronic kidney disease (CKD). CKD has a higher prevalence in people aged 65 years or older (34%) than in people aged 45–64 years (12%) or 18–44 years (6%). Furthermore, the “Life and expectations post-kidney transplant: a qualitative analysis of patient responses” study published in 2019 reported that ~17,600 kidney transplants are performed each year in the US.

According to the American Joint Replacement Registry (AJRR) on Knee and Hip Arthroplasty’s 7th annual report, ~2 million hip and knee procedures were performed between 2019 and 2020 in the US. Angioplasty and atherectomy are two of the most common procedures performed in the US. According to the most recent interventional cardiology procedural data, more than 965,000 angioplasties are performed in the US each year. An angioplasty, also known as percutaneous coronary intervention (PCI), is a procedure in which a stent is inserted into a blocked or constricted artery. The development of advanced surgical techniques and procedures has increased the range and complexity of surgeries performed. Minimally invasive procedures, robotic-assisted surgeries, and other innovative techniques have gained popularity due to their potential for faster recovery, reduced complications, and improved patient outcomes. These advancements require accurate and reliable diagnostic information, which, in turn, drives the demand for vacuum blood collection tubes to collect samples for pre-operative testing and post-operative monitoring.

Advances in anesthesia and blood management also play a crucial role in surgical procedures, and accurate pre-operative patient assessment and monitoring are essential for successful outcomes. Blood management, including appropriate interventions to prevent excessive bleeding or clotting, also contributes to surgical success and patient safety. Vacuum blood collection tubes are used for pre-operative blood tests to assess coagulation parameters, blood typing, and screening for infectious diseases, helping healthcare providers make informed decisions regarding anesthesia management and blood transfusions during surgeries.

An increase in organ transplant procedures performed across the US results in an upsurge of blood transfer procedures that need collection units such as bags and tubes. The American Cancer Society estimates that more than 1.9 million people are likely to be diagnosed with cancer in 2023. Many cancer patients need to undergo blood transfusion procedures as a part of the management of chemotherapy or radiation side effects or to make up for the blood lost during surgeries. According to the United Network for Organ Sharing, 42,887 organ transplants were performed in the US in 2022, recording an increase of 3.7% over 2021. The American Red Cross Blood Services reported that every two seconds, a need for blood araises for cancer therapies, surgeries, traumatic injuries, and other chronic illness treatments in the US. Thus, the rise in the number of surgeries and blood transfusions fuels the demand for vacuum blood collection tubes, boosting the North America vacuum blood collection tube market.

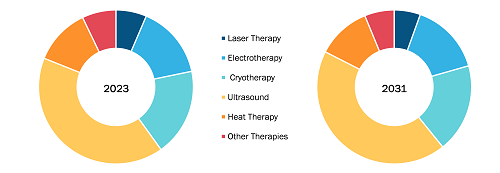

North America Vacuum Blood Collection Tube Market: Segmental Overview

The North America vacuum blood collection tube market is segmented on the basis of product, material, application, and end user. Based on product, the market is divided into heparin tubes, EDTA tubes, glucose tubes, serum separating tubes, ERS tubes, and others. The vacuum blood collection tube market, by material, is segmented into PET, polypropylene, and tempered glass. Based on application, the market is segmented into od routine examination, biochemical test, and coagulation testing. In terms of end user, the vacuum blood collection tube market is segmented into hospitals and clinics, ambulatory surgical centers, pathology labs, and blood banks.

North America Vacuum Blood Collection Tube Market: Competitive Landscape and Key Developments

Becton Dickinson and Co, Greiner Bio-One International GmbH, Sekisui Chemical Co Ltd, SARSTEDT AG & Co KG, Cardinal Health Inc, McKesson Corp, HemaSource Inc, and Medline Industries LP are a few key companies operating in the vacuum blood collection tube market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the vacuum blood collection tube market.

A few of the recent developments in the global vacuum blood collection tube market are mentioned below:

- In July 2023, SARSTEDT AG & Co KG has launched 360 solutions that will be used to improve specimen quality, reduce turnaround time, and automate labs of all sizes with customizable modular systems. The company has demonstrated S-Monovette and Tempus600 at the AACC Annual Scientific Meeting & Clinical Lab Expo. The conferences have helped in showcasing products’ specifications.

- In June 2022, Cardinal Health announced the acquisition of ScalaMed, a HIPAA-compliant smart platform that transmits medicines directly to patients via a secure mobile app. ScalaMed’s technology and assets are being transferred to Outcomes, a Cardinal Health firm, as part of the transaction. ScalaMed shifts prescription management from the provider to the patient, allowing patients to transfer prescriptions issued by their clinician to any pharmacy for the initial fill. The platform provides patients with increased freedom, easier access, and price comparison when choosing a pharmacy.

- In April 2021, Greiner Bio-One launched VACUETTE line, the innovative evoprotect safety Blood Collection Set. It meets the requirements of the EU Directive 2010/32. It is an innovative safety mechanism that can be conveniently activated while the needle is in the vein protects blood collection staff against potential injuries.