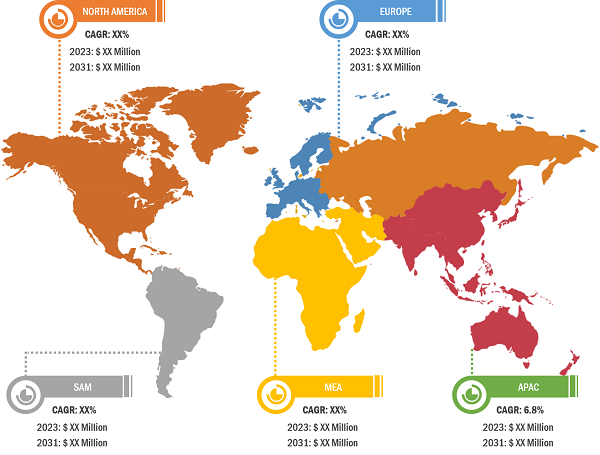

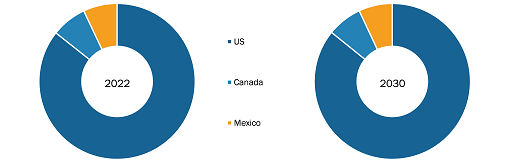

NA and APAC High Speed Copper Cable Market

The emergence of generative models is a major advancement in the development of artificial intelligence (AI). Generative AI uses cutting-edge deep learning algorithms to produce results that are almost identical to human-created material. This groundbreaking technology enables robots to evaluate massive amounts of information and provide well-informed split-second responses in a variety of formats, including text, video, audio, and graphics. As generative AI develops and matures, it will change the fundamental approach to data. In addition, with the implementation of generative AI, the necessity for high-speed connections rises, leading to 800G connectivity requirements in data centers, networking, and related applications. With the growth of generative AI, the market players are focused on working on advancements in cable technology, leading to the development of 224 Gbps-PAM4 solutions. Thus, the growing adoption of generative AI is expected to bring new trends in the NA and APAC high speed copper cable market growth during the forecast period.

Taiwan Holds Second Largest NA and APAC High Speed Copper Cable Market Share in Asia Pacific

The proliferation of the 5G services in Taiwan has been the prime factor for the high speed copper cable market. After Executive Yuan approved an action plan for 5G technology in Taiwan in 2019, ~US$ 657.9 million was invested in a four-year plan from 2019 to 2022 to boost 5G technology in the country. The investment was focused on developing a suitable environment for the 5G technology. In addition, the country’s focus on the increase in the nation’s digital competitiveness further generated the need for high speed internet services. This factor has led to the deployment of 5G services, further fueling the NA and APAC high speed copper cable market growth in the country.

The country’s policies, such as the Smart Nation Program (2021–2025), place equal emphasis on software and hardware for the development of infrastructure that supports digitalization in the country. Under Asia New Bay Area 5G AIoT Innovation Park, the government planned to invest approximately US$ 0.3 billion (NT$ 11 billion) during 2021–2025 to boost 5G Artificial Intelligence of Things (AIoT). The increasing government focus on boosting the internet infrastructure in the country generates the need for high speed copper cables.

NA and APAC High Speed Copper Cable Market Analysis: Segmental Overview

Based on type, the NA and APAC high speed copper cable market is segmented into direct attach copper (DAC) cable, active electrical cable (AEC), active copper cable (ACC), and others. The direct attach copper (DAC) cable segment held the largest NA and APAC High Speed Copper Cable Market share in 2023 and is anticipated to record the highest CAGR during 2023–2031. By application, the market is segmented into switch to switch interconnect, switch to server interconnect, and server to storage interconnect. The switch to switch interconnect segment held the largest market share in 2023 and is anticipated to record the highest CAGR during 2023–2031. Based on bandwidth, the market is categorized into 56G, 112G, and 224G and above. The 112G segment held the largest market share in 2023, whereas 224G segment is anticipated to record the highest CAGR during 2023–2031. Based on bandwidth, the market is categorized into data center, telecommunication, networking, high performance computing, and others. The data center segment held the largest market share in 2023 and is anticipated to record the highest CAGR during 2023–2031.

NA and APAC High Speed Copper Cable Market: Competitive Landscape and Key Developments

TE Connectivity Ltd, Molex LLC, Samtec Inc, Amphenol Corp, Yamaichi Electronics Co., Ltd., Credo Technology Group Holding Ltd, JPC Connectivity, NVIDIA Corp, Volex Plc, and The Siemon Co are among the key players profiled in the NA and APAC High Speed Copper Cable Market report. Several other major players were also studied and analyzed in the NA and APAC High Speed Copper Cable market report to get a holistic view of the market and its ecosystem. The report provides detailed market insights to help major players strategize their growth. As per the company press releases, below are a few recent key developments:

- In 2024, Samtec opened a new design and manufacturing center in Taiwan. The Taiwan Design Center will design (obviously), develop, and build leading-edge connector products for multiple industries, including datacom, telecom, artificial intelligence and machine learning, test and measurement, industrial, and medical. The state-of-the-art 70,000-square-foot facility (6,503 square meters) consists of three floors of manufacturing, new product development and engineering, machine and equipment design, and connector and cable assembly.