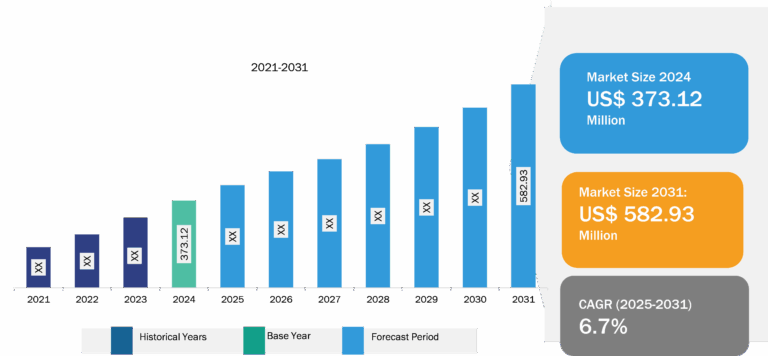

US Land Survey Equipment Market

Increasing Need for Drones or UAVs in Mapping and Surveying to Fuel US land survey equipment Market Growth During Forecast Period

The drone/unmanned aerial vehicle (UAV) industry is considered one of the fastest-growing industries. Drones/UAVs have gained immense traction due to the growing need for safe, cost-effective solutions for data collection, mapping, surveying, and inspection. They can perform increasingly complex tasks such as data collection, mapping, and surveying in extreme environments where manual surveying techniques are risky and impossible. Particularly, mini and micro quad drones are used for scanning and surveying and are extremely beneficial in places where humans cannot perform tasks in a timely and efficient manner.

Drones/UAVs are used in applications such as topographic surveying, dam surveying, forestry management & monitoring, geological hazard monitoring, and mining mapping, which increases the demand among users for high-precision mapping and surveying. For instance, in December 2023, the Federal Aviation Administration (FAA) reported that 790,918 drones were registered in the US. Therefore, the increasing demand for drones in mapping and surveying applications is driving the market. Drones cover large areas and provide accurate data in less time as compared to manual surveying, which helps users in the study of aerial data of land for making precise measurements.

Growing demand for 3D drones in land surveys is boosting the market. 3D drones are equipped with advanced sensors such as light detection and ranging (LiDAR) and photogrammetry cameras for collecting highly accurate spatial data of terrain. For example, Vision Aerial Inc offers 3D drones used in numerous applications, including land surveying, aerial mapping, land planning & management, urban planning, site scouting, and topographic surveys. Surveillance by these drones helps better analyze situations to make certain decisions beneficial to increase productivity. However, significant benefits offered by 3D drones, such as safety, accuracy, analysis, and data visualization, drive the US land survey equipment market.

Moreover, rising demand for land survey equipment and growing number of infrastructural development activities are among the factors contributing to the growing US land survey equipment market share. The US land survey equipment market trend include rising deployment of cloud-based software and services. The US land survey equipment market report emphasizes the key factors driving the market and prominent players’ developments.

US land survey equipment Market: Industry Overview

The US land survey equipment market analysis has been carried out by considering the following segments: solutions, industry, and application. Based on the solution, the US land survey equipment market is segmented into hardware, services, and software. Based on industry, the US land survey equipment market is segmented into mining, construction, agriculture, oil & gas, and others. Based on application, the US land survey equipment market is segmented into volumetric calculations, inspection, layout points, monitoring, and others.

The US land survey equipment market growth depends on several factors, such as the growing digitalization, urbanization, real estate business, and increasing use of advanced construction software. For instance, according to CBRE Group data of December 2023, investors are planning to invest in commercial real estate from Q2 of 2024 actively. This is projected to increase the construction of new apartments, thereby creating demand for land survey equipment among engineers. Equipment such as total stations and GPS are highly used by the real estate industry for precise measurement of dimensions, land boundaries, and topographical features and thus held a major US land survey equipment market share. This further supports engineers in assessing land value, determination of property boundaries, and creating detailed maps.

The presence of a large number of manufacturers is driving the US land survey equipment market. These players are continuously engaged in the development of advanced equipment to attract customers. Further, the market in the US is projected to grow, owing to the rising demand for land survey equipment from the construction, agriculture, and real estate industries. Additionally, technological advancements leading to increased production and growing R&D activities are a few factors supporting the US land survey equipment market growth.

The rising adoption of automobiles has increased the need for new road developments. For instance, as reported by the US Census Bureau, in December 2023, the government raised funding of US$ 100.4 billion in November 2023 for the construction of highways. The government is also engaged in the development and maintenance of roads to enhance traveler experience by reducing the risks of accidents. For instance, according to RAMSEY COUNTY data, Hodgson Road, Lexington Avenue, and Maryland Avenue are under construction. The Old Highway 8 is also in the resurfacing phase. Such infrastructure development requires land survey equipment to calculate area, location, route, and site planning.

The US is one of the most advanced countries in terms of technology and architecture. The country is always ahead in constructing smart homes and healthcare retails. In April 2023, LEGO Group announced the construction of a 1.7 million sq. ft. carbon-neutral production facility for children in Chesterfield County, Virginia. This project incurred a cost of ~US$ 1 billion and is expected to commence operation by the end of 2025. The company is using energy-efficient production equipment for building facilities and reducing carbon emissions.

Similarly, in July 2022, the US Energy Department disbursed a loan of US$ 2.5 billion to General Motors and LG Energy Solution’s joint venture, Ultium Cells, a unit of LG Chem, for the construction of a new manufacturing facility of the lithium-ion battery cell. Ultium Cells is investing US$ 7 million to construct three plants. One plant started operating in August 2022, whereas other plants will commence operation in 2024. Land survey equipment is required for the appropriate construction of these plants as it helps in measuring site feasibility and generating detailed survey data to make better decisions and minimize the risk of structural failures.

In July 2022, the Texas Department of Transportation awarded the contract to Webber (a subsidiary of Ferrovial) for the expansion of four highways, including Denton, Collin, Kaufman, and Coman counties. The US$ 340 million project is expected to start by the end of 2022 and is expected to complete by 2025. Thus, the growing number of construction activities in the US drives the land survey equipment market.

US land survey equipment Market: Competitive Landscape and Key Developments

Hexagon AB; Topcon; Septentrio; Trimble Inc.; Carlson Software Inc.; Juniper Systems Inc.; Raven Industries, Inc.; Shanghai Huace Navigation Technology Ltd.; Spectra Precision; and Robert Bosch Tool Corporation are among the key players profiles in the US land survey equipment market report. The strategic presence of key players positions US as a key region for the land survey equipment market growth. The report provides detailed market insights, which help the key players strategize their market growth. A few developments are mentioned below:

- In January 2024, Juniper Systems launched the Mesa 4 Rugged Tablet running Windows 11 worldwide. The tablet offers mobile workers computing power and rugged protection, with performance upgrades across all major internal components. The Mesa 4 is designed and assembled in the USA, offering up to three times the CPU performance of the Mesa 3, increased RAM size and speed, and NVMe-based SSD storage. It maintains the same rugged features as the Mesa 3, including an IP68 rating, MIL-STD-810H certification, ergonomic design, and extensive testing. The Mesa family helps Juniper Systems provide powerful rugged computing and data collection devices to mobile field workers

- In January 2024, Septentrio has launched the AntaRx smart antenna, designed for machine automation and control in construction, precision agriculture, and logistics. The ruggedized antenna can handle high levels of shocks and vibrations, offering high-accuracy RTK positioning down to the centimeter level. It includes INS integration, dual antenna mode, and 4G cellular communication. The product targets industrial applications like construction and mining, offering a high degree of robustness validated through extensive testing against industry standards. The AntaRx adds to Septentrio’s machine control GNSS receiver portfolio, used by some of the world’s largest construction companies