FGD Gypsum Market

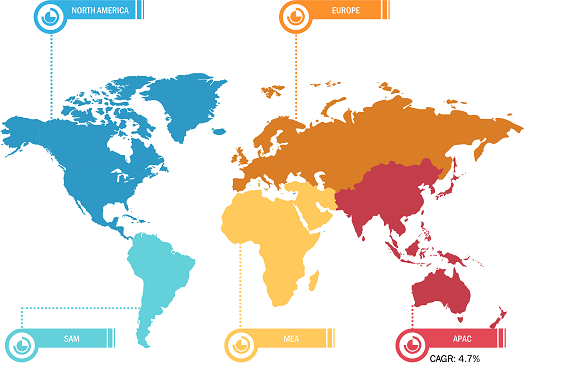

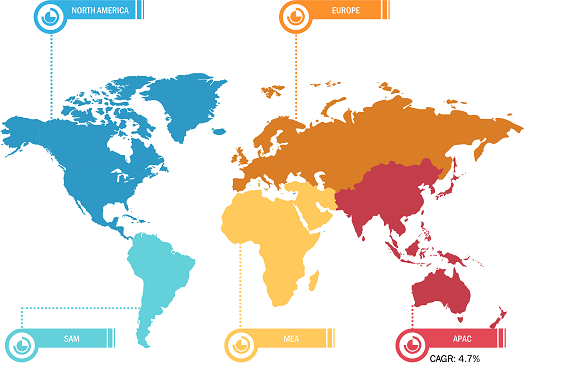

In 2022, Asia Pacific held the largest share of the global FGD gypsum market. Major factors driving the growth of the FGD gypsum market in Asia Pacific are the increasing FGD system installation in coal power plants and rising construction activities. According to the report published by International Energy Agency in 2022, Chinese power sector accounts for one-third of global coal consumption, which grew significantly in 2021 due to an increase in electricity demand. Moreover, Southeast Asian countries such as Indonesia and Vietnam planned to expand coal-based power. According to Indonesia Ministry of Energy and Mineral Resources, Electricity Supply Business Plan (RUPTL) 2019–2028, Indonesia planned to expand coal power capacity by 27 Gigawatts (GW). Nonetheless, stringent government regulations pertaining to coal power plant emissions have prompted coal power plants to install Flue Gas Desulfurization (FGD) system to convert flue gases generated by power plants into FGD gypsum. Chinese government implemented a series of policies such as on-grid tariff premium and operational priority for power plants with scrubbers to promote the installation of FGD system. According to the Federation of Indian Chambers of Commerce & Industry (FICCI), the Central Electricity Authority (CEA) drafted a plan for phased implementation of the FGD system at power plants. In 2021, FGD system was installed at the 1,340 Megawatts NTPC (National Thermal Power Corporation) coal-power plant.

Growing Construction Industry Drives FGD Gypsum Market Growth

Gypsum is used in the construction industry as a filler for cement and plasters to increase their strength while reducing the setting time of concrete. FGD gypsum, a synthetic gypsum, is highly preferred due to its lower life cycle impact compared to natural gypsum. It is also used to make decorative panels, drywall panels, wallboard, and gypsum board. The rising demand for these panels in the construction industry bolsters the demand for FGD gypsum. According to the Gypsum Association, ∼ 50% of the gypsum used to produce drywall panels in the US is FGD gypsum. The construction industry in various countries across the world is rapidly growing due to a rise in government investments and an increase in demand for residential construction. Further, European countries are creating and strengthening their infrastructure by enacting reforms and legislation, which drives the growth of the real estate and infrastructure industries. According to the European Construction Industry Federation, the volume of permits for new buildings (excluding civil engineering) in Germany was US$ 130 billion in 2021, 8% more than in 2020.

FGD Gypsum Market: Segmental Overview

Based on application, the global FGD gypsum market is segmented into wallboard/drywall, cement, agriculture, water treatment, and others. The wallboard/drywall segment held the largest FGD gypsum market share in 2022. Wallboard or drywall is a building material used as an alternative to conventional brick/stone walls. FGD gypsum is widely used in the form of wallboards and drywalls in the construction industry. It is used as a core ingredient for gypsum-based drywall panels. The core of drywall provides structural strength even if it is lightweight. FGD gypsum contains a trace amount of calcium sulfate hemihydrate, which contributes to the fire-retardant properties. FGD gypsum is known for consistent quality and purity, which is advantageous for drywall manufacturing. Wallboard and drywall manufacturers have increased the utilization of synthetic gypsum, such as FGD gypsum, as an effective alternative to natural gypsum. Rising construction and renovation activities across the globe propel the demand for drywalls.

Impact of COVID-19 Pandemic on FGD Gypsum Market

Before the COVID-19 pandemic, the surging construction activities primarily drove the global FGD gypsum market. However, the construction industry experienced an adverse impact of the pandemic during the first quarter of 2020. The crisis led to social distancing restrictions and economic fallout, restricting FGD gypsum manufacturing and distribution. Moreover, low-income and mid-income consumers faced financial difficulties in the initial months of 2020 owing to the economic recession caused by the COVID-19 pandemic. As a result, primary nonessential product demand and construction activities declined, which dropped the sales of FGD gypsums.

FGD Gypsum Market: Competition Landscape