US Fire Alarm System Contractor Market

According to a new comprehensive report from The Insight Partners, the US Fire Alarm System Contractor Market is observing significant growth owing to increase in number of fire incidents in the US and rise in the number of safety regulations regarding fire detection and alarm systems.

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the US Fire Alarm System Contractor Market comprises a vast array of technology, product type, and application which are expected to register strength during the coming years.

Overview of Report Findings

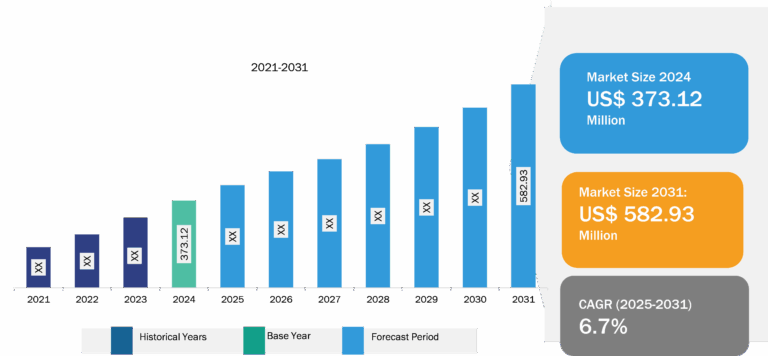

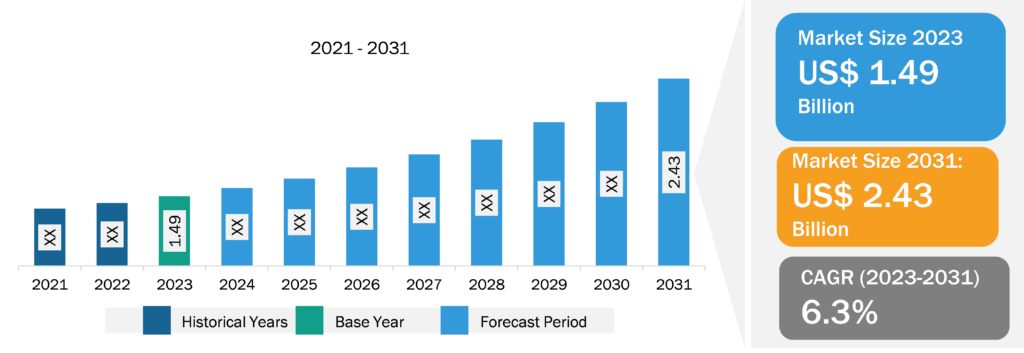

- Market Growth: The US Fire Alarm System Contractor Market was valued at US$ 1.49 billion in 2023 and is projected to reach US$ 2.43 billion by 2031; it is expected to register a CAGR of 6.3% during 2022–2030.

- Integration with Building Management Systems: The US are witnessing a rise in the number of smart buildings. Modern buildings are becoming more complicated with the need to control different technologies, which can be achieved with the integration of all of the components, such as power systems, fire systems, security systems, lighting, and others, into building management systems (BMS). With this integration, BMS can provide increased efficiency, lower operating costs, and offer a safer, more secure, and responsive building environment. It also improves reporting, information management, and decision-making by providing facility-wide insight and control, resulting in higher performance.

- Rising Adoption in Healthcare Industry: The adoption of fire alarm systems in the US healthcare industry is proliferating, driven by various factors, such as the need to safeguard patients, comply with regulations, and improve response times during emergencies. Healthcare facilities, including hospitals, nursing homes, and surgery centers, experience a few challenges, such as accommodating bedridden patients and implementing specialized fire safety solutions. According to the data of Definitive Healthcare, LLC, there are more than 7,300 active hospitals across the US; Texas, California, and Florida rank among the top three cities in the US, accounting for 757, 514, and 361 hospitals, respectively, as of July 2024. Fire safety in healthcare facilities is crucial, considering the high possibility of catastrophic consequences that can lead to an increased concentration of vulnerable patients in the event of a fire. To protect staff, patients, and the facility, hospital authorities employ a range of fire safety systems for different purposes.

- IoT-Based Fire Alarm and Remote Monitoring Systems: The Internet of Things (IoT) will play a critical role in the future of fire safety. IoT fire alarm systems operate on a network of interconnected sensors and devices that communicate with one another, as well as cloud-based platforms. Various companies are providing cloud-based fire alarm systems. For instance, in September 2024, Johnson Controls announced the release of SafeLINC. This cloud-based data-hosting infrastructure allows users to remotely access and gather actionable data from the entire suite of fire alarm control panels. SafeLINC provides users with a cloud-connected gateway and a cloud application platform accessible via web browsers and native iOS and Android mobile apps. This arrangement provides real-time data collecting, analysis, and response, making fire alarms more intelligent and efficient.

Market Segmentation

- Based on technology, the US Fire Alarm System Contractor Market is bifurcated into addressable systems and conventional systems. The addressable systems segment dominated the market in 2023.

- By product type, the US Fire Alarm System Contractor Market is segmented into detector type and alarm type. Detector type is further sub-segmented into smoke detectors, heat detectors, flame detectors, and others. Similarly, alarm type is further sub-segmented into audible alarms, visual alarms, manual call-points alarms. The detector type segment dominated the market in 2023.

- In terms of application, the US Fire Alarm System Contractor Market is segmented into commercial, industrial, and residential. The commercial segment dominated the market in 2023.

Competitive Strategy and Development

- Key Players: A few major companies operating in the US Fire Alarm System Contractor Market include Acuity International; HireRight LLC; ADP, Inc.; Pinkerton Consulting and Investigations Inc; GoodHire; Capita Plc; KPMG Assurance and Consulting Services LLP; Verity Screening Solutions; ezyHire; Triton Inc;Revealbackground.com; First Advantage;, Zeremark; DataFlow Group; Cisive; Accurate Background, LLC; Reed Group; AuthBridge; Paychex, Inc.; and Insperity Inc.

- Trending Topics: Fire Safety Equipment Market, Fire Testing Market, Fire Suppression System Market among others

Global Headlines on US Fire Alarm System Contractor Market

- ” Cintas opened a new Cleanroom facility in North Carolina’s Research Triangle. The state-of-the-art facility in Graham, N.C., created additional capacity in Cintas’ national Cleanroom footprint that now includes five Cleanroom facilities around the United States. The new Research Triangle Cleanroom facility will support high-growth industries in the region, including pharmaceuticals, biotechnology, medical device manufacturing, compounding pharmacies, electronics manufacturing, aerospace and defense, nanotechnology, semiconductors, automotive, and optics, among other industries.”

- “Pye-Barker Fire & Safety acquired DACSIS, a fire suppression and fire alarm systems integrator based in Scott, Louisiana, west of Lafayette. DACSIS’s expertise in full fire code protection for commercial and industrial customers complements the offerings of Pye-Barker’s nearby commercial alarm and security teams. It creates more opportunities for Pye-Barker to provide complete life safety protection to Gulf Coast businesses.”

Conclusion

The US Fire Alarm System Contractor Market is predicted to witness significant growth during the forecast period owing to the rising number of fire incidents. In 2022, local fire departments responded to approximately 1.5 million fires in the US, according to the National Fire Protection Association (NFPA). These incidents resulted in 3,790 civilian deaths and 13,250 documented civilian fire injuries. The projected property damage from these fires was US$ 18 billion. Due to these rising fire incidents, the government of the US is taking various strict initiatives to install fire alarm systems in residential, commercial, and industrial settings, which is boosting the growth of the market.

To increase efficiency and provide a safer building environment, various companies are working on integrating fire alarm systems with building management systems (BMS), which is likely to create an opportunity for the market growth during the forecast period. In addition, the growing number of construction projects in the country is expected to offer numerous opportunities to the market players in the coming years. Furthermore, the growing adoption of fire alarm system in the healthcare facilities is expected to fuel the market growth in the forecasted period. Moreover, the rise in technological advancements, such as the integration of IoT, video smoke detection, and remote monitoring, are expected to bolster the US Fire Alarm System Contractor Market in the near future.

The report from The Insight Partners, therefore, provides several stakeholders—including solution providers, system integrators, and end-user —with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.