Mexico CNC Machine Market

According to a new comprehensive report from The Insight Partners, the Mexico CNC Machine is observing significant growth owing to growing foreign direct investments in the Mexican industrial sector.

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the CNC machine market comprises a vast array of CNC machines which are expected to register strength during the coming years.

Overview of Report Findings

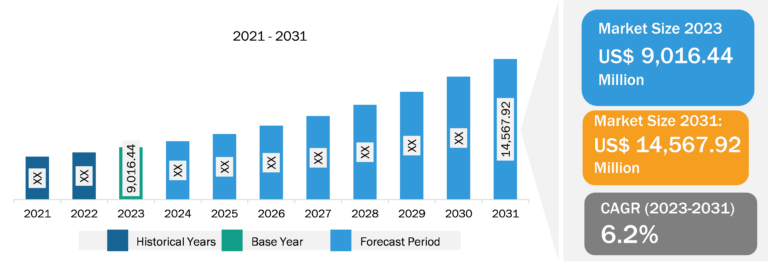

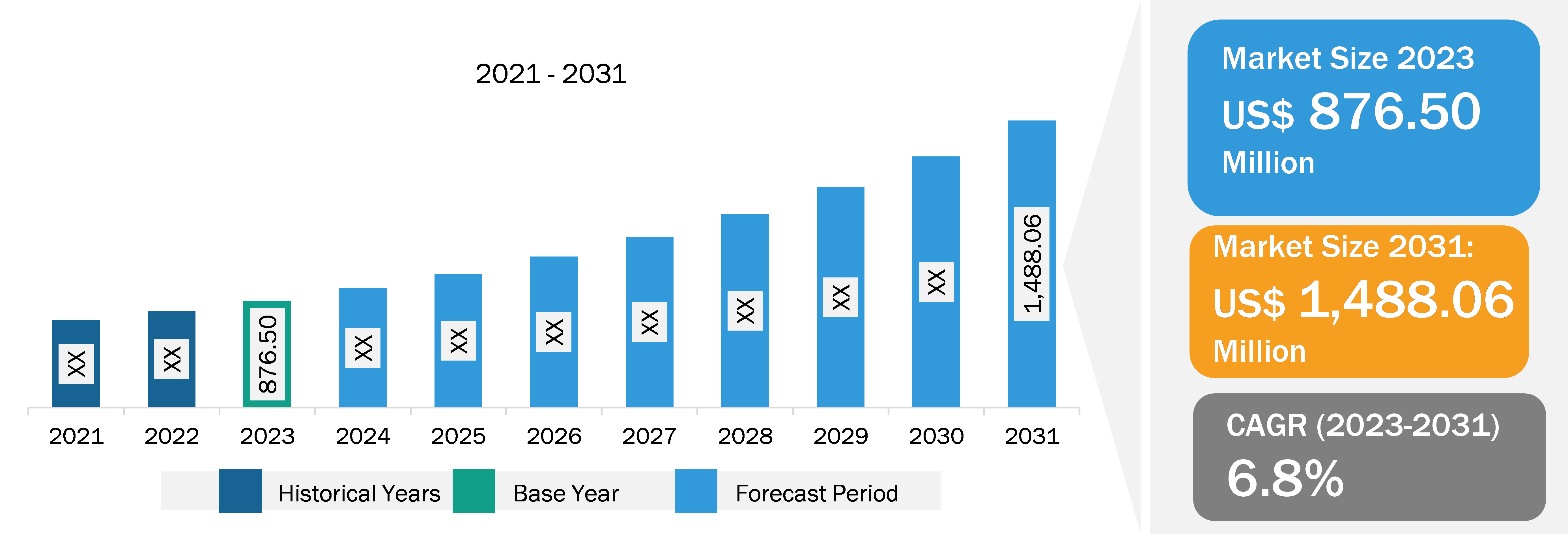

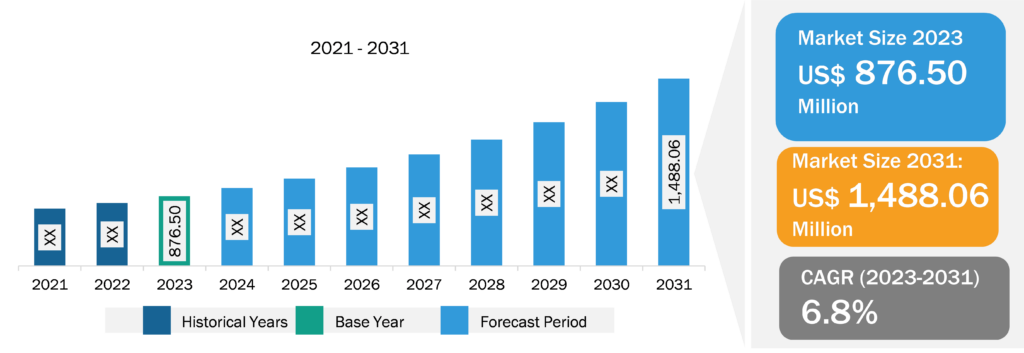

- Market Growth: The CNC machine market is expected to reach US$ 1488.06 million by 2031 from US$ 876.50 million in 2023, at a CAGR of 6.8% during the forecast period. CNC machines are automated machines that play a major role in the manufacturing sector. These machines are used for complex cutting and manufacturing of a wide range of items by eliminating the risk of human errors. CNC machines use software programming languages such as G-code to produce the parts. These machines are used to manufacture automotive and aerospace parts. There is an increase in investments across the aerospace sector in Mexico, which is driving the CNC machine market growth. According to the International Trade Administration, the aviation and aerospace sector in Mexico received significant investment of more than US$ 11.8 billion annually as of 2024. Further, automotive sector export in Mexico was valued at ~US$ 189 billion in 2023, which increased by 14.3% compared to 2022. The automotive industry has become the major driver for the growth of the CNC machine market.

- Mexico is the 15th largest economy globally and the largest exporter in Latin America. In 2022, Mexico’s gross domestic product (GDP) was valued at US$ 1.41 trillion. According to the World Bank Report in 2022, the industrial and services sector in Mexico accounted for 32.1% of the country’s GDP. The industrial sector in Mexico, including mining, manufacturing, oil, & gas, has contributed between 25% and 35% of the overall GDP. The Mexico CNC machine market is driven by increasing industrial activities and rising foreign trade. In 2023, Mexico’s Ministry of Economy reported an increase in foreign direct investments (FDIs) by 27%, reaching US$ 36 billion; 50% of this investment is in the manufacturing sector in Mexico. From January 2024 to June 2024, FDIs in Mexico reached US$ 31.1 billion across several industrial sectors. Mexico’s overall manufacturing output for 2023 was valued at US$ 360.73 billion, which increased by 14.73% compared to 2022. The increase in FDIs and the growth of the industrial sector in Mexico drive the Mexico CNC machine market.

- Automotive production accounted for 3.5% of Mexico’s overall GDP and 20% of the manufacturing sector’s GDP. Car manufacturers in Mexico include Ford Motor Co (F), General Motors Co (GM), Mercedes Benz, Honda Motor LTD (HMC), Toyota Motor Corp (TM), and Volkswagen Group. Mexico is the largest exporter of automobiles and auto components. Mexico’s international sales of motor cars and other vehicles valued at US$ 58.5 billion in 2023. Automotive manufacturers are located in the northern region of Sonora, Baja California, Chihuahua, Nuevo León, Coahuila, and San Luis Potosí. Original equipment manufacturer (OEM) plants for automotive are in Aguascalientes, Guanajuato, Estado de Mexico, Jalisco, Morelos, Hidalgo, and Puebla. In terms of supply chains, automotive parts producers are located primarily in Chihuahua, Coahuila, Guanajuato, Nuevo León, Puebla, Queretaro, San Luis Potosi, Tamaulipas, and Estado de Mexico. According to the Mexican Automotive Industry Association (AMIA), Mexico’s automotive industry production reached ~4.1 million, which is an increase of 10.8% compared to 2022. The rising automotive production and the growing automotive sector investments have created a high demand for CNC machines.

- CNC machines are widely used to manufacture various industrial components in the energy and power sector. In the energy and power sector, CNC machines are widely used to produce various components, such as seals, gears, pumps, and valves. These components are used in various energy and power-related applications, such as hydroelectric dams, wind turbines, and oil and gas drilling rigs. In 2022, the National Power System in Mexico’s power generation was 340,713 GWh, ~31.2% of the clean energy sources. In August 2024, the Federal Electricity Commission in Mexico and the government invested ~US$ 19.31 billion in energy generation-related projects. This investment funded the development of nearly 35 generation projects and 41 distribution projects. In 2023, five energy-related transmission projects were completed, with a total investment of $ 16.04 million. The rising investment in energy and power-related projects across the country is expected to create significant opportunities for the CNC machine market growth during the forecast period.

- The manufacturing sector in Mexico is developing, with a major focus on advanced technologies such as industrial automation, robotics, the Internet of Things, artificial intelligence (AI), 3D printing, additive manufacturing, automation, wireless technologies, and autonomous vehicles. The rise of Industry 4.0 in Mexico, with the rising adoption of smart factories and industrial automation, is expected to be a key trend in the CNC machine market. The integration of automation and robotics in CNC machine manufacturing is increasing rapidly growing. CNC machine manufacturers are developing artificial intelligence and sensors-based machines to meet growing industry 4.0 demand. For instance, in May 2024, ANCA CNC Machines integrated autonomous manufacturing and artificial intelligence into their machines. ANCA’s Integrated Manufacturing System offers an ecosystem to automate the production of cutting tools using CNC machines. In September 2023, Okuma America Corporation launched a next-generation CNC machine with advanced technology integration. The new advanced control Okuma OSP-P500 CNC machine is the latest technology-based machine that fully optimizes modern manufacturing operations.

Market Segmentation

- The Mexico CNC Machine is segmented based on machine type, technology, and Industry.

- Based on machine type, the CNC machine market is segmented as lathe machines, milling machines, laser machines, grinding machines, boring machines and others.

- Based on technology, the CNC machine market is segmented into horizontal (3-axis, 4-axis and 5-axis), vertical (3-axis, 4-axis and 5-axis).

- Based on industry, the CNC machine market is segmented into aerospace and defense, automotive, industrial, metal and mining, power and energy and others

Competitive Strategy and Development

- Key Players: A few major companies operating in the CNC machine market include CITIZEN MACHINERY CO., LTD;Nakamura-Tome CO., LTD.; Omnitec; Haas Automation, Inc.; Technocrafts; DN SOLUTIONS;Jinan Takara Cnc Machine Co., Ltd.; JINN FA MACHINE; Tengzhou Borui Cnc Machine Tool Co., Ltd.; Zaozhuang Shenhuan Cnc Machine Co., Ltd.; OKUMA CORPORATION; Hision; DMG MORI; Yamazaki Mazak Corporation; Hyunndai Wia Machine Tool.

- Trending Topics: Laser Cutting Machine Market, CNC 3D Printer Market

Global Headlines on Intelligent Transportation System (ITS)

- ” Siemens Mobility introduced Siemens Xcelerator, Railigent X for AI-based maintenance, and its Mobility Software Suite X for seamless intermodal travel”

- ” With the growing transition toward cloud services, EFKON enhanced its proven security management system to fully replicate the Hardware Security Module (HSM) functionality – usually hosted in their Back-Office Systems – within a virtual cloud environment “

- ” Cisco IoT solutions for roadside infrastructure help organizations address key challenges of legacy networks and devices, cyber and physical security risks, and access to real-time data, visibility, and contro”

- ” Kapsch TrafficCom’s Automatic Number Plate Recognition (ANPR) software has received a big update lately. Depending on the application, the update can attain top performance in automatic number plate recognition”

Conclusion

Intelligent transportation systems (ITS) use state-of-the-art wireless, electronic, and automated technologies to monitor, assess, and control transportation networks. They use information and communications technology (ICT) to connect automobiles and transportation infrastructure. Thus, the advantages of wireless devices, sensor technologies, and smart ICT services have led to a surge in the adoption of ITS. Further, ITS has numerous applications in tolling, commercial vehicle operations, traffic operations, traveler information, and public transportation to improve traffic flow, prevent collisions, and enhance passenger comfort and safety.

The report from The Insight Partners, therefore, provides several stakeholders—including component providers, system technology integrator, system manufacturers and others—with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.