Plastic for SLS 3D Printing Market

SLS 3D printing is increasingly adopted in a wide range of industries, such as aerospace, automotive, healthcare, and manufacturing. This is due to the advantages of SLS 3D printing over conventional manufacturing methods, such as the ability to produce complex and customized parts with high precision and accuracy. SLS 3D printing is well-suited for prototyping and rapid manufacturing applications because SLS 3D printers can produce high-quality parts in a relatively short amount of time. SLS 3D printing is also employed for rapid prototyping and manufacturing of medical devices, surgical equipment, diagnostic tools, prosthetics, and implants. The presence of SLS 3D printing companies in the region is further expected to boost the demand for plastics for SLS 3D printing.

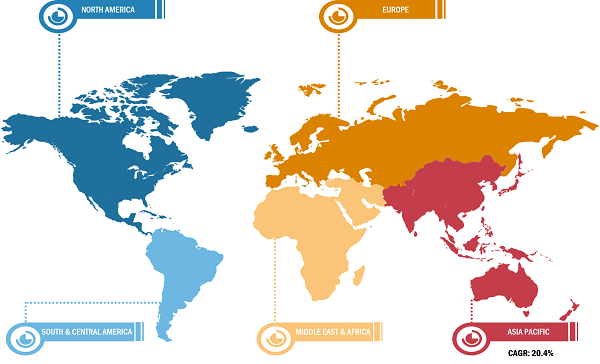

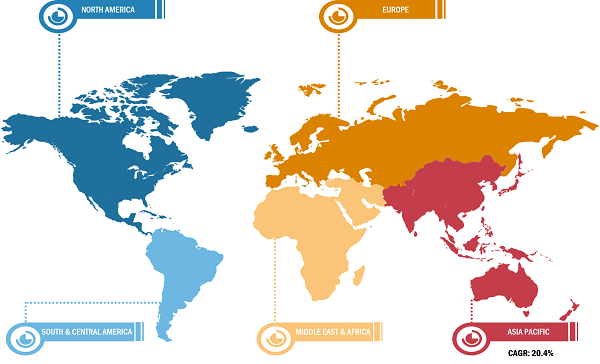

In 2022, Europe dominated the plastic for SLS 3D printing market. A 2022 report by the International Energy Agency stated that 2.3 million electric vehicles were sold in Europe in 2021 (a rise from 1.4 million in 2020). According to the International Trade Administration report published in 2022, increased investment in the automotive industry creates lucrative opportunities for automotive components and materials manufacturers. Turkey marked the presence of 48,000 hybrid and 2,000 electric vehicles on the roads and ~800 vehicle charging stations as of 2022. Several SLS 3D printing companies in the region launched product portfolios suitable for automotive interior components, gimbal bellows, air cleaner covers, hoses, grips, connectors, and joints. For instance, in October 2023, CRP Technology Srl announced the launch of Windform TPU for the SLS 3D printing process. In September 2022, Wematter partnered with OKM3D to establish a sales and service network for the Gravity SLS 3D printer in Germany. Thus, advancements in the automotive industry and strategic initiatives by the market players in the region are projected to boost the demand for plastics for SLS 3D printing in the coming years.

Advancements in SLS-Compatible Plastic Materials

Many companies are focused on the continuous development of SLS-compatible plastic materials with improved properties, such as durability, heat resistance, and flexibility. For instance, companies such as HP and BASF have been collaborating to develop innovative SLS materials. They have introduced PA11 and PA12 nylon materials that exhibit not only improved strength but also increased flexibility, making them suitable for applications ranging from automotive components to consumer goods. These materials are designed to withstand harsh and extreme conditions while maintaining their integrity. Moreover, advancements in heat-resistant plastics are becoming increasingly relevant, especially in the aerospace and industrial sectors. These materials have found applications in producing aircraft interiors and components for critical machinery operating in high-temperature environments. In the healthcare sector, the development of biocompatible plastic materials for SLS has enabled the creation of patient-specific implants and surgical tools. These materials not only exhibit high strength and flexibility but also meet stringent biocompatibility standards. Therefore, the rising development of SLS-compatible plastic materials is propelling their use in different application sectors such as automotive, aerospace & defense, and healthcare, thereby driving the market.

Plastic for SLS 3D Printing Market: Segmental Overview

Based on type, the plastic for SLS 3D printing market is segmented into polyamide, thermoplastic polyurethane (TPU), polyether ether ketone (PEEK), and others. In 2022, the polyamide segment held the largest market share, whereas the thermoplastic polyurethane (TPU) segment is considered to register the highest CAGR from 2022 to 2030. Polyamide is a preferred material for SLS 3D printing due to its exceptional qualities and adaptability. Among the various types of polyamides used for SLS, polyamide 12 (PA12) is particularly popular. It is majorly utilized for its strength, flexibility, and resistance to chemicals and heat, making it an ideal choice for various applications. Thermoplastic polyurethane (TPU) is a versatile and increasingly popular material in the market. TPU is a type of elastomer that exhibits a remarkable balance of flexibility, durability, and resilience, making it well-suited for a wide range of applications.

Based on end-use industry, the market is segmented into healthcare, aerospace & defense, automotive, electronics, and others. The electronics segment held the largest plastic for SLS 3D printing market share in 2022. SLS 3D printing technology offers several advantages for producing intricate, customized, and small-scale electronic components. Plastic-based SLS 3D printing is majorly utilized for the manufacturing of customized enclosures and casings for consumer electronics. Companies have employed this technology to create smartphone cases, tablet holders, and custom-fit components for wearable devices, offering consumers the ability to personalize their gadgets.

Impact of COVID-19 Pandemic on Plastic for SLS 3D Printing Market

Before the onset of the COVID-19 pandemic, the SLS 3D printing market was growing steadily, driven by rising demand from the automotive, aerospace & defense, and electronics sectors. The automotive sector was one of the largest consumers of plastic for SLS 3D printing. Plastic material is used in a variety of automotive applications, including custom plastic parts, aircraft parts, and electronics. The market witnessed a strong emphasis on material innovation. Companies were investing in research and development to create new and improved 3D printing materials, particularly in the plastics segment. These materials offer enhanced properties such as strength, durability, flexibility, and heat resistance. High-performance plastics such as nylon, ABS, and polycarbonate became popular for additive manufacturing.

During the COVID-19 pandemic in 2020, various industries had to slow down their operations due to disruptions in the supply chain caused by the restrictions on national and international borders. The pandemic introduced various economic challenges, including trade barriers and tariffs, currency fluctuations, and regulatory challenges, hindering the plastic for SLS 3D printing market growth in different regions. The shutdown of production facilities negatively impacted the 3D printing market growth in early 2020. With the recovery of operations of the automotive and aerospace & defense sectors, the demand for 3D printing materials has been growing. In addition, the expansion of the electronics sector across the globe is boosting the demand for plastic for SLS 3D printing.

Plastic for SLS 3D Printing Market: Competitive Landscape and Key Developments

3D Systems Corp, BASF SE, Evonik Industries AG, Arkema SA, Ensinger GmbH, Fiberlab SA, Stratasys Ltd, Sinterit Sp Zoo, EOS Gmb, and CRP Service SRL are a few players operating in the global plastic for SLS 3D printing market. Players operating in the global plastic for SLS 3D printing market focus on providing high-quality products to fulfill customer demand.

Key Developments

- In June 2023, 3D Systems announced a collaboration with SWANY Co Ltd to promote the adoption of large-format pellet extrusion 3D printing in Japan.

- In February 2021, 3D Systems introduced a High-Speed Fusion industrial 3D printer platform and material portfolio in collaboration with Jabil Inc.

- In October 2022, Evonik intended to improve overall eco-balances by aligning its INFINAM polyamide 12 (PA12) powders by introducing PA12 powders with much lower CO2 emissions.