Cloud Infrastructure Entitlements Management (CIEM) Market

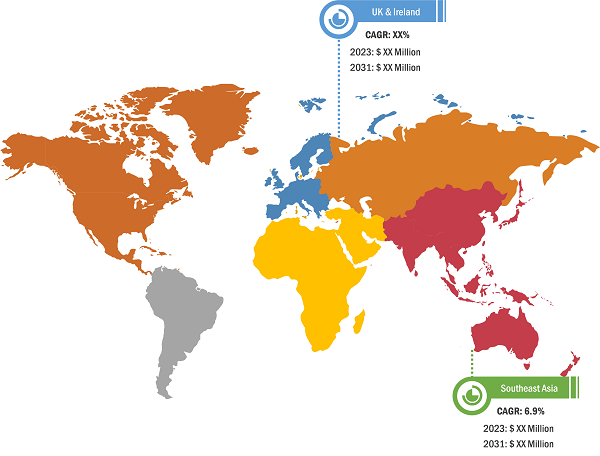

The report includes growth prospects owing to the current cloud infrastructure entitlements management (CIEM) market trends and their foreseeable impact during the forecast period. In terms of revenue, Asia Pacific dominated the cloud infrastructure entitlements management (CIEM) market share followed by North America and Europe.

The Asia Pacific cloud infrastructure entitlements management (CIEM) market is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. In terms of revenue, China dominated the cloud infrastructure entitlements management (CIEM) market share. The growth of cloud technology is expected to witness a rise in investment for cloud deployments across emerging markets and developed markets in the region. Cloud adoption is driven by the establishment of data centers across APAC countries by major providers such as Microsoft, Amazon Web Services, and Google Cloud. Also, better bandwidth connectivity to emerging economies in the region has easily allowed the providers to offer cloud services from hubs such as Singapore. Further, banking and financial services are adopting cloud technologies to store huge amounts of customer data. The growing adoption of cloud computing across the region is driving the demand for cloud infrastructure entitlements management (CIEM), particularly after the onset of the COVID-19 pandemic, as organizations started relying on the cloud to ensure employees can securely access networks and resources from home. For instance, according to a report published by Cisco, organizations in Asia Pacific across various sectors such as BFSI, telecommunications, government & defense, financial services, and manufacturing have been the most active in the adoption of cloud networking. All such factors contribute to the cloud infrastructure entitlements management (CIEM) market growth in Asia Pacific.

China has a vast and rapidly growing cloud market. Government support for digital transformation has led to increased cloud adoption in more traditional sectors in the country. For example, through the 14th Five Year Plan (14th FYP), the government of China is prompting the digital transformation of Chinese industries. Chinese businesses aim to get a well-organized, simple, and stable cloud environment. Users in China are focused on utilizing cloud computing on a large scale. Thus, the significant potential in the Chinese cloud market is likely to boost the adoption of cloud infrastructure entitlements management solutions and services in the coming years.

India has a huge potential for adopting cloud computing owing to the ongoing transition toward digitalization and the growing need for faster-speed data transmissions. Cloud adoption has increased rapidly in the country during the COVID-19 pandemic as enterprises adopted new technologies to maintain uninterrupted operations and address their needs. Multi-cloud adoption has emerged as a valuable cloud strategy, enabling them to become more agile so that they can scale up or down as needed and avoid vendor lock-in. According to the January 2022 report published by Nutanix, enterprises in India began moving to multi-cloud environments during the COVID-19 pandemic for security, performance, cost efficiencies, and business continuity, especially with a surge in remote working. Moreover, 84% of Indian enterprises prefer a hybrid multi-cloud operating model. According to a blog published by Cyber Media (India) Ltd in May 2021, 22% of enterprises in India are using a multi-cloud environment, which is expected to reach 50% in the coming two years. All such factors contribute to India’s significant cloud infrastructure entitlements management (CIEM) market growth.

Rising Demand for Hybrid and Multi-Cloud Solutions to Provide Growth Opportunities for Cloud Infrastructure Entitlements Management (CIEM) Market During Forecast Period

With advancements in cloud computing and increasing demand for hybrid and multi-cloud environments, the IT landscape will continue to shift and evolve. Hybrid cloud refers to the combination of public cloud and on-premises infrastructure. Multi-cloud computing, on the other hand, is the use of multiple public cloud providers. Increasing adoption of hybrid and multi-cloud solutions is a significant trend in the IT industry. These strategies offer several benefits that can help businesses to improve their flexibility, resilience, scalability, and cost savings. In the past few years, the adoption of hybrid and multi-cloud infrastructure has accelerated exponentially. A recent survey by Dataversity Digital LLC suggested that 98% of companies on the public cloud have already planned to switch to a multi-cloud architecture. Furthermore, according to the 2022 Global Hybrid Cloud Trends Report, 82% of organizations have adopted a hybrid cloud. In the coming years, we will witness more companies shifting toward hybrid and multi-cloud environments. CIEM plays a pivotal role in hybrid and multi-cloud environments, providing centralized visible control and enhanced security. Thus, rising demand for hybrid and multi-cloud solutions provides opportunities for cloud infrastructure entitlements management (CIEM) market growth.

Global Cloud Infrastructure Entitlements Management (CIEM) Market: Segmental Overview

Based on end user, the market is segmented into IT & telecom, healthcare, manufacturing, BFSI, retail & e-commerce, and others. The IT & telecom segment is expected to dominate the market, and the BFSI segment is expected to register the highest CAGR in the cloud infrastructure entitlements management (CIEM) market during the forecast period.

Cloud Infrastructure Entitlements Management (CIEM) Market Analysis: Competitive Landscape and Key Developments

Microsoft; Palo Alto Networks; Check Point Software Technologies Ltd.; CrowdStrike Holdings Inc; CyberArk Software Ltd; Radware Ltd; One Identity LLC; Zscaler Inc; Orca Security; and Tenable, Inc. are among the key players profiled in the cloud infrastructure entitlements management (CIEM) market report. Several other major cloud infrastructure entitlements management (CIEM) market players were also studied and analyzed during this market research study to get a holistic view of the market and its ecosystem. The cloud infrastructure entitlements management (CIEM) market report can help stakeholders in this marketplace plan their growth strategies. The cloud infrastructure entitlements management (CIEM) market forecast provides detailed market insights, which help the key players strategize their growth. A few developments are mentioned below:

The cloud infrastructure entitlements management (CIEM) market leaders focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities. As per company press releases, below are a few recent key developments:

- In June 2023, Lacework announced the launch of cloud entitlement management capability to its cloud-native application protection platform (CNAPP). With this new set of capabilities, organizations can enforce the principle of least privilege when building, deploying, using, and managing cloud infrastructure services.

- In October 2023, Tenable announced the acquisition of Ermetic, Ltd. Under this acquisition, Tenable and Ermetic will help organizations address a few of the most difficult challenges in cybersecurity together.

- In May 2022, Uptycs announced the launch of cloud infrastructure entitlement management (CIEM) capabilities that strengthen its cloud security posture management (CSPM) offering. In addition, Uptycs announced CSPM support for Google Cloud Platform (GCP) and Microsoft Azure, as well as PCI compliance coverage. These new capabilities provide security and governance, risk, and compliance teams with continuous monitoring of cloud services, identities, and entitlements in order to reduce their cloud attacks risk.