Utility Compact Tractors Market

Increased Adoption of Snow Removal Applications Boosts Utility Compact Tractors Market Growth

Heavy snowfall and accumulation of snow affect the country in many ways. Snowfall can cause transit delays, lost workdays, property damage, accidents, injuries, and even fatalities. In addition, it also negatively affects heavily on the overall purchasing habits of the consumer. During the snowfall, owing to difficulties in transit, consumers’ visits to the retail stores are reduced, thus reducing impulsive buying and ultimately affecting the sales of the companies. These sales of the companies directly affect the overall country’s economic activities. According to the data published by the US Commerce Department in 2024, retail sales dropped to 0.8% in the first two months of 2024.Owing to such problems, governments across the globe invests heavily on the snow removal activities. According to the US government data in 2022, the Massachusetts government has approximately 4000 snow plows worth US$ 800 million, whereas Pennsylvania has 2,252 snow plows worth US$ 450 million. As per the Minnesota Department of Transportation data, during 2022-2023, US$ 174 million was spent on snow and ice removal operations. This cost of approximately 25% higher than the amount spent during 2021-2022. Apart from the US, Canada, Japan, Norway, South Korea, and Russia are among the top countries where snowfall causes serious problems. As per the Canadian government in 2024, Winnipeg’s ( a province in Canada) budget for snow removal reached approximately US$ 90 million in 2022. In addition, in 2021, the snow removal budget in Montreal accounted for 3% of the total Montreal budget. Further, according to the Japanese government, in 2022, snow removal activities in Aomori cost approximately US$ 45 million to the city’s government. Thus, owing to the negative effects of snowfall, such as road blockage, accidents, and injuries, among others, governments across the globe spend heavily on snow removal operations. Increasing need and capital for snow removal, the demand for utility compact tractors has increased. These compact tractors with snow plows and snow blower attachments become the ideal solution for snow removal tasks.

Apart from the increasing demand for snow removal, manufacturers’ product and development activities have also positively affected the adoption of the utility compact tractor’s adoption. For instance, in January 2024, Hilltip started offering an innovative V-plow, a snow removal attachment for compact tractors weighing 2.5 to 5 tons. In addition, in August 2023, John Deere introduced the SB12F Series Front-Mount Snowblower attachment for compact tractors. Such product development activities have helped the utility compact tractor industry to grow.

Utility Compact Tractors Market Analysis: Type Overview

On the basis of drive type, the Utility Compact Tractors Market is segmented into ICE and Electric. Electric drive type is projected to lead the market during the forecast period. As the focus on sustainability is increasing, the adoption of electric vehicles across industries is growing rapidly. In addition, government financial aid and regulations such as tax exemption programs are also supporting the adoption of the electric utility compact tractors. Further, one of the main advantages of the electric compact tractor is reduced fuel costs which reduces the operational costs and ultimately affects the overall profits positively. Thus, to cater to the increasing demand for electric utility compact tractors, many compact tractor manufacturers started introducing new products. For instance, in September 2023, New Holland introduced its new T4 electrically powered utility tractor. The new tractor is powered by zero-emission motors and comes with autonomous driving features.

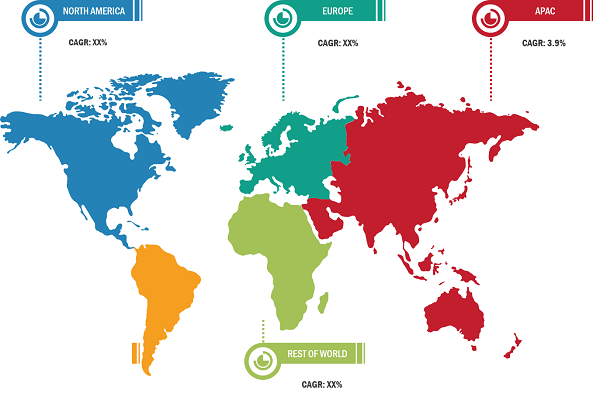

The Utility Compact Tractors Market is primarily divided into North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). In terms of revenue, Asia Pacific dominated the Utility Compact Tractors Market in 2022.

The Utility Compact Tractors Market in Asia Pacific is further segmented into Australia, China, India, Japan, South Korea, and the Rest of Europe. China dominated the Asia Pacific Utility Compact Tractors Market in 2022. China is one of the world’s top rice producers and consumers, accounting for more than 40% of total rice production. Maize accounts for more than 33% of Chinese cereal production, and the country contributes 23% of worldwide maize output. Thus, strong agriculture growth along with the presence of domestic Utility Compact Tractor manufacturers justify the dominance of this country in the Utility Compact Tractors Market in Asia Pacific. Continuous product development activities by compact tractor manufacturers in China also benefit the market. In addition, the experience and expertise of Chinese vehicle manufacturers in the electric and self-driving technology is expected to bring new Utility Compact Tractors Market trends in the coming years.

Utility Compact Tractors Market: Competitive Landscape and Key Developments

John Deere, Kubota, Massey Ferguson, Mahindra, Case IH, Montana Tractors, Fendt, and Sonalika International are among the prominent players profiled in the Utility Compact Tractors Market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. A few of the key developments, as per press releases, are mentioned below:

| Year | News | Country |

| March 2023 | TYM launched the new series of 4 tractors with a telematics system (T76 only) and hydraulic top links. | APAC |

| May 2023 | John Deere introduced the 2024 model-year enhancements to its 3R- and 4-Series compact utility tractors. These tractors are equipped with accessories that are useful for commercial snow removal. | North America |