Sterilization Technologies Market

Factors such as the increasing prevalence of healthcare-associated infections and the rising number of surgical procedures propel the sterilization technologies market growth. However, the stringent regulations regarding chemical emissions impede the growth of the market. Further, continuous developments in sterilization technologies are expected to bring new trends in the market in the coming years.

The sterilization technologies market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. North America accounted for the largest share of the global market in 2022. The US held the largest share of the market in this region in 2022 and is estimated to continue its dominance from 2022 to 2030.

Medical Device Industry Contributes Significantly to Sterilization Technologies Market Growth

The growing geriatric population, the prevalence of chronic diseases, and the need for pediatric care have been bolstering the demand for technologically advanced healthcare facilities. The burgeoning demand for better healthcare facilities has prompted developing countries to prioritize the development and promote the use of technology-enabled healthcare solutions. Leading revenue-generating medical device businesses invest heavily in R&D to employ improved and convenient sterilization technologies in their manufacturing facilities. Different types of medical equipment play a crucial role in patient monitoring and treatment. Sterilization is an essential phase in the medical device manufacturing process. The selection of a sterilization method depends on material compatibility, process availability, processing location, physical device features, regulatory approval, cost, and local regulatory specifications. Sterilization of medical devices plays an essential role during the manufacturing and usage of these devices. Inadequate device sanitization can result in health problems and difficulties while obtaining market approval from regulatory authorities such as the FDA. Nonetheless, healthcare companies must effectively manage sterilization to maintain patient safety. Thus, the flourishing medical device industry is expected to boost the sterilization technologies market growth in the coming years.

Shutdown of Medical Device Sterilization Facilities Hampers Growth of Sterilization Technologies Market

The sterilization technologies market has been growing rapidly with the increasing application of these technologies, especially chemical-based techniques, in various medical device and pharmaceutical manufacturing facilities. Ethylene oxide (EtO) sterilization is widely used in the medical device industry. As per the FDA, over 20 billion medical devices are sold annually in the US, accounting for ~50% of all devices, and they are sanitized using EtO. However, due to increased concerns over the toxicity of EtO residuals, the Environmental Protection Agency recently imposed restrictions on its use; further, notices rolled out to shut down multiple sterilization facilities have posed various challenges to medical device manufacturers. For instance, on January 21, 2020, Medline Industries temporarily closed its Waukegan facility. The facility was used to manufacture and decontaminate 16,000 custom surgical kits daily. Medline voluntarily shut the facility to comply with a state EtO emission-control law. On June 2, 2021, Steril Milano S.R.L. (Italy) announced the shutdown of its EtO sterilization facilities (effective from March 2021) in Monza and Reggiolo , which offered medical device sterilization services. According to the FDA, the facilities were closed due to the improper sterilization of medical devices, raising sterility concerns.

On January 21, 2020, Georgia State Authorities accused Becton Dickinson and Company of releasing excessive EtO, which resulted in the shutdown of its medical device sterilization facility in Covington. It adversely affected the supply of critical medical devices such as surgical kits, feeding tubes, and different catheter types. On January 21, 2020, the Lake County Health Department announced that the BD sterilization facility was closed down from December 13, 2019. Thus, shutdown of medical device sterilization facilities hamper the sterilization technologies market growth.

Sterilization Technologies Market: Segmental Overview

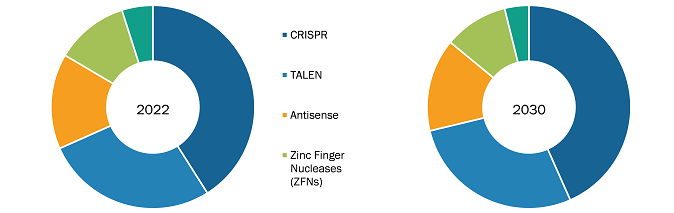

By method, the sterilization technologies market is segmented into ethylene oxide sterilization, chlorine dioxide sterilization, gamma ray sterilization, electron beam sterilization, steam sterilization, and others. The ethylene oxide sterilization segment held the largest market share in 2022. The chlorine dioxide sterilization segment is anticipated to register the highest CAGR during 2022–2030.

The sterilization technologies market, by end user, is divided into medical device companies, pharmaceutical and biotechnology companies, hospitals and clinics, laboratories, and others. The medical device companies segment accounted for the largest market share in 2022. It is anticipated to register the highest CAGR during 2022–2030.

The sterilization technologies market report, based on geography, is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Sterilization Technologies Market: Competitive Landscape and Key Developments

Advanced Sterilization Products Services Inc, Steris Plc, Atec Pharmatechnik GmbH, Belimed Inc, Andersen Sterilizers Inc, Consolidated Machine Corp, Sterile Technologies Inc., Tuttnauer, BMT Medical Technology SRO, and Steelco SpA are among the prominent players profiled in the market report. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the market.

A few of the recent developments in the global sterilization technologies market are mentioned below:

• In August 2023, the FDA cleared the Steris V-PRO maX 2 Low-Temperature Sterilization System with a specialty cycle for the sterilization of 3D-printed devices used in healthcare facilities. This is the first FDA-approved system capable of effectively sterilizing surgical instruments such as patient-specific surgical guides (e.g., osteotomy, shoulder, hip, knee, and spine) and 3D printed anatomical models intended for single use during operative procedures.

• In June 2023, Shimadzu Corporation collaborated with Shyld, a US-based artificial intelligence (AI) and robotics expert, to develop an AI-enhanced ultraviolet irradiation C (UV-C) disinfection technolog y. The technology aims to redefine the infection control landscape by combining Shimadzu’s optics and Shyld’s AI innovations.

• In May 2023, Ahlstrom launched Reliance Fusion, a next-generation simultaneous sterilization wrap that helps increase the efficiency of surgical equipment tray sterilization at hospitals . Reliance Fusion integrates top-quality cellulose and polypropylene-based materials.