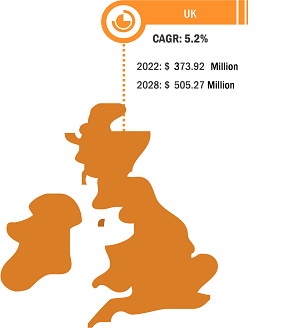

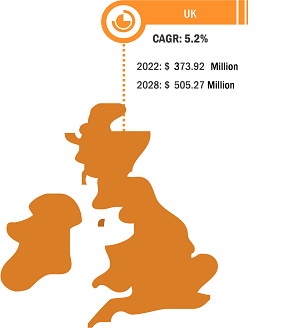

UK Medical Courier Market

Growing Strategic Initiatives Offer Opportunities for UK Medical Courier Market During Forecast Period

Several giants operating in the industry are taking strategic initiatives such as mergers and acquisitions, partnerships and collaborations, as well as unveiling new products to expand their foothold, support the end users in faster delivery of medical supplies, offer value-based care, and maintain a competitive edge in the market.

For instance, a consortium led by AGS Airports launched its next phase—Care and Equity – Healthcare Logistics UAS Scotland (CAELUS)—in partnership with NHS Scotland in September 2022. It secured US$ 12.56 million in funding from the Future Flight Challenge at UK Research and Innovation in August 2022. CAELUS brings together 16 partners, including Atkins, the University of Strathclyde, NATS, and NHS Scotland. Together they are work to deliver essential medicines, blood, and other medical supplies throughout Scotland, including remote communities, through the first national drone network to transport. By securing US$ 1.86 million in January 2020, the CAELUS consortium designed drone landing stations for NHS sites across Scotland and developed a virtual model (digital twin) of the proposed delivery network, which connects hospitals, pathology laboratories, distribution centers, and GP surgeries across Scotland. NHS Scotland has said it will bring its “Once for Scotland” approach to the project. Further, the second phase will involve live flight trials and remove remaining barriers to safely use drones at scale within Scotland’s airspace.

UK Medical Courier Market: Segmental Overview

The UK medical courier market, by product type, is segmented into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The medical supplies and equipment segment held the largest share of the market in 2022. The lab specimens segment is anticipated to register the highest CAGR in the market during the forecast period. Many labs and medical facilities have in-house delivery services to handle lab specimens. However, many labs and medical facility centers outsource medical logistics services offered by independent shipping and delivery companies. Lab specimens are critical products that need a temperature-controlled environment. While transporting lab specimens, it is essential to ensure safe and compliant collection, pickup, and delivery. Various guidelines are published by regulatory bodies in the UK for the safe transport of lab specimens. According to the Oxford University Hospitals NHS Foundation Trust data published in January 2023, over three-quarters of all medical diagnosis relies on laboratory diagnostics, and the NHS performs more than 6.5 million tests each year. According to The Royal College of Pathology, nearly 105 hospitals offer pathology services, ~300,000 tests are performed every working day, and almost 14 tests are performed on each patient yearly in England and Wales. Thus, the number of pathology tests performed in a year in the country will significantly influence the market expansion during the forecast period.

UK Medical Courier Market: Competitive Landscape and Key Developments

ERS Transition Ltd, Send Direct Ltd, Med Logistics Group Ltd, CitySprint (UK) Ltd, United Parcel Service Inc, FedEx Corp, Aylesford Couriers Ltd, Reliant Couriers & Haulage Ltd, Coulson Ventures Ltd, and Deutsche Post AG are among the leading companies operating in the UK medical courier market. These players are focusing on expanding and diversifying their market presence and acquiring a novel customer base, thereby tapping prevailing business opportunities in the UK medical courier market.

Many market players are launching their innovative products in the UK medical courier market with advanced features. For instance,

In April 2022, FedEx Express, a subsidiary of FedEx Corp. and the world’s largest express transportation company, has expanded its operations at Newcastle International Airport, to serve growing export and import demands in the region. The new facility supports an upgrade to a FedEx-branded B737-400 aircraft, which is three times the size of its current ATR72 aircraft.

In July 2022, DHL announced plans to invest £482m across its UK e-commerce operation, DHL Parcel UK. The investment comes following a 40% volume uplift since the start of 2020 and soaring demand for its e-commerce and B2B services. The new facility will have the capacity to handle over 500k items per day.

In July 2022, Med Logistics Group Ltd has plans to use electric vehicles. By 2023, the company aims to use fully electric within London.

In March 2023, In October 2022, Med Logistics Group Ltd partnered with Skyfarer and University Hospitals Coventry and Warwickshire (UHCW) NHS Trust to conduct a trial for Beyond Visual Line of Sight (BVLOS) drone in the UK. The drone is first-of-its-kind, and the trial was completed under secure CAA-approved airspace called “The Medical Logistics UK Corridor”.