Iron Powder Market

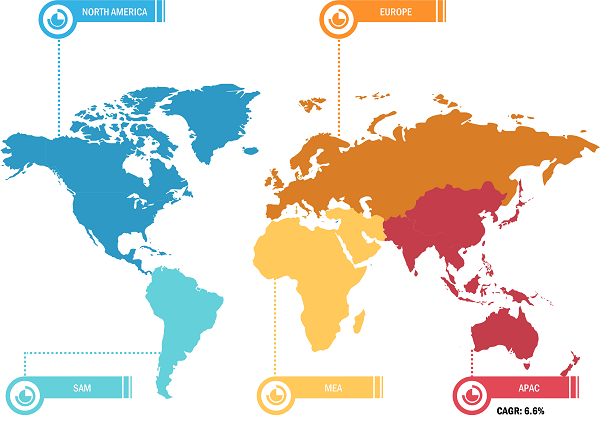

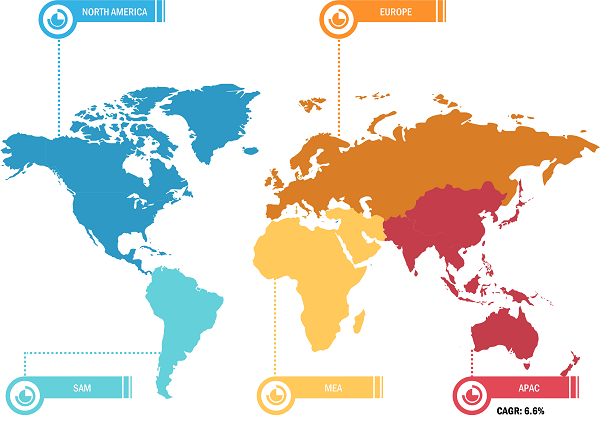

In 2022, Asia Pacific accounted for the largest portion of the global iron powder market share. Asia Pacific’s rapid industrialization and economic growth have led to an increased demand for iron powder. It is a fundamental raw material used in a wide range of industries, including construction, automotive, and electronics. The region’s burgeoning infrastructure development and manufacturing activities have significantly contributed to the high consumption of iron powder. Furthermore, Asia Pacific’s robust automotive and construction sectors have been pivotal in driving the market. Iron powder is used in the production of components such as gears, bearings, and structural parts in these industries. With the growing middle class and urbanization in many Asia Pacific countries, the demand for automotive and infrastructure has risen, thus propelling the market.

Increasing Demand from Electronics Industry Propels Iron Powder Market Growth

The iron powder market has experienced significant growth, primarily driven by rising demand from the electronics industry. The electronics industry relies heavily on powdered iron for various applications, such as manufacturing inductors and transformers. These components are essential for the functioning of electronic devices, including smartphones, computers, and power supplies. As consumer electronics continue to advance and become readily available, the demand for high-quality iron powder rises. Additionally, the trend toward miniaturization in the electronics industry has created a need for smaller, more efficient components. Iron powder is well-suited for this purpose, as it can be finely tuned to meet specific requirements, such as magnetic properties and particle size distribution. This versatility has made iron powder attractive for manufacturers producing compact, high-performance electronic devices.

Iron Powder Market: Segmental Overview

Based on type, the iron powder market is segmented into reduced, atomized, and electrolytic. The atomized segment held the largest share of the market in 2022. The electrolytic segment is expected to record the highest CAGR from 2022 to 2030. Atomized iron powder is produced using a specialized atomization process. The resulting iron powder typically has a high purity level and good flow properties, making it suitable for a wide range of industrial uses. Atomized iron powder finds applications in various industries, including metallurgy, manufacturing, and the production of components such as sintered parts, magnetic materials, and brazing alloys. Its properties, such as good compressibility and flowability, make it valuable in processes such as powder metallurgy, where it can be compacted and sintered to create intricate and high-strength parts. Recently, the demand for atomized iron powder has been steadily rising, mainly due to the growth of industries such as construction, automotive manufacturing, and the burgeoning renewable energy sector. In the automotive industry, atomized iron powder is utilized in the production of sintered parts, contributing to lightweight and fuel-efficient vehicles. Due to all these factors, the atomized segment dominates the iron powder market.

Based on the manufacturing process, the iron powder market is segmented into physical [atomization and electro-deposition], chemical [reduction and decomposition], and mechanical. The physical segment held the largest market share in 2022. The physical manufacturing process of iron powder is a complex and meticulously controlled process from raw ore to the fine powder used in various industries. For iron powder production, the crude iron is finely ground and then subjected to atomization or electrolysis methods, resulting in iron powder particles of specific sizes and purities. The physical manufacturing process of iron powder is highly adaptable and the most commonly utilized process, allowing for the production of iron powder with tailored properties to meet the specific needs of industries such as metallurgy, electronics, and automotive manufacturing. Due to all these factors, the physical segment dominates the iron powder market.

Impact of COVID-19 Pandemic on Iron Powder Market

Before the COVID-19 pandemic, the iron powder market was mainly driven by the increasing use of iron powder in paints & coatings, additive manufacturing, medical, soft magnetic products, and metallurgy. However, due to the pandemic, governments of various countries across the globe imposed country-wide lockdowns that directly impacted the growth of the industrial sector. The shutdown of production facilities negatively impacted the market growth in 2020. The disruptions in the supply chain of iron powder resulted in increased costs of iron powder in different regions. However, with the ease of lockdown measures, various industries regained momentum, which increased the demand for iron powder. Further, many economies began reviving with the resumption of operations in different sectors in 2021. As a result, the market is growing with the rise in demand from various sectors.

Iron Powder Market: Competitive Landscape and Key Developments

Rio Tinto Metal Powders, American Elements Inc, Industrial Metal Powders (India) Pvt Ltd, CNPC Powder North America Inc, Ashland Inc, BASF SE, Hoganas AB, JFE Steel Corp, Reade International Corp, and Kobe Steel Ltd are among the players operating in the global iron powder market. The market players focus on providing high-quality products to fulfill customer demand.

Key Developments

- In May 2023, Xi’an Bright Laser Technologies Co., Ltd. (BLT) announced its Phase IV facilities expansion project in Xi’an, China. The fourth phase of BLT’s Additive Manufacturing construction project is expected to focus on expanding its metal AM powder production lines and customized products production lines, with a total facility area of ~163,200 m².

- In February 2021, the specialty chemicals group ALTANA completed the acquisition of the business of TLS Technik GmbH & Co. Spezialpulver KG, thus strategically expanding its ECKART division. TLS is engaged in the production of high‑quality metal powders for industrial 3D printing.