Bioproduction Market

Rising Adoption of Regenerative Medicines Drives Bioproduction Market

Regenerative therapies help in the regeneration of cells, tissues, and organs to restore their functions. A number of regenerative medicine applications for human clinical trials are submitted to the Food and Drug Administration (FDA) each year. As per the Alliance for Regenerative Medicine, in 2019 (Q3), 1,052 clinical trials utilizing regenerative medicine were underway globally; 218 cellular therapy trials were underway (41 Phase I, 147 Phase II, 30 Phase III) in 2019. Rapid advancements are being made in regenerative medicines to provide effective solutions for chronic conditions. Cell therapy is one of the fastest-growing segments of the regenerative medicine domain. Novartis’ Kymriah was the first cell therapy solution offered to treat B-cell acute leukemia. Moreover, RepliCel, a regenerative medicine supplier, has a wide range of regenerative medicine products in the pipeline, with three products in the development phase—RCS-01, RCH-01, and RCT-01. Further, Sernova is encountered in the development of regenerative medicine technologies and has a huge pipeline of products for conditions such as diabetes, hemophilia A, and hyperthyroidism. Thus, the rising adoption of regenerative medicines is driving the bioproduction market.

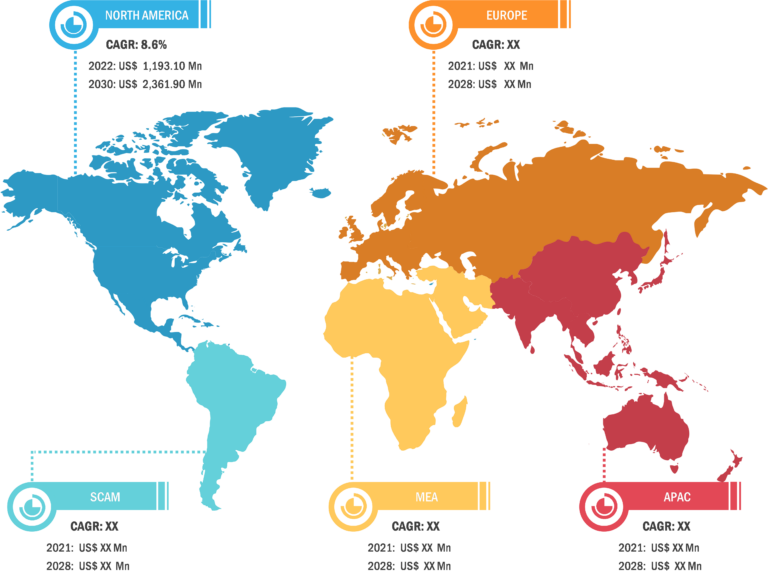

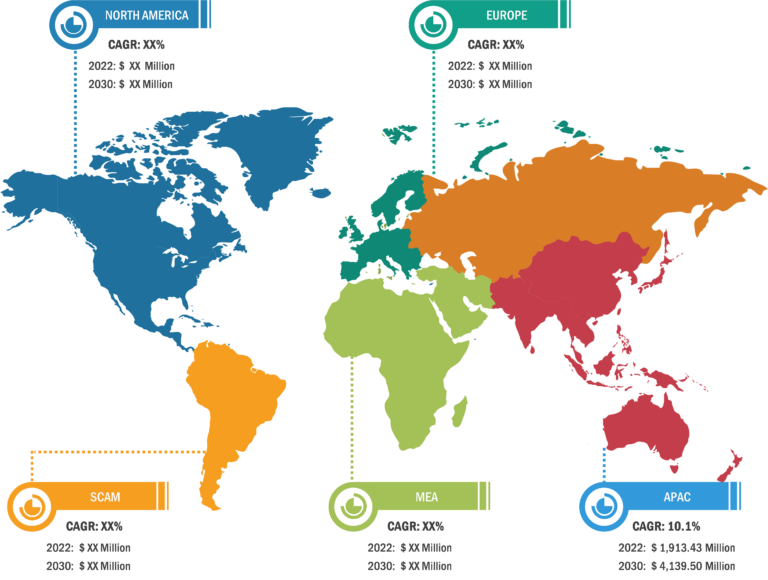

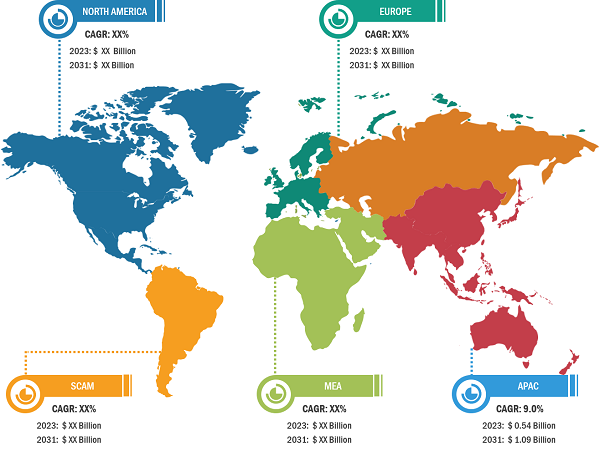

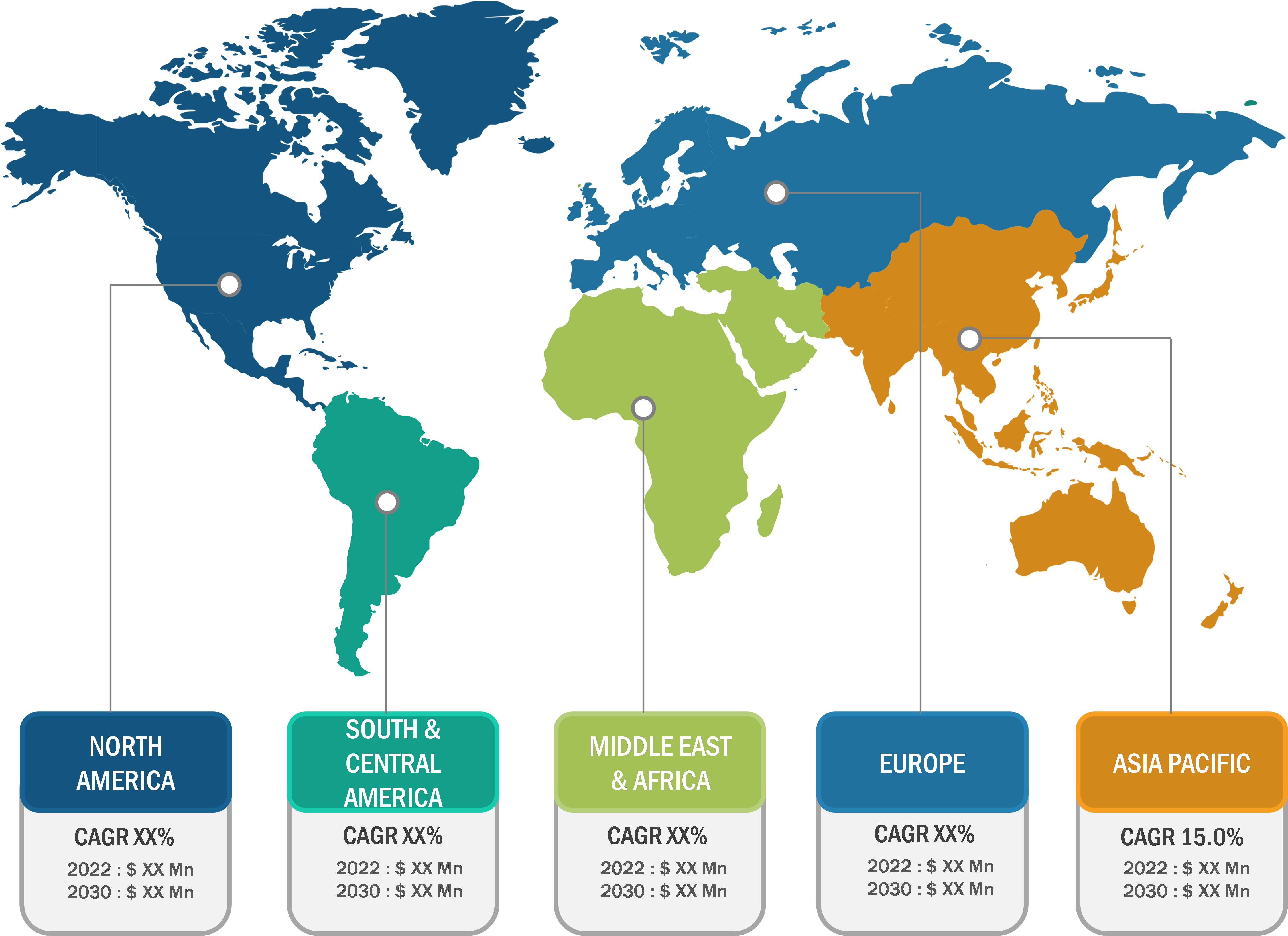

Bioproduction Market: Regional Overview

Geographically, the bioproduction market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held the largest share of the global bioproduction market. Further, Asia Pacific is predicted to register the highest CAGR during 2022–2030. Market growth in Asia Pacific is attributed to growing need for superior treatment solutions, increasing focus on research and development activities, and favorable regulatory scenarios. Additionally, increasing investments and developing healthcare infrastructure to boost research activities are estimated to drive the Asia Pacific bioproduction market during 2022–2030.

The Asia Pacific bioproduction market is subsegmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. In China, the demand for healthcare is increasing rapidly. Factors such as rising incidence of chronic diseases, growing geriatric population, and increasing government initiatives in the healthcare sector are driving the cell therapy market in China. Improvements in basic and private medical insurance plans have also accelerated the growth of the medical sector in the country. The rising income levels have led to the demand for more sophisticated healthcare services. The rise in the geriatric population has led to an increase in the specialty medical community in the country. In China, the growing prevalence of cancer is likely to increase the adoption of cell therapy.

According to Generics and Biosimilars Initiative (GaBI), in 2021, the National Medical Products Administration (NMPA) approved 13 copy biologicals within the product classes of monoclonal antibody and tumor necrosis factor (TNF)-inhibitor for use in China.

In February 2019, China’s first authorized biosimilar was approved. Shanghai Henlius Biopharmaceutical developed the rituximab biosimilar HLX01 for the treatment of Non-Hodgkin’s Lymphoma (NHL). In 2019, three more biosimilars were approved in China; in 2020, seven biosimilars were approved. Luye Pharma Group Ltd’s bevacizumab biosimilar was approved in May 2021 for non-small cell lung cancer, and in July 2021, an infliximab biosimilar was approved by Mabpharm Ltd for ankylosing spondylitis.

Thus, the Chinese biosimilars will continue to surge in the future, with 11 biosimilars in pre-registration awaiting NMPA approval and approximately 100 biosimilars in development. Therefore, China’s strong biosimilar pipeline and the NMPA’s latest regulation changes will foster growth in the bioproduction market in China.

Industry Developments and Future Opportunities:

Various initiatives taken by leading players operating in the global bioproduction market are listed below:

- In March 2023, Lonza declared that its intended cGMP clinical and commercial drug product production line in Visp (CH) has been completed. Customers with a range of production demands for drug products, for both clinical and commercial supply, will be served by the new line. Modern liquid and lyophilized vial filling isolator line for multiple modalities that satisfies the GMP Annex 1 requirement for manufacturing sterile products is part of this 1,200 square meter cGMP facility. The line is already completely operating and has a cGMP license; in April 2023, the first client batches are scheduled to be filled.

- In October 2023, Lonza declared the continuation of a long-term partnership with a significant international biopharmaceutical partner. The extension of the agreement will add two new bioconjugation suites for the commercial supply of ADCs at Lonza’s Ibex® Dedicate Biopark in Visp (CH), therefore quadrupling the current dedicated bioconjugation capacity. The addition will take up 1,500 square meter of production area and be connected to vital infrastructure that allows for the processing of bioconjugates in a highly automated, high throughput setting and the containment of extremely powerful drug linkers.

- In October 2023, Lonza announced the expansion of a partnership for the commercial-scale filling of ADCs with a significant biopharmaceutical partner. At its Stein (CH) facility, Lonza is required under the agreement to build a specialized aseptic cGMP filling line on a commercial scale. The aseptic filling of highly potent ADCs and containment lyophilization will be made possible by the new dedicated filling line. The extra filling capabilities bolster Lonza’s ability and adaptability to further support the commercial and clinical supply of bioconjugates.

- In October 2023, Thermo Fisher Scientific Inc announced an expansion of its manufacturing capacity to support biologic therapies in St. Louis, Missouri. The company has made investments to add 58,000 square feet of biologics manufacturing space since 2021. The manufacturing unit installed four Thermo Scientific DynaDrive Single-Use Bioreactors, each with the capacity to process up to 5,000 liters. The biologic therapies developed in this manufacturing unit will be intended for diseases including cancer, auto-immune conditions, and rare genetic disorders.

Bioproduction Market: Competitive Landscape and Key Developments

Lonza Group AG, bbi-biotech GmbH, Danaher Corp, Sartorius AG, FUJIFILM Irvine Scientific Inc, Thermo Fisher Scientific Inc, Merck KGaA, F. Hoffmann-La Roche Ltd, and Bio-Rad Laboratories Inc. are among the leading companies operating in the bioproduction market. The focus of these players is on expanding and diversifying their market presence and acquiring a novel customer base, thereby exploiting attractive business opportunities prevailing in the bioproduction market.