Polycarbonate Market

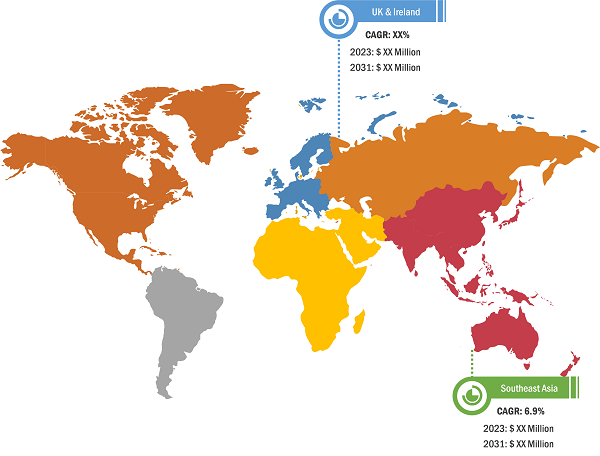

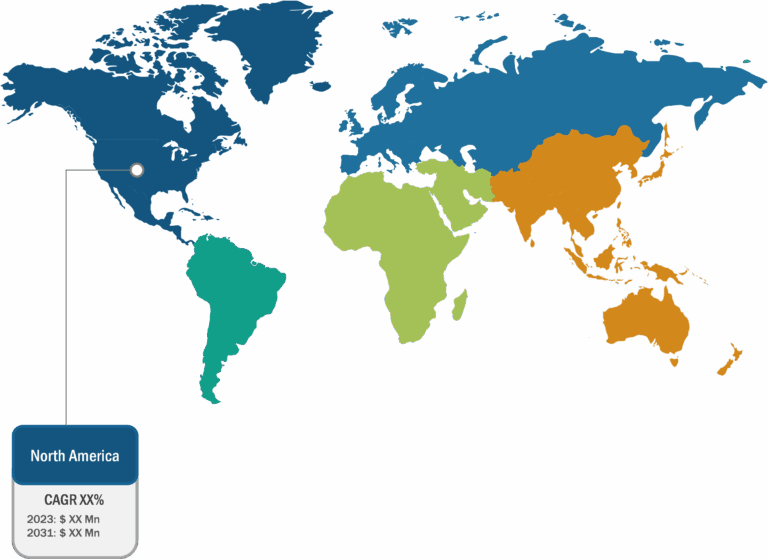

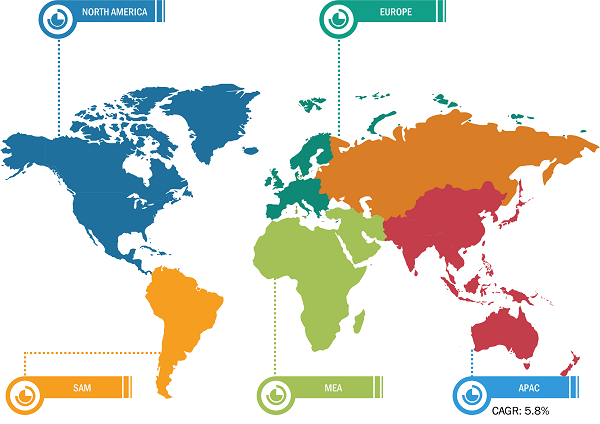

In 2022, Asia Pacific held the largest share of the global polycarbonate market and is expected to record the highest CAGR in the global polycarbonate market during the forecast period. Demand for polycarbonate is directly proportional to the expansion of the manufacturing industry across the region.

Growing Demand from Automotive and Solar Energy Sectors Drives Global Polycarbonate Market Growth

In the automotive industry, polycarbonate in the form of sheets is used for various exterior and interior vehicle parts, including bumpers, headlight lenses, sunroofs, and side mirrors. Their exceptional impact resistance is crucial in enhancing passenger safety and reducing the damage risk in the event of accidents. The demand for safer and more durable vehicles has led to the increased adoption of polycarbonate in automotive manufacturing. As fuel efficiency and environmental concerns become prominent, automakers actively seek ways to reduce the weight of vehicles. Polycarbonate is significantly lighter than traditional materials such as glass, and its use helps in achieving weight reduction targets while improving the overall efficiency of vehicles.

According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle production in North America increased from ~13.5 million in 2021 to 14.8 million vehicles (a rise of 10%) in 2022. As the automotive industry continues to evolve and innovate, high-performance materials are increasingly in demand. In addition, as the automotive industry experiences a transformative shift toward electric vehicles (EVs), polycarbonate plays crucial role. With the rising demand for EVs, governments in the region are making favorable decisions to improve the production and supply chain of EVs. On August 16, 2022, the President of the US signed the US Inflation Reduction Act to strengthen domestic supply chains for EVs, minerals, and batteries. Between August 2022 (when the Inflation Reduction Act was passed) and March 2023, major EV and battery manufacturers announced investments totaling ~US$ 52 billion in EV supply chains in North America. As the automotive sector continues to evolve and innovate, polycarbonate is poised to remain a fundamental material for producing high-quality, efficient, and environmentally friendly automotive components.

In the solar panel manufacturing industry, polycarbonate is used as the front and back cover of solar modules to safeguard the delicate photovoltaic cells from environmental elements such as dust, moisture, and UV radiation. Polycarbonate is chosen for this role due to its excellent impact resistance, high optical clarity, and UV stability, which are crucial for ensuring solar panels’ long-term efficiency and durability. Moreover, the lightweight nature of polycarbonate is advantageous in the context of solar panels. Lightweight covers reduce the overall weight of solar modules, making them easier to handle during installation. Additionally, lightweight materials help improve the portability of solar panels, which can be beneficial for off-grid or mobile applications. The growing solar energy sector, due to rising emphasis on renewable energy sources, bolsters the demand for solar panels. The versatility of polycarbonate sheets also allows them to be used in concentrating solar power (CSP) systems, which require durable and heat-resistant materials for their reflectors and protective components. Significant investments in solar energy manufacturing are expected to boost the demand for polycarbonate in the coming years.

Furthermore, the recyclability of polycarbonate aligns with the sustainability goals of the solar power industry, where environmental responsibility is a priority. Recycling these sheets at the end of their lifecycle contributes to the eco-friendliness of solar panel manufacturing, making polycarbonate an attractive choice for environmentally conscious consumers and businesses. Therefore, the rising use of polycarbonate in the solar power industry would offer lucrative opportunities for the polycarbonate market in the future.

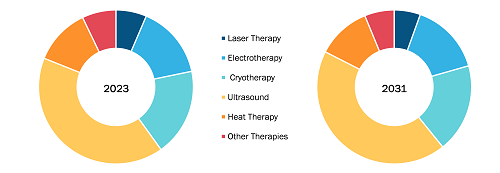

Polycarbonate Market: Segmental Overview

Based on product type, the polycarbonate market is segmented into sheets and films, blends, tubes, and others. The blends segment held the largest share of the global polycarbonate market in 2022. Polycarbonate (PC) is increasingly used in blends due to its excellent compatibility with multiple polymers. The polycarbonate blends include rubber-modified polycarbonate for improving impact properties and PC/PBT blends allowing toughness to be retained at lower temperatures and having improved fuel and weather resistance.

Based on process, the polycarbonate market is bifurcated into extrusion and injection molding. The injection molding segment held a larger share of the global polycarbonate market in 2022. Injection molding is a high-speed production technique with low cost to create a huge volume of finished products with limited human intervention. Polycarbonate is an amorphous thermoplastic polymer with functional groups linked with carbonate groups that can be processed using injection molding.

Based on application, the polycarbonate market is segmented into transportation, building and construction, electrical and electronics, optical media, medical devices, and others. The electrical and electronics segment held the largest share of the global polycarbonate market in 2022. The high demand for polycarbonate in the electrical and electronics sector, owing to the rising usage of electronics appliances such as refrigerators, air conditioners, coffee machines, food mixers, washing machines, hair dryers, steam iron water tanks, etc., across the world drives the market growth for the electrical and electronics segment.

Impact of COVID-19 Pandemic on Polycarbonate Market

In 2020, various industries had to slow down their operations due to disruptions in value chains caused by the shutdown of national and international boundaries. The COVID-19 pandemic caused supply chain disruptions in the chemical & materials industry and hampered the growth of the polycarbonate market. Adverse effects of the pandemic on the manufacturing industry negatively impacted the demand for polycarbonate from this industry.

Various economies have started reviving their operations. With this, the demand for polycarbonate started increasing. The increasing use of polycarbonate in heavy industries is expected to offer lucrative opportunities for the global polycarbonate market during the forecast period.

Polycarbonate Market: Competition Landscape

Covestro AG; LOTTE Chemical CORPORATION; Mitsubishi Chemical Group Corporation; SABIC; TEIJIN LIMITED; Formosa Chemicals & Fibre Corp.; LUXI GROUP; Idemitsu Kosan Co., Ltd.; Entec Polymers; and Trinseo are among the major players working in the global polycarbonate market. Furthermore, players operating in the global polycarbonate market focus on strategies such as investments in research & development activities.