Mediterranean Fish Vaccine Market

Based on region, the Mediterranean fish vaccine market is divided into France, Italy, Spain, Egypt, Greece, Turkey, Israel, and the Rest of the Mediterranean. France holds the largest market share and is expected to record the fastest CAGR in the market in this region during 2022–2030. According to the “Fisheries and Aquaculture in France” report published by the Organisation for Economic Co-operation and Development (OECD) in January 2021, the country produced ~0.8 million tons of fish in 2018, including mollusks (also known as molluscs) and crustaceans that together accounted for US$ 2,323.5 million of sales. 36% of these sales were contributed by aquaculture, while fisheries from wild resources accounted for the rest 64%. The report further stated that aquaculture production volume increased by 8% during 2008–2018, recording a 13% rise in terms of value.

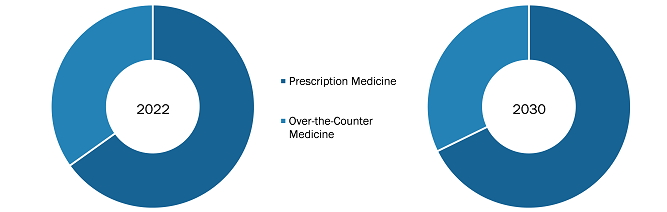

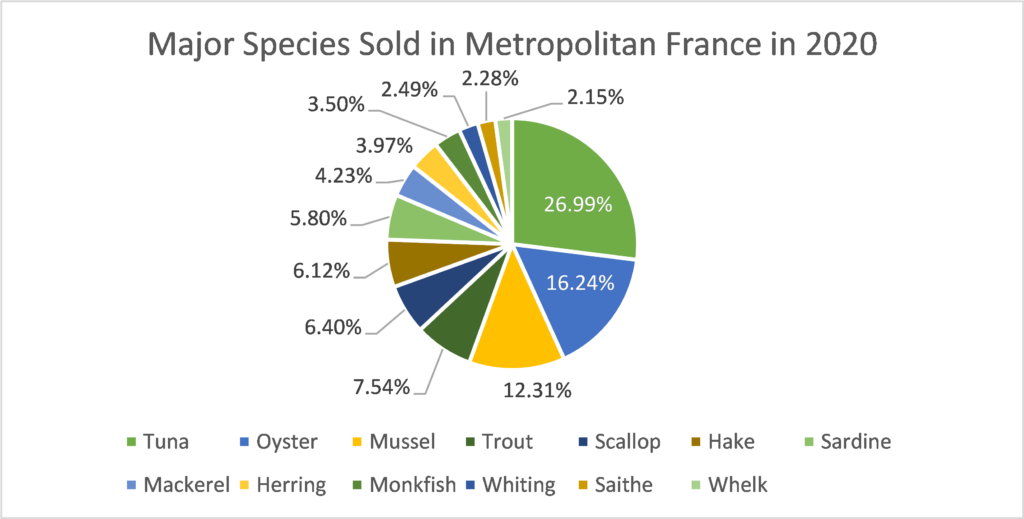

In addition, France has recorded a significant increase in the sales of major species in the past 3 years. Following is the pictorial representation of major species sold in metropolitan parts of the country in 2020.

Source: MAA/DPMA published in the fisheries and aquaculture sector in France (2022), by FranceAgriMer

The key factors contributing to the growth of aquaculture businesses in France include favorable environmental and climatic conditions, easy access to Atlantic and Mediterranean coastlines, short, distanced coastline, appropriate infrastructure and skilled human resources, and accessibility to research facilities in France. According to projections by the European Maritime and Fisheries Fund (MFF), aquaculture activities in France are expected to grow three times by 2023, contributing notably to the food supply, environmental protection, and employment. Thus, the flourishing aquaculture sector is a major factor driving the demand for fish vaccines in France.

Shift from Conventional Vaccines to DNA Vaccines to Emerge as Future Trend in Mediterranean Fish Vaccine Market

The development of conventional vaccines is a time-consuming process, which makes them less preferred interventions to control the prevalence of emerging pathogens. With advancements in fields such as genetics, immunology, and biotechnology, new and faster methods for fish vaccine development have emerged in recent years. These methods include deoxyribonucleic acid (DNA) vaccines, recombinant vaccines, and vaccines developed using genetically engineered vectors. DNA vaccines are extremely stable and do not require cold conditions for handling, which makes their storage and transport easier than conventional vaccines. Any vaccine that is developed and licensed for use should also be relatively quick and affordable to produce. More notably, they should produce strong, long-lived immune responses. Also, more work is required to comprehend their drawbacks, such as the potential of the fish’s immune system to become tolerant to the antigens.

Experimental DNA vaccines have been developed in the past decade against various aquatic pathogens that infect various fish species. However, only a few have been commercialized and made available for actual use. For example, Clynav, a salmonid alphavirus subtype 3 vaccine, is a DNA vaccine that is commercialized in the European Union against the pancreas disease virus. Therefore, a shift from conventional to DNA vaccines is expected to bring new growth trends into the Mediterranean fish vaccine market during the forecast period.

Inactivated Vaccine Type Accounts for Largest Share of Mediterranean Fish Vaccine Market

The Mediterranean fish vaccine market, by vaccine type, is segmented into inactivated vaccine, live-attenuated vaccine, toxoid vaccine, subunit vaccine, conjugate vaccine, and recombinant vaccine. The inactivated vaccine segment held the largest Mediterranean fish vaccine market share in 2022. Pathogenic bacteria in inactivated vaccines are killed using formalin without disrupting their immunogenic properties. Although inactivated vaccines have been the traditional means of vaccination, they are generally used when attenuated vaccines are not available against a particular condition. Moreover, this type of vaccine is useful when the pathogenicity and characterization of the infection are unknown. Inactivated vaccines are more immunogenic but pose no harm or contamination risk to the environment. They are stable due to the no possibility of reversion. However, the major disadvantages of these vaccines include elevated costs; ineffectiveness against intracellular organisms; and the requirement of multiple doses, adjuvants, and booster doses. Inactivated fish vaccines are preferred in Spain, Norway, Ireland, Finland, and other European countries. For instance, HIPRA offers inactivated L. garviae for Lactococciosis in rainbow trout, amberjack, and yellowtail.

The recombinant vaccine segment is anticipated to register the highest CAGR during 2022–2030. With technological advancements, it has now become possible to formulate vaccines by using only the immunogenic part of the pathogen, which can be expressed in heterologous hosts. Elanco Animal Health Incorporated has approved a recombinant vector vaccine named Clynav in the European Union and Norway. Clyvnav was developed using DNA-recombinant technology to use the outcomes for preventing pancreas disease in salmonids. The recombinant vector vaccines under development appear to induce greater immunity over conventional fish vaccines. Thus, the market for recombinant fish vaccines is estimated to grow at the fastest CAGR during the forecast period.

Mediterranean Fish Vaccine Market: Segmental Overview

On the basis of route of administration, the Mediterranean fish vaccine market is segmented into immersion vaccine, injection vaccine, and oral vaccine. The injection vaccine segment held the largest market share in 2022. The immersion vaccine segment is anticipated to register the highest CAGR during 2022–2030. Based on species, the Mediterranean fish vaccine market is segmented into turbot, European anchovy and seabass, salmon, Mediterranean Sea bass, common dentex and common pandora, sea bream, rainbow wrasse, sparus aurata, trout, Mediterranean swordfish and bluefin tuna, grouper and amberjack, and others (Beadlet anemone, Blacktailed wrasse, Black scorpionfish, Cardinalfish, Caulerpa prolifera, Damselfish, Deep-snouted pipefish, and Dotted seaslug). The salmon segment held the largest Mediterranean fish vaccine market share in 2022. Further, the Mediterranean Sea bass segment is anticipated to register the highest CAGR during 2022–2030. On the basis of clinical indication, the Mediterranean fish vaccine market is segmented into bacterial infection and viral infection. The bacterial infection segment held a larger market share in 2022, and it is anticipated to register the highest CAGR during 2022–2030.

Mediterranean Fish Vaccine Market Analysis: Competitive Landscape and Key Developments

Zoetis Inc, Merck & Co Inc, HIPRA SA, ICTYODEV SAS, Acuipharma Aquaculture Health SL, Phibro Animal Health Corp, Vaxxinova International BV, Kyoto Biken Laboratories Inc, Elanco Animal Health Inc, and Ceva SA are a few of the key companies operating in the Mediterranean fish vaccine market. The market leaders focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities.

- In February 2020, HIPRA conducted a conference in Monastir (Tunisia). The event was organized for Mediterranean producers and veterinarians from Tunisia and Algeria. The company addressed the issues that affect production in the Maghreb area. Addressing challenges faced by Mediterranean fish farmers, mainly associated with viral nervous necrosis and Pasteurellosis, has been one of the primary goals of the event.

- In July 2020, Zoetis Inc. announced the complete acquisition of Fish Vet Group, which was a part of Benchmark Holdings, PLC. The acquisition was made to add Fish Vet Group under the Pharmaq business segment of Zoetis. The strategic acquisition was made to strengthen Pharmaq’s geographic reach, and enhance its diagnostics expertise and testing services, including environmental testing.

- In March 2020, HIPRA and Skretting, an Italian company, collaborated to develop a sustainable solution against significantly spreading Lactococcosis, which has become a threat to aquaculture due to high mortality rates and production loss. The collaboration was aimed at the development of solutions by combining Skretting’s OPTILINE HT and PROTECTM with HIPRA’s ICTHIOVAC LG vaccine.