Image Guided Radiotherapy Market

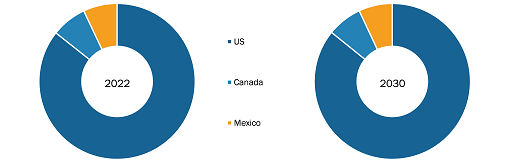

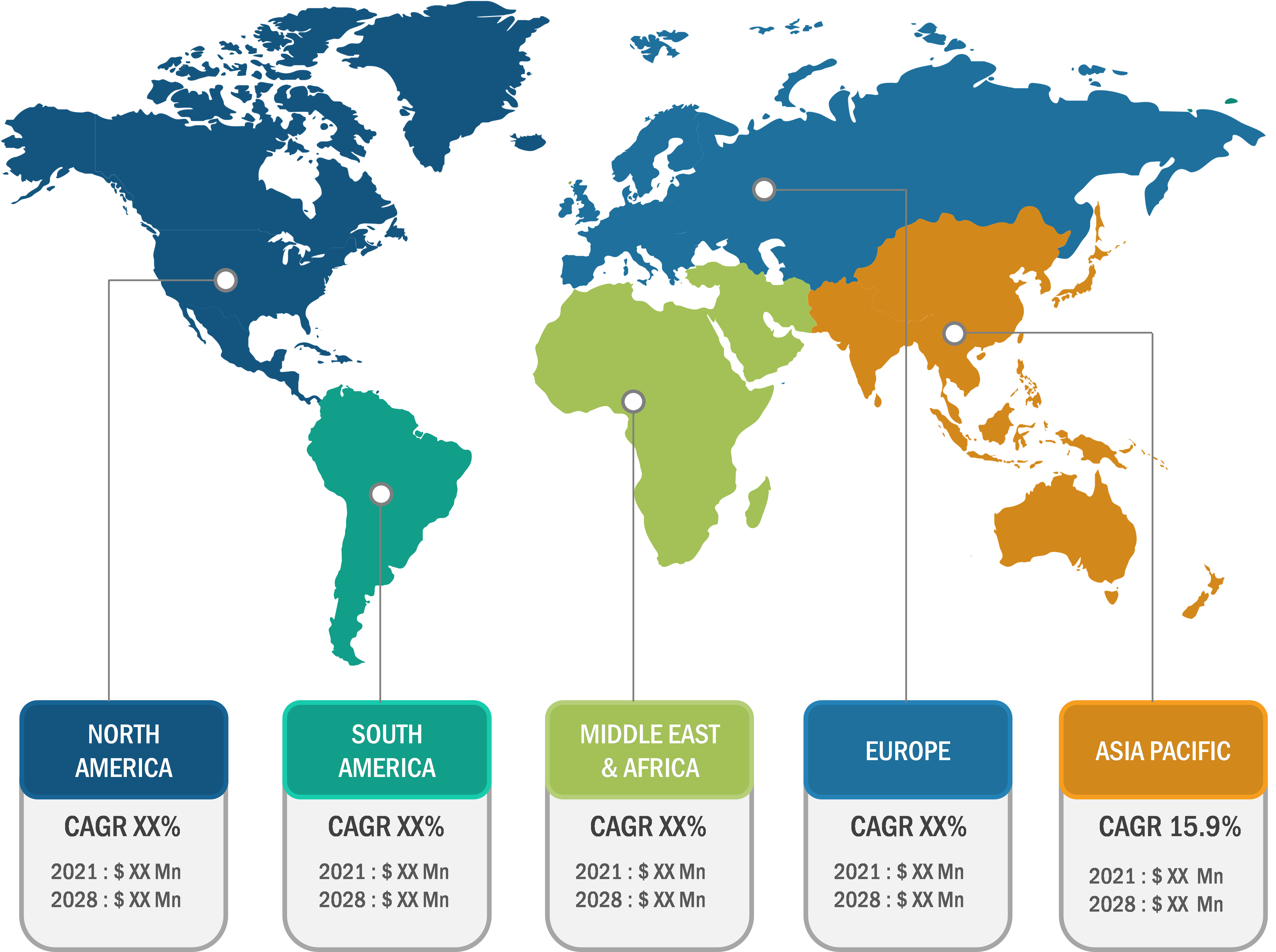

North America accounted for a major share of the global image-guided radiotherapy market in 2022. North America has an advanced healthcare infrastructure due to a higher incidence of cancer. In North America, a sophisticated healthcare infrastructure coupled with easy access to state-of-the-art medical technologies creates a favorable environment for the integration of advanced treatment modalities, such as image-guided radiation therapy. The region’s comprehensive healthcare reimbursement frameworks are increasing the uptake of sophisticated treatments, including image-guided radiation therapy, ensuring that they are accessible to a wider range of patients. These factors are responsible for expanding and strengthening the image-guided radiotherapy market in the region. Asia Pacific is expected to register the fastest CAGR in the global image-guided radiotherapy market during 2022–2030. The market growth in the region is due to the increasing prevalence of cancer, growing cancer awareness, and availability of new treatments.

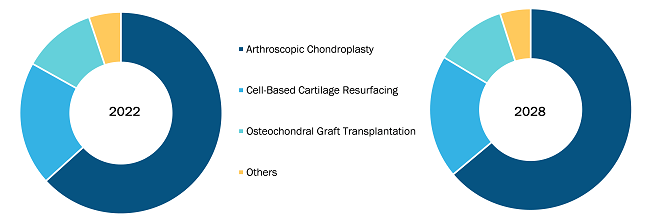

In terms of application, the global image-guided radiotherapy market is segmented into breast cancer, lung cancer, gastrointestinal cancer, prostate cancer, gynecological cancers, head and neck cancer, and others. The breast cancer segment held the largest market share in 2022. The lung cancer segment is anticipated to register the highest CAGR of 16.3% during 2022–2030. The increasing incidences of breast cancer worldwide are driving the image-guided radiotherapy market. The inherent precision of image-guided radiotherapy reduces the need for frequent and uncomfortable repositioning of patients during treatment sessions. This is attributed to increased patient comfort, which is particularly relevant for those undergoing breast cancer treatment. Image-guided radiotherapy allows for precise localization of the tumor and enables dynamic adjustments during treatment to ensure accurate radiation delivery to the tumor site. This ability minimizes the risk of adverse impact on adjacent healthy tissues. As a result, this capability significantly contributes to strengthening the importance, attractiveness, and value proposition of image-guided radiotherapy in the market.

Based on end user, the global image-guided radiotherapy market is segmented into hospitals, oncology centers, and radiotherapy centers. The hospitals segment held the largest market share in 2022. The oncology centers segment is anticipated to register the highest CAGR of 16.0% during 2022–2030. Hospitals are grappling with a significant influx of cancer patients, increasing the appeal of image-guided radiation therapy. The precision inherent in image-guided radiotherapy, its ability to target the tumor, and its optimized treatment delivery harmonize seamlessly with the need to manage the patient caseload competently. This symbiotic convergence not only optimizes patient-centered care but also surges the demand for image-guided radiotherapy and establishes it as a core therapeutic modality for healthcare organizations dealing with the complexities of cancer treatment management. The hospital strategically leverages its comprehensive healthcare delivery, state-of-the-art infrastructure, synergistic collaborative environment, and unwavering commitment to patient-centered care to drive adoption. The cumulative effect of these aspects significantly promotes the expansion of image-guided radiotherapy in the hospital ecosystem and consequently strengthens its market position and appeal.

Introduction of Technologically Advanced Systems Fuels Image-Guided Radiotherapy Market Growth

Imaging is a fundamental part of the diagnostic process. From ultrasounds to MRIs and CT scans, radiologists use medical imaging to diagnose and treat diseases properly. Also, doctors use imaging technologies to determine whether a particular therapy has been an effective method for treating a patient. Over the past couple of decades, the capabilities of imaging have radically increased. Numerous advancements in imaging technologies have occurred. This progress is important in providing accurate diagnoses and bettering patient care. These advancements, along with the power of AI and digital technology, raise better procedural efficiency in providing and accomplishing patient care. Artificial intelligence (AI) helps in improving various parts of the healthcare industry, medical imaging technology being one of the fields benefiting greatly. AI is being used in advanced imaging devices, which can help in detecting diseases earlier and guiding them during diagnosis and early treatment.

In August 2021, Manipal Hospitals, India’s second largest multi-specialty hospital, launched an advanced Radixact system equipped with Synchrony Automatic, real-time motion synchronization technology for the precise treatment of cancer patients. Philips expanded the company’s mobile C-arm portfolio through Zenition 10 in 2023. In 2023, GE Healthcare expanded PET/MR capabilities with AIR technologies to improve diagnostic precision, simplify treatment evaluation, and simultaneously improve patient comfort. In 2023, the launch of Pixxoscan expanded GE Healthcare’s MRI contrast agent portfolio. In February 2022, the Department of Radiation Oncology at Max Institute of Cancer Care (MICC), Saket, India, launched Radixact X9 Tomotherapy, which is combined with the 2nd Generation Synchronized Respiratory Motion Management System. This radiation therapy treatment for cancer patients uses artificial intelligence (AI)-based real-time tracking and treatment delivery to ensure that the tumor is not missed due to chest or abdominal breathing movement during radiation treatment. In September 2021, SkinCure Oncology announced positive clinical trial results, demonstrating positive data (99.3% cure rate) for image-guided superficial radiotherapy (IGSRT) in the treatment of basal cell carcinoma (BCC) and squamous cell carcinoma (SCC). Therefore, such technological advancements are expected to drive the growth of the image-guided radiotherapy market.

Image-Guided Radiotherapy Market: Imaging Type Overview

Based on imaging type, the global image-guided radiotherapy market is divided into magnetic resonance imaging (MRI), positron emission tomography (PET), computed tomography (CT) imaging, X-ray imaging, and others. The magnetic resonance imaging (MRI) segment held the largest market share in 2022. The computed tomography (CT) imaging segment is anticipated to register the highest CAGR of 15.8% from 2022 to 2030. The ability of PET to provide functional insights guides the delivery of radiation doses, effectively reducing the burden on healthy tissue and subsequently reducing the occurrence of side effects. PET facilitates the simultaneous acquisition of structural and molecular data and provides valuable support for treatment strategy and immediate evaluation throughout radiotherapy. This special feature reinforces the market progress of image-guided radiotherapy and increases its usefulness and attractiveness in the medical field. This contribution significantly strengthens the market development of image-guided radiotherapy and increases its attractiveness and positioning in the healthcare sector.

Image-Guided Radiotherapy Market: Competitive Landscape and Key Developments

ViewRay, GE Healthcare, Hitachi, Ltd.; Siemens AG, Koninklijke Philips N.V.; TOSHIBA CORPORATION, Varian Medical Systems, Inc.; Vision RT Ltd.; Elekta AB, Accuray Incorporated, and HORIBA Group are among the key companies operating in the image-guided radiotherapy market. Leading players are implementing strategies such as expansion, launch of new products, and acquisition of a new customer base for tapping prevailing business opportunities.

- In May 2023, Philips expanded its mobile C-arm portfolio with Zenition 10.

- In April 2023, GE HealthCare expanded its portfolio of magnetic resonance imaging (MRI) contrast agents with the launch of Pixxoscan. It provides customers with access to two leading macrocyclic molecules: Clariscan (gadoteric acid) and Pixxoscan (gadobutrol).

- In June 2023, GE HealthCare announced its plans to expand its PET/MR capabilities with AIR technologies to improve diagnostic precision and simplify treatment evaluation while increasing patient comfort.

- In September 2022, the National Medical Products Administration (NMPA), China’s regulatory authority, approved the sale and use of ViewRay’s MRIdian MRI-guided radiation therapy system.

- In March 2022, Hwasun Hospital of Chonnam National University introduced the “Halcyon 3.0” radiotherapy system and used it for comprehensive treatment. Halcyon 3.0 is a state-of-the-art radiation cancer treatment device that can deliver intensity-modulated radiation therapy based on real-time image guidance.