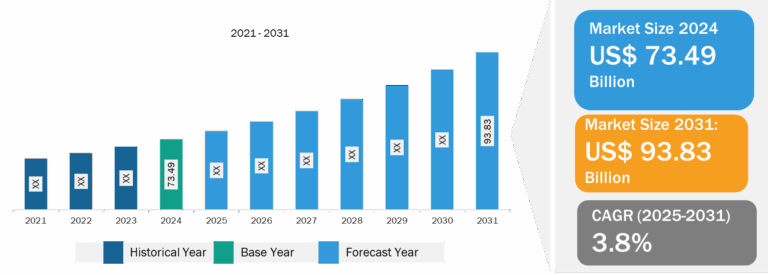

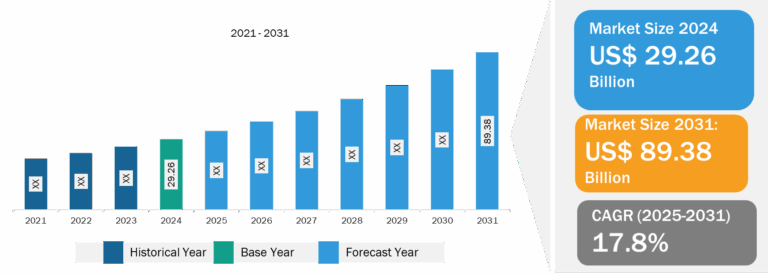

Meeting Management Software Market

Increasing Cost of Unproductive Meetings Drives Meeting Management Software Market

The financial impact of ineffective meetings is substantial. According to a 2019 State of Meetings report, inadequately organized meetings incurred a cost of US$ 399 billion for organizations in the US. An estimated amount of US$ 73 billion and US$ 58 billion were wasted due to inadequately organized/unproductive meetings in Germany and the UK, respectively, with Switzerland experiencing a loss of US$ 33 billion. Meeting management software effectively tracks the duration of the entire agenda, as well as the time allocated to each agenda item and individual speaker. In terms of enhancing productivity, the software can contribute to a team’s efficiency in numerous methods. The meeting management tool provides a simple method for documenting in-meeting tasks and decisions, as well as facilitating the monitoring of action items post-meeting. Meeting management software includes an agenda builder feature that enables teams to create simple, intricate, or customized templates, thereby facilitating the add-on task of organization and structure to their meetings. Through automation, the software reduces costs by storing meeting records using intelligent tools. Retrieving the meeting summary or minutes is readily accessible, enabling efficient processing of the recorded information when required. Thus, the rising cost of unproductive meetings boosts the demand for meeting management software, which drives the market.

Meeting Management Software Market: Industry Overview

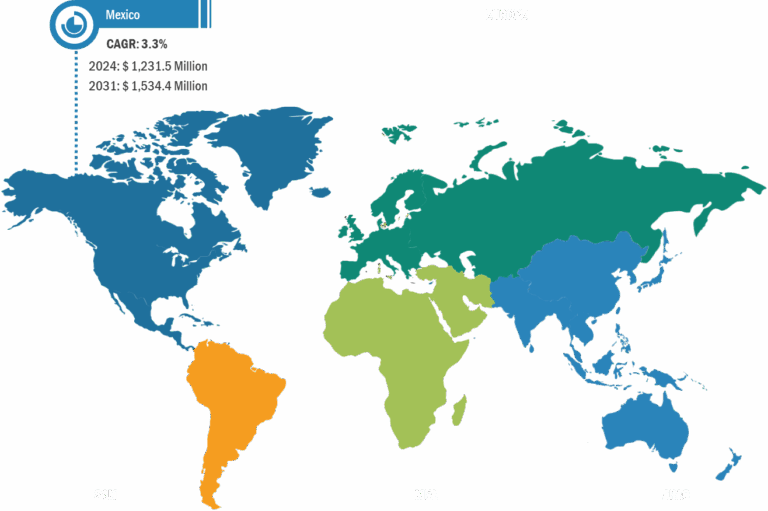

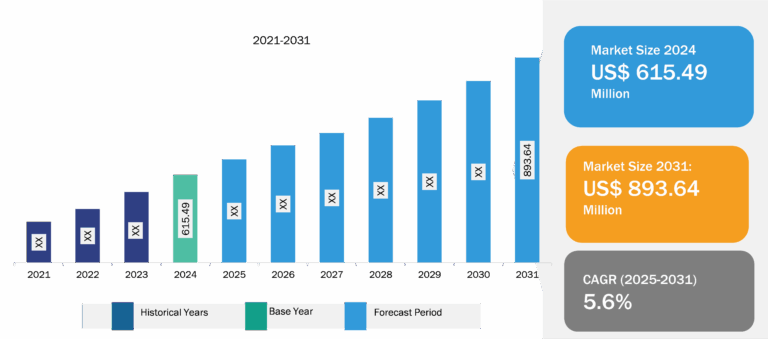

The meeting management software market is segmented on the basis of deployment type, enterprise size, application, and geography. In terms of deployment type, the meeting management software market is bifurcated into on-premises and cloud. Based on enterprise size, the market is divided into SMEs and large enterprises. By application, the meeting management software market is segmented into corporate, government, healthcare, and others. Geographically, the meeting management software market is segmented into North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Based on end user, the meeting management software market is segmented into corporate, healthcare, government, and others. The corporate segment held the largest share of the meeting management software market. Meeting management software is significantly used in corporate settings to streamline the process of organizing, scheduling, conducting, and documenting meetings. A corporate executive assistant uses meeting management software to schedule board meetings for senior leadership. They observe meeting details, including date, time, location (virtual or physical), and participant lists, and send out automated invitations to attendees. A team leader uses meeting management software to create agendas for weekly project status meetings. They outline discussion topics, allocate time slots for each item, and attach relevant documents or presentations for review by attendees. During a product development meeting, team members use meeting management software to collaborate on design documents and share feedback in real time. They use integrated tools for document editing, version control, and commenting to streamline the collaboration process. A global sales team uses meeting management software to conduct virtual sales meetings with clients across different time zones. They leverage features such as video conferencing, screen sharing, and chat to facilitate effective communication and presentations. Thus, meeting management software is integral to corporate operations, enabling efficient communication, collaboration, decision-making, and documentation across teams and departments. Its versatile features and applications contribute to enhanced productivity, transparency, and accountability in corporate meetings and workflows.

The market in Europe is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. In terms of revenue, the UK dominated the Europe meeting management software market. The meeting management software market in the UK is driven by the need for efficient and focused team meetings, the integration of management platforms, and the emphasis on customer satisfaction and loyalty. These factors contribute to the demand for meeting management software in the UK. According to the Office for National Statistics (ONS), as of 2023, 44% of the UK workforce was engaged in remote work; this included 16% who worked remotely on a full-time basis and 28% who were classified as hybrid workers, dividing their work time between office and home-based settings. These statistics support the significance of streamlined communication and collaboration, further driving the demand for meeting management software in the UK.

Meeting Management Software Market: Competitive Landscape and Key Developments

Cisco Systems Inc; Intelex Technologies Inc; Cvent Inc.; Fellow Insights, Inc.; Avoma, Inc.; Televic; Tyler Technologies Inc; Granicus, LLC; Decisions; and MatchWare.com are among the key players profiled in the meeting management software market report. Several other major market players were also studied and analyzed during this market research study to get a holistic view of the market and its ecosystem. The meeting management software market forecast provides detailed market insights, which help the key players strategize their growth. As per company press releases, a few developments are mentioned below:

- In February 2024, Cisco and NVIDIA announced plans to deliver AI infrastructure solutions for the data center that are easy to deploy and manage, enabling the massive computing power that enterprises need to succeed in the AI era. Cisco and NVIDIA offered a broad range of integrated product solutions over the past several years across Webex collaboration devices and data center compute environments to enable hybrid workforces with flexible workspaces, AI-powered meetings and virtual desktop infrastructure. The companies are further establishing data centers to provide enterprise customers with scalable and automated AI cluster management, automated troubleshooting, and best-in-class customer experiences, among other features.

- In January 2024, Cisco, Microsoft Corp., and Samsung Electronics Co. Ltd. announced new meeting room solutions to deliver enhanced collaboration experiences for hybrid meetings. With a collective vision to enable seamless and inclusive meetings for all users, the companies launched integrated video collaboration solutions for the Cisco Room Series.