Colonoscopy Devices Market

Technological Advancements in Colonoscopy Devices Drive Colonoscopy Devices Market Growth

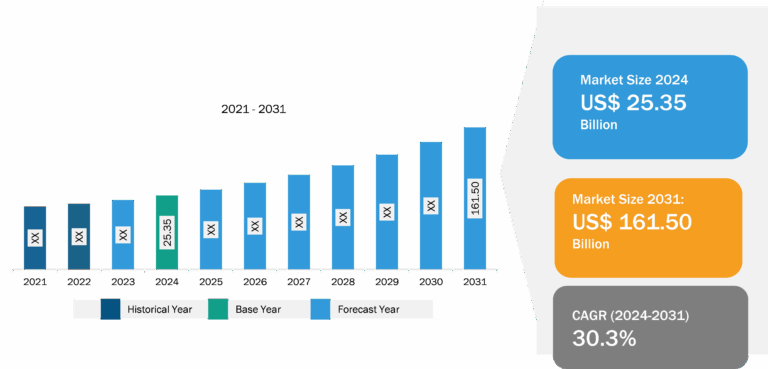

The success rate of diagnosing colorectal conditions, including cancer, has increased with technological advancements in colonoscopy devices. Flexible endoscopy is an effective method enabling the early diagnosis and treatment of gastrointestinal cancer, which makes it a popular choice for screening. However, a large population that benefits from endoscopic colorectal cancer screening feels skeptical about undergoing the procedure. Psychological barriers due to indignity of the process, fear of procedure-related pain, discomfort in bowel preparation, and potential need for sedation underline an urgent need for new technologies to address these issues. Following are a few of the critical advancements in colonoscopy:

- Third eye technology

- Extra-Wide-Angle-View colonoscope

- Fuse full spectrum endoscopy colonoscopy platform

- NaviAidTM G-EYETM balloon colonoscope

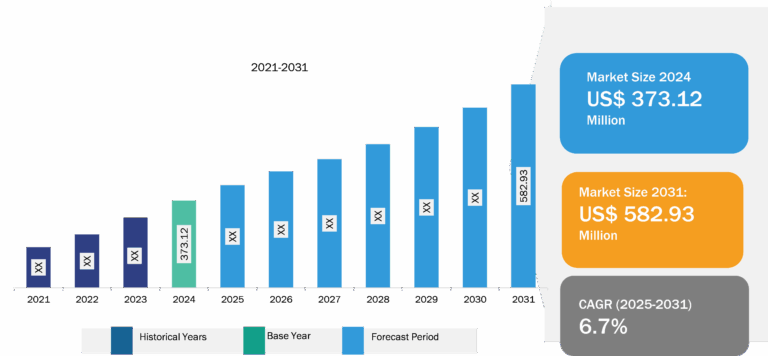

To significantly reduce the adenoma “miss rate” of standard forward-viewing colonoscopy, manufacturers are continuously striving to improve the current colonoscopy techniques by exploring more advanced optics and wider-angle visualization tools along with a user-friendly, intuitive endoscopic platform interface. Thus, the colonoscopy devices market size is likely to grow by 2030 owing to the introduction of such technologies.

Colonoscopy Devices Market: Regional Overview

In terms of geography, the colonoscopy devices market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held the largest market share. The market growth is fueled by increasing burden of aging population, rising number of product launches, and R&D activities to develop advanced colonoscopy devices.

The US accounted for a significant share of the North American market as increasing public awareness of colon cancer through media campaigns initiated by cancer awareness groups and government agencies, and an aging population who are encouraged to have regular checkups. According to the American Cancer Society, an estimated 104,610 new colon cancer cases and 43,340 rectal cancer cases were diagnosed in the US in 2020. Some medical societies in the US recommend a screening colonoscopy every ten years for adults aged 50 and over without an increased risk of colon cancer. Additionally, launch of new products will offer opportunities in the forecast period. For instance, in 2020, SMART Medical Systems Ltd., a developer and manufacturer of innovative endoscopy products, initiated commercial and clinical effort in the US, following issuance of a second FDA clearance for its flagship G-EYE Colonoscope, based on Fujifilm’s 510(k) cleared colonoscopes.

Asia Pacific is expected to record the highest CAGR during the forecast period. The colonoscopy devices market in the region is driven by factors such as an increasing number of R&D activities, adoption of innovative technology and products, and upsurging prevalence of chronic diseases in this region.

Colorectal cancer is one of the leading causes of cancer deaths in China. The risk of CRC increases with age, especially after 35 years, and peaks in people aged 80–84. Due to the rapidly aging population and increasing fat intake in China, CRC cases are expected to increase in the coming years. In addition, the National Central Cancer Registry (NCCR) showed that the prognosis of CRC in China was significantly worse compared to the developed world.

Colonoscopy Devices Market: Competitive Landscape and Key Developments

The colonoscopy devices marketreport emphasizes prominent players operating in the market. The players include AMBU AS, Fujifilm, Endomed systems gmbh, Olympus, Steris PLC, GI View, Boston Scientific Corporation, PENTAX Medical, Avantis Medical Systems, and SonoScape Medical Corp. Market players focus on expanding and diversifying their businesses, and acquiring novel customer bases, which allows them to explore attractive business opportunities prevailing in the colonoscopy devices market.

In November 2021, Wision A.I. Ltd, a startup in the field of AI-assisted diagnostics for gastrointestinal endoscopy, received the European CE Mark approval for EndoScreener, an AI-assisted polyp detection software used during colonoscopy. Also, it is the first CE Mark class II certificate under the new Medical Devices Regulation (MDR 2017/745).

In April 2021, the US Food and Drug Administration (FDA) granted de novo clearance for GI Genius intelligent endoscopy module of Medtronic in the US. The GI Genius module is the first commercially available computer-aided detection (CADe) system using AI to identify colorectal polyps. The module is compatible with any colonoscope video. It provides physicians with a powerful solution in the fight against colorectal cancer.

In April 2021, FUJIFILM Medical Systems launched the G-EYE 700 Series Colonoscope. G-EYE, a technology developed by Smart Medical, assists during routine examinations. The G-EYE 700 series colonoscopes expanded Fujifilm’s innovative colonoscope portfolio offering. G-EYE will be offered as an extension to the 700-series colonoscope family that is compatible with Fujifilm’s ELUXEO endoscopic video imaging system.

In August 2020, Olympus acquired Arc Medical Design and has the right to design, manufacture, distribute, and formulate a business strategy for the worldwide Endocuff product portfolio. Endocuff Vision, a device attached to the distal end of a colonoscope, is designed to maintain and maximize visibility during a colonoscopy.

In May 2020, FDA issued 510(k) clearance for the G-EYE Colonoscope SMART manufactured by Medical Systems Ltd. The G-EYE colonoscope is a standard colonoscope that SMART remanufactures by installing its proprietary G-EYE balloon on the distal bending section of the colonoscope. During the colonoscopy, the G-EYE colonoscope is inserted in the standard technique, with the balloon deflated.