Healthcare CRM Market

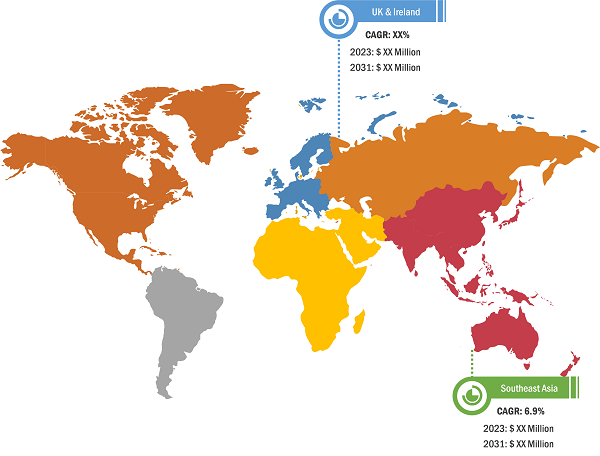

North America accounted for the largest share of the global healthcare CRM market in 2022, and Asia Pacific is expected to record the highest CAGR during 2022–2030. The US held the largest share of the healthcare CRM market in North America. Healthcare CRM software is primarily associated with hospitals, clinics, and ambulatory surgical centers to schedule and manage appointments, especially in emergency, outpatient, in-patient, and surgical departments. Efficient patient scheduling management remains an urgent issue for most hospitals and clinics. Due to improper medical scheduling, patients experience delays in receiving quality care in public and private healthcare systems. The 2022 survey of Physician Appointment Wait Times and Medicare and Medicaid Acceptance Rates states that there is a waiting period of an average of 26 days to schedule a first-time appointment with a physician, an 8% increase since 2017 when the average wait time was ~24 days. This leads to prolonged wait times, scheduling difficulties, and an imbalance of supply and demand in the public and private healthcare sectors. Healthcare CRM software enables hospitals and clinics to track the arrival and departure of patients and gain real-time updates on co-pays and cancellations. The use of software reduces the no-shows by 30% with appointment reminder calls. It enhances the entire treatment procedure and improves communication with the patient.

Furthermore, the US reports a high prevalence of chronic and acute diseases. According to the “Heart Disease and Stroke Statistics – 2023 Update” by the American Heart Association, coronary heart disease (CHD) was a leading cause (41.2%) of deaths associated with CVDs in the US in 2020, followed by stroke (17.3%), other CVDs (16.8%), high blood pressure (12.9%), heart failure (9.2%), and diseases of the arteries (2.6%). As per the US Centers for Disease Control and Prevention (CDC), ~1 in 20 adults in the US aged 20 and above suffer from coronary artery disease. Thus, a high prevalence of CVDs and other chronic diseases propels the demand for medical scheduling and adoption of healthcare CRM in the US. Also, the rapid adoption of healthcare IT in the US is anticipated to drive the healthcare CRM market growth in the future.

Increasing Demand for Data-Driven Insights, Analytics, and Population Health Management Drives Healthcare CRM Market Growth

The demand for data-driven insights, analytics, and population health management is significantly promoting the development of the healthcare industry, which, in turn, propels the demand for healthcare CRM. This increase in demand can be related to the growing emphasis on value-based care and the demand for healthcare organizations to improve patient outcomes, lower costs, and improve overall care quality.

Data-driven insights analytics are critical in healthcare CRM since they allow organizations to examine and evaluate large volumes of patient data to identify trends, patterns, and correlations. This enables healthcare practitioners to understand their patient population better, allowing them to make more accurate decisions about treatment plans, interventions, and resource allocation. Healthcare organizations may also identify high-risk patients, forecast potential illnesses, and intervene proactively to prevent negative outcomes by employing data-driven analytics. Similarly, population health management is another significant driver of the growing demand for data-driven insights and analytics in the healthcare CRM market. Population health management, focusing on improving the health outcomes of entire populations, necessitates healthcare organizations having an extensive understanding of their patient population and the factors that impact their health. Data-driven insights analytics allow healthcare professionals to segment their patient population based on criteria including demographics, clinical problems, and risk factors. This allows them to personalize medical services and treatment plans to the individual requirements of distinct patient groups.

Furthermore, healthcare CRM developers rapidly integrate advanced analytics and population health management capabilities into healthcare CRM platforms. These capabilities enable healthcare organizations to use data to enhance clinical and operational outcomes, resulting in better patient care and lower costs. Thus, the increasing demand for data-driven insights, analytics, and population health management propels the demand for healthcare CRM to improve patient outcomes, reduce costs, and enhance the overall quality of care, which fuels the growth of the healthcare CRM market.

Healthcare CRM Market: Segmental Overview

The global healthcare CRM market is segmented on the basis of deployment mode, product type, application, and end user.

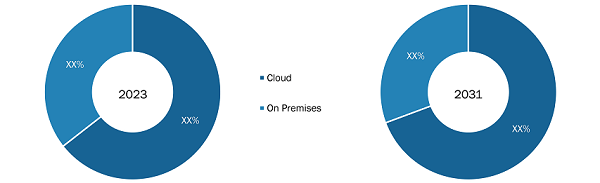

Based on deployment mode, the healthcare CRM market is bifurcated into cloud-based and on-premise. The cloud-based segment held a larger share of the market in 2022 and is expected to register a higher CAGR in the market from 2022 to 2030. Cloud-based healthcare CRM solutions are hosted on the vendor’s servers and accessed through a web browser. Cloud-based CRM solutions offer unparalleled accessibility, allowing healthcare professionals to access patient data and CRM tools from any location with internet connectivity. This flexibility is particularly valuable for healthcare providers working remotely or across multiple locations.

The healthcare CRM market, by product type, is segmented into analytical CRM, collaborative CRM, and operational CRM. The operational CRM segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR in the market during 2022–2030.

By application, the healthcare CRM market is segmented into case management, relationship management, community outreach, case coordination, and others. The relationship management segment held the largest share of the market in 2022 and is expected to register the highest CAGR in the market from 2022 to 2030.

In terms of end user, the healthcare CRM market is segmented into providers, payers, and others. The providers segment held the largest share of the market in 2022 and is expected to register the highest CAGR in the market from 2022 to 2030.

Healthcare CRM Market: Competitive Landscape and Key Developments

Pegasystems Inc, Sage Group Plc, IQVIA Holdings Inc, VerioMed Corp, Pipedrive Inc, WebMD Ignite Inc, Zendesk Inc, SugarCRM Inc, SAP SE, Veeva Systems Inc, Oracle Corp, ScienceSoft USA Corp, Microsoft Corp, Salesforce Inc, and International Business Machines Corp are a few key companies operating in the healthcare CRM market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the healthcare CRM market.

A few of the recent developments in the global healthcare CRM market are mentioned below:

- In August 2023, IBM and Salesforce announced a collaboration to help businesses worldwide across industries accelerate the adoption of AI for CRM. Together, the two companies support clients to revolutionize customer, partner, and employee experiences while helping safeguard their data.

- In April 2022, Cured announced the launch of the next evolution of its digital marketing and customer relationship management (CRM) platform built for healthcare, further enabling the company to deliver on its mission to bring care full circle. These platform advancements empower healthcare organizations to build unparalleled relationships with new customers and existing patients.

- In March 2022, Epic launched a CRM system, Cheers, for health systems and is developing an app that uses real-world data to help physicians research best care practices for their patients.

- In March 2022, Invoca announced AI-powered conversation intelligence for healthcare providers. The new solution enables empathetic, patient-first experiences that help increase patient acquisition. Invoca’s cloud platform records, transcribes, and analyzes 100% of patient calls while ensuring HIPAA compliance.

- In November 2021, Pegasystems Inc collaborated with Google Cloud, which improved experiences in healthcare with better data insights and personalization. This partnership between Pega and Google Cloud brought together the capabilities of Google Cloud’s Healthcare Data Engine and Pega’s suite of intelligent healthcare solutions.