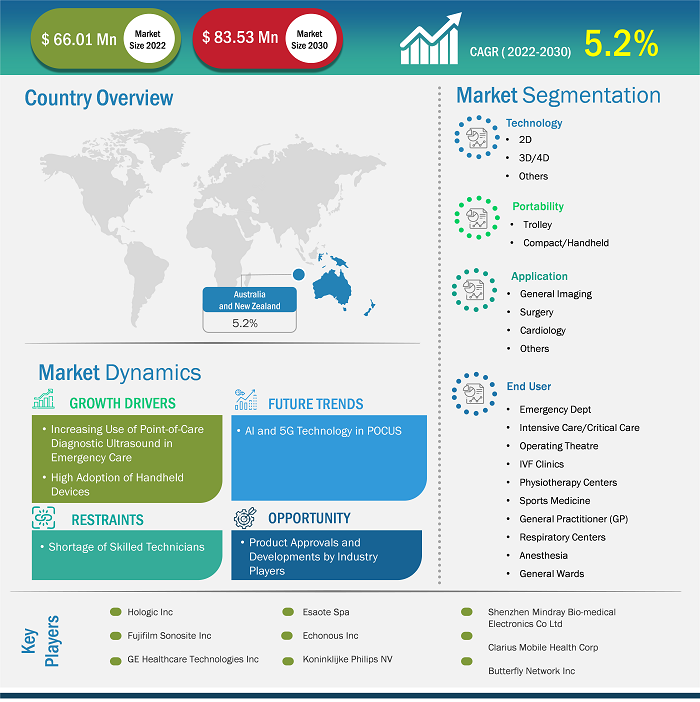

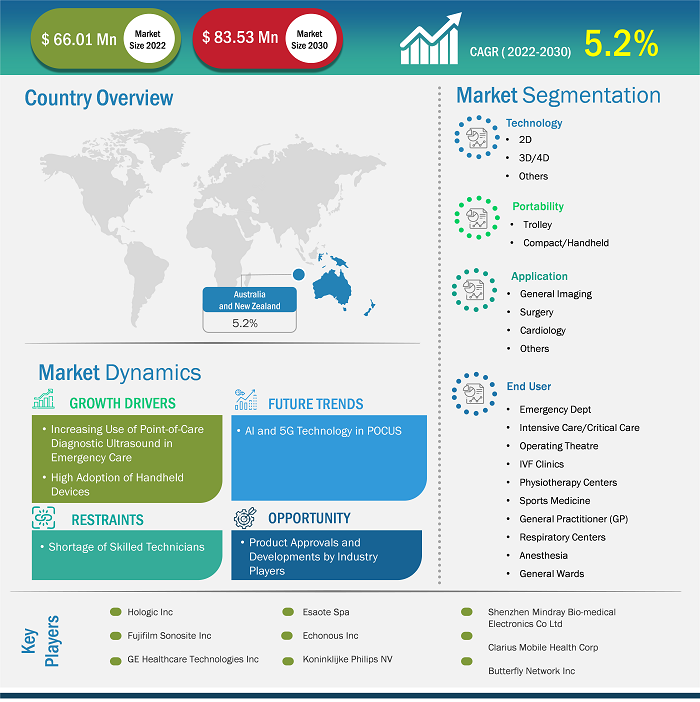

Australia and New Zealand Point-of-Care Diagnostic Ultrasound Market

Point-of-care ultrasound (POCUS) refers to portable ultrasound systems, and it is similar to “bedside ultrasound.” POCUS is an extensive term that encapsulates various scenarios in which portable ultrasound machines can be utilized. For instance, a patient may be scanned using portable ultrasound while in an ambulance on the way to an emergency room. Or a patient may be scanned in the trauma bay after being transported to the hospital emergency room. It indicates that portable ultrasound can be transported wherever the patient is. The increasing use of point-of-care diagnostic ultrasound in emergency care and the high adoption of handheld devices are the major factors contributing to the growing Australia and New Zealand point-of-care diagnostic ultrasound market size. However, the shortage of skilled technicians is the major factor hindering Australia and New Zealand point-of-care diagnostic ultrasound market growth.

High Adoption of Handheld Devices to Drive Genetic Testing Services Market Growth

Nowadays, medical practitioners prefer using compact, portable gadgets that allow them to quickly diagnose patients and expedite every other phase of the patient care process. For infection control (patient safety) during surgeries and invasive procedures, they prefer sanitizable ultrasound equipment in the operating room and intensive care unit. It establishes a balanced approach between patient satisfaction and the clinician’s professional intellect while avoiding the risk of infection and radiation exposure. Additionally, point-of-care (POC) ultrasound provides real-time analysis, dynamic imaging, and precision-based clinical visualization.

POCUS is a useful bedside instrument used largely in perioperative settings because of its accuracy, speed, ease of use, and dependability. Ultrasound has long been a trusted diagnostic tool for hospital doctors. However, the equipment was usually bulky and expensive, and it was primarily limited to obstetrics, cardiology, and radiology labs. POCUS (which is easier to use, more affordable, and portable) has quickly altered that paradigm and is now a standard tool for physicians working in a variety of disciplines.

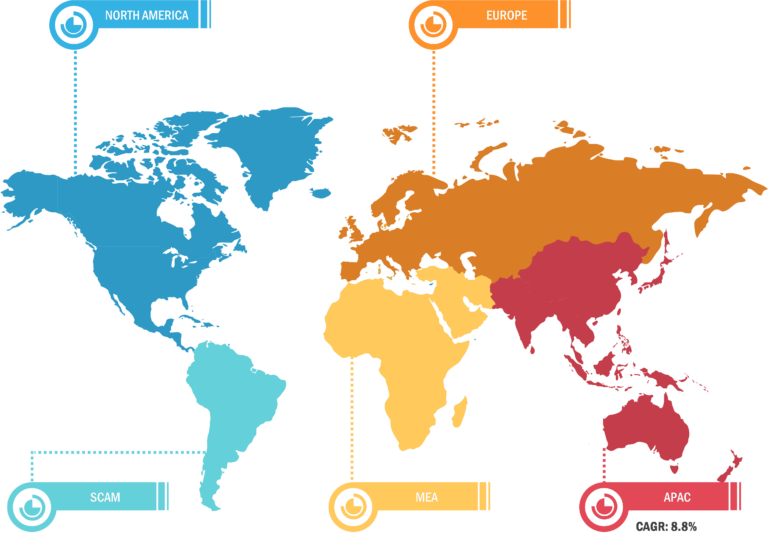

Australia and New Zealand Point-of-Care Diagnostic Ultrasound Market: Country Overview

Among the studied countries, Australia accounted for the largest market share for the point-of-care diagnostic ultrasound market. According to the Australian Institute of Health and Welfare cancer data 2021, cancer is a major cause of illness and death in the country. In 2021, ~151,000 new cancer cases were diagnosed in Australians—an average of 413 cases per day. In the same year, ~49,000 people succumbed to death due to cancer in the country—an average of 135 deaths per day. In addition, colorectal cancer is estimated to be the fourth most diagnosed cancer in the country in 2023, with around 15,400 cases reported that year. POCUS has proved to be an accurate technique for the diagnosis of gastrointestinal cancers.

POCUS in emergency departments is also a fast-growing subspecialty and was in the limelight during the pandemic because of the efficacy of lung POCUS in the diagnosis, assessment of severity, and monitoring disease progression in COVID-19 patients, as per the study titled “Preparedness of Australasian emergency departments for point-of-care ultrasound in the COVID-19 pandemic,” published in 2021. The rising number of chronic diseases necessitates quick and efficient diagnosis tools like POCUS for timely identification, evaluation, and management.

Australia and New Zealand Point-of-Care Diagnostic Ultrasound Market: Competitive Landscape and Key Developments

GE Healthcare; Butterfly Network, Inc.; Fujifilm; Esoate SpA; Hologic, Inc; Echonous Inc; Koninklijke Philips NV; Shenzhen Mindray Bio-medical Electronics Co Ltd; and Clarius Mobile Health Corp. are a few of the key companies operating in the Australia and New Zealand point-of-care diagnostic ultrasound market. These companies focus on product innovation strategies to meet evolving customer demands and maintain their brand name.

A few of the developments in the Australia and New Zealand point-of-care diagnostic ultrasound market are mentioned below:

- In October 2023, Butterfly Network Inc. introduced Butterfly iQ+ Vet, a portable ultrasound device that makes use of technology used for other iQ products. As of December 2022, iQ+ Vet is accessible in about 20 foreign countries, offering veterinarians a first-of-its-kind technological advancement. The device comes with Color-Doppler and NeedleViz, two uniquely crafted animal-specific probes for convenience and maneuverability.

- In July 2022, GE Healthcare Technologies Inc. launched the next-generation Voluson Expert 22. The system was an addition to GE Healthcare Technologies Inc’s Women’s Health portfolio that utilizes graphic-based beam former technology, which produces higher quality images and offers greater flexibility in imaging functions. Cutting-edge tools powered by artificial intelligence ensure greater exam consistency and decrease the number of tasks. Customizable touch panels, color, and lighting options provide a revolutionary user experience.