Brain Implants Market

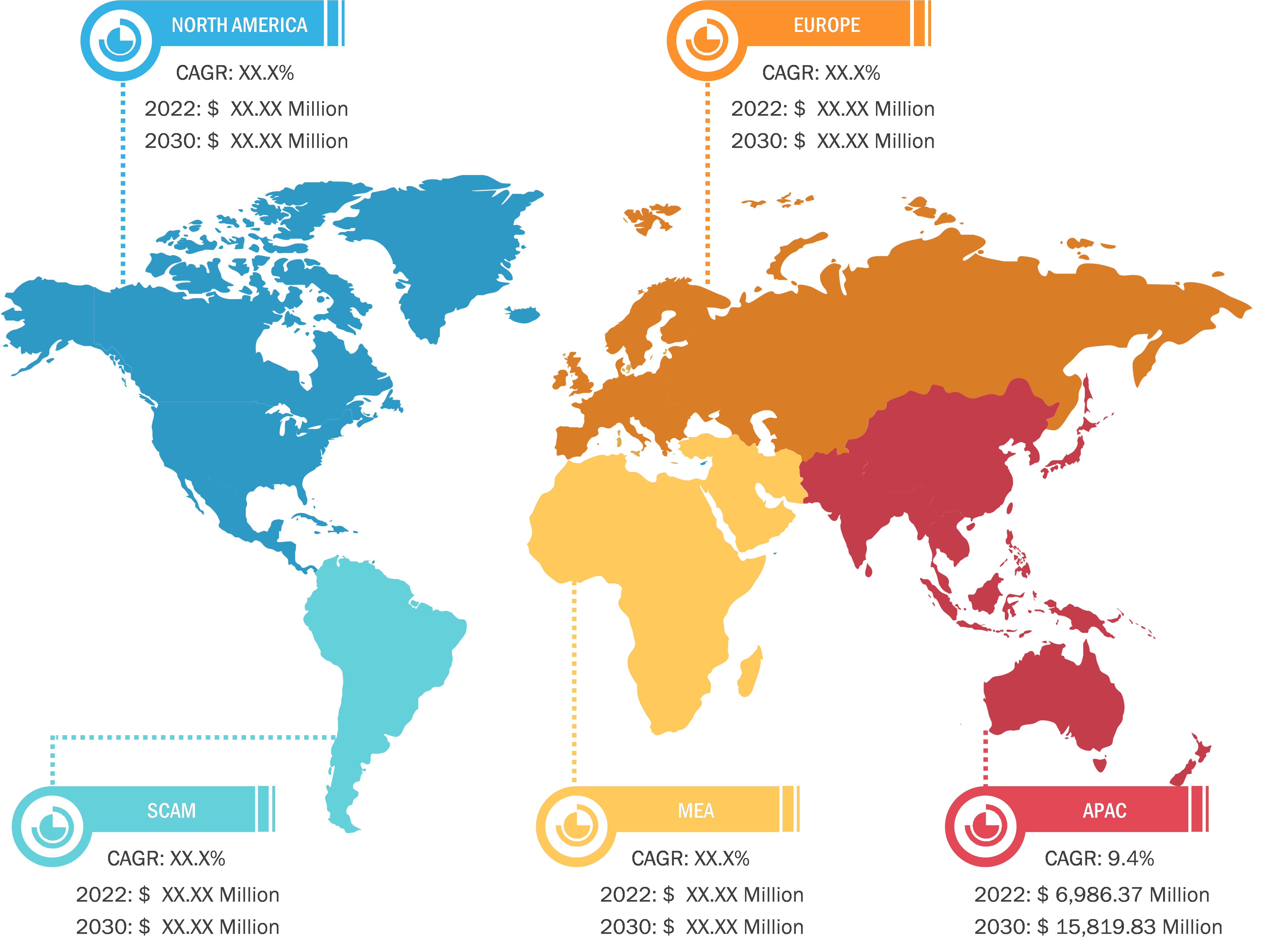

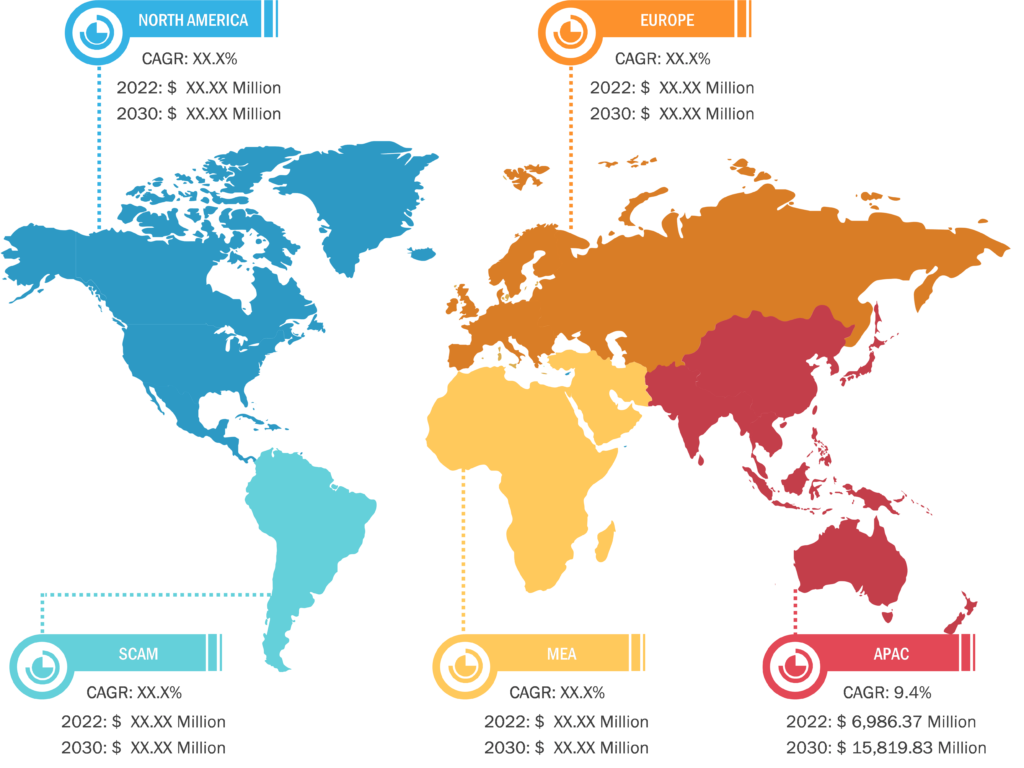

Asia Pacific is anticipated to register the highest CAGR in the brain implants market during 2022–2030. North America accounted for the largest share of the market in 2022. The US is the largest contributor to the brain implants market in this region, and it is further expected to record the fastest CAGR during 2022–2030. The increasing prevalence of Parkinson’s disease (PD) and other neurological diseases, growing awareness about neurological disorders, positive research results, and growing investments in the development of various stimulators are among the main factors driving the brain implants market in the US. According to the Parkinson’s Foundation, 930,000 people in the US were suffering from PD in 2020, and the number is expected to increase to 1.2 million by 2030. Brain implants such as deep brain stimulation (DBS) systems have proven to be potential treatment options for PD. DBS devices have been observed to be effective in controlling tremors associated with PD. As per the Oregon Health & Science University (OSHU) Brain Institute, in the US, ~90% of patients with essential tremors experienced moderate relief from symptoms after DBS.

According to the “2022 Alzheimer’s disease facts and figures,” published in March 2022, ~6.5 million Americans aged 65 and above were found to have Alzheimer’s disease in 2022, and the number is projected to rise to 13.8 million by 2060. Moreover, major market players focus on introducing new versions of DBS devices. In March 2023, researchers at Michigan Technological University used neuromorphic computing to improve the efficacy and energy efficiency of DBS systems used to treat PD. Similarly, researchers from the University of North Carolina at Chapel Hill could generate new neurons in the brain and stimulate them using DBS. This process helped restore cognitive and noncognitive functions in a mouse model that had Alzheimer’s disease.

Rising Number of Spinal Cord Injuries Drives Brain Implants Market Growth

As per the study “Spinal Cord Injuries,” published in May 2022, 250,000–500,000 patients worldwide suffer a spinal cord injury (SCI) yearly. According to the National SCI Data Sheet 2022, nearly 18,000 new SCI cases are diagnosed yearly in the US. The 2023 United States Spinal Cord Injury Statistics state that ~302,000 people living in the country have suffered a traumatic SCI. As per the Spinal Injuries Association, ~2,500 people sustain an SCI annually in the UK, and ~50,000 persons are living with an SCI in the country. SCI can lead to severe locomotor deficits or even complete leg paralysis. Spinal cord stimulation is one of the most preferred techniques employed to treat such situations. According to the article “Epidemiology of traumatic spinal cord injuries: a large population-based study,” published in April 2022, the overall age–sex-standardized incidence rate of traumatic spinal cord injuries was 26.5 per 1 million population, and the rates were directly related to age in both the genders. Moreover, the incidence rate of traumatic spinal cord injuries is 59.2 per 1 million and 23.3 per 1 million in males and females, respectively, in people aged 65 and above. Spinal cord stimulators are implantable devices that help block pain signals sent from the brain. Therefore, increasing cases of spinal cord injuries fuel the demand for spinal cord stimulators, which in turn drives the growth of the brain implants market.

Brain Implants Market: Segmental Overview

The brain implants market, by treatment, is segmented into deep brain stimulation, spinal cord stimulation, vagus nerve stimulator, invasive and non-invasive brain-computer interfaces, responsive neurostimulation for seizures, auditory brainstem implant, and ophthalmic aids/implant. In 2022, the spinal cord stimulation segment held the largest share of the market, and the invasive and non-invasive brain–computer interfaces segment is expected to grow at the fastest CAGR during 2022–2030.

The brain implants market, by application, is segmented into chronic pain, Parkinson’s disease, Alzheimer’s disease, epilepsy, essential tremor, depression, dystonia, amyotrophic lateral sclerosis (ALS), neurofibromatosis 2/total ossification of the cochlea, and others. In 2022, the chronic implant segment held the largest share of the market. The Alzheimer’s disease segment is expected to record the fastest CAGR during the 2022-2030.

The brain implants market, by end user, is segmented into hospitals and specialized clinics/neurological centers. In 2022, the hospitals segment held a larger share of the market. The hospitals segment is estimated to register a CAGR of 12.6% during 2022–2030.

Brain Implants Market: Competitive Landscape and Key Developments

Boston Scientific Corp, Medtronic Plc, Functional Neuromodulation Ltd, Fisher Wallace Laboratories Inc., Synchron Inc., Blackrock Microsystems Inc, Renishaw Plc., Abbott Laboratories, Neurospine LLC, CorTec GmbH, BrainGate, Aleva Neurotherapeutics SA, NeuroSky Inc, Neuralink Corp, NeuroPace Inc., ONWARD Medical NV, and Paradromics Inc. are a few key companies operating in the brain implants market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the brain implants market.

A few of the recent developments in the global brain implants market are mentioned below:

- In June 2023, Boston Scientific Corp received US Food and Drug Administration (FDA) approval for the Vercise Neural Navigator 5 Software, which is used as part of the Vercise Genus Deep Brain Stimulation (DBS) Systems. It provides clinicians with simple and actionable data for efficient programming in the treatment of people living with Parkinson’s disease or essential tremor.

- In May 2022, Blackrock Neurotech collaborated with AE Studio, a group of world-class data scientists, developers, and designers specializing in developing products to enhance human agency.