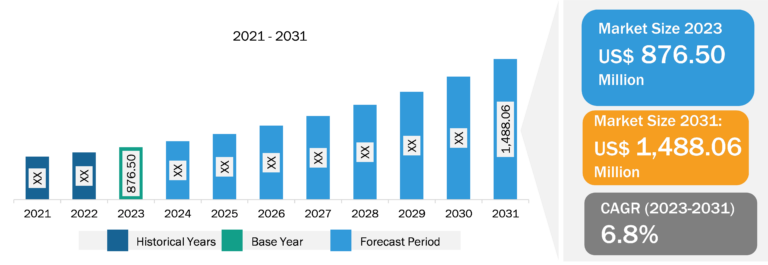

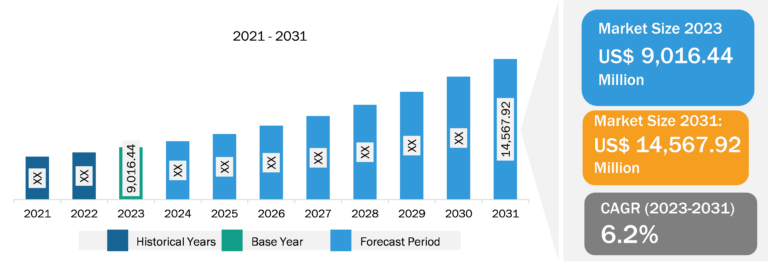

Cold Storage Market

Cold storage is an exclusive storage facility that stores temperature-sensitive goods or products, often perishable items, including frozen foods, fresh produce, and pharmaceutical products. Cold storage facilities help ensure the integrity, freshness, and safety of perishable products. The rising consumer preference for processed and easy-to-cook canned food boosts the demand for cold storage facilities. In addition, the growing adoption of omnichannel grocery shopping and the proliferation of online shopping are also benefitting the cold storage market globally. Consumers are considering online shopping for groceries as it is safe and helps save time. The growing demand for canned and frozen food products is having a positive impact on the food & beverages sector. Furthermore, the booming development in the pharmaceutical sector in terms of rising demand, is also propelling the development of the cold storage market from 2022 to 2030. Globalization and expansion in transport logistics have also boosted the supply chain of various products nationally or internationally. This trend has improved the demand for cold storage facilities to ensure that the products reach consumers in ideal condition, preserving a necessary temperature, regardless of distance and time of travel. The increase in imports and exports of processed and frozen food and pharmaceutical products contributes to the growing cold storage market size. The cold storage market size is likely to increase by 2030 owing to sustainable refrigeration and storage technologies.

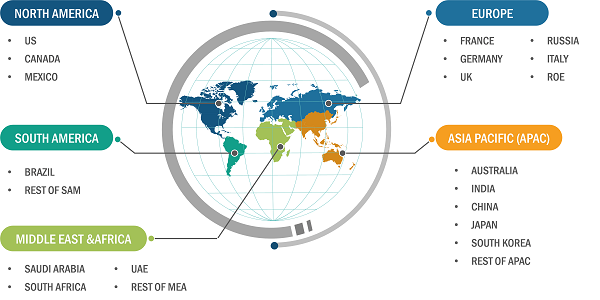

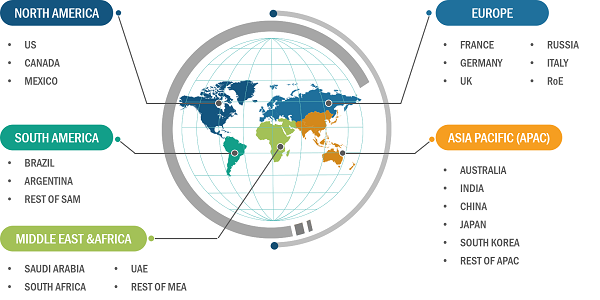

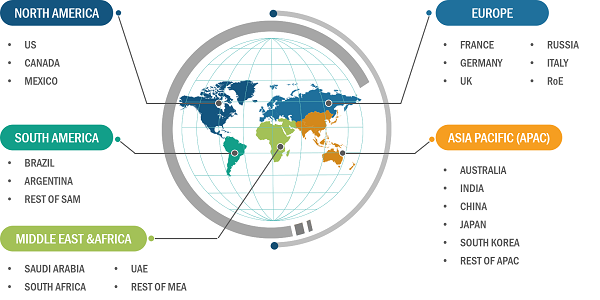

Geographically, the scope of the cold storage market report is primarily divided into North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). In terms of revenue, North America, Europe, and Asia Pacific are leading regions, followed by the Middle East & Africa and South America. Growing population, increasing per capita income, and rising consumer inclination toward consuming frozen and processed food products are boosting the demand for cold storage facilities in countries such as the US, China, India, South Korea, Japan, Brazil, and Germany. Increasing per capita income, changing consumer food preferences, and busy lifestyles are the major factors boosting the demand for processed meat, fruits, vegetables, seafood, and fish products in South America. The rising consumption of processed and canned food has propelled the use of cold storage, facilitating the expansion of the Middle East & Africa market. Automation in cold storage facilities is expected to bring new cold storage market trends in the coming years.

Rise in Food Waste Steering Cold Storage Market Growth

The growing instances of food waste worldwide fuel the demand for cold storage facilities. Cold storage facilities can reduce the share of food product waste globally as they play a crucial role in supply chain management. In 2022, ~931 million tons of food were wasted globally: 26% was from food service, 61% was from households, and 13% was from retail. Australia and New Zealand accounted for almost 5 to 6% of food waste along the supply chain. In Central and Southern Asia, the food waste ratio increased to 20–21%. In addition, in North America and Europe, food wastage accounted for almost 16% in 2023. The proper usage of cold storage facilities can reduce the ratio of food wastage as it can preserve and increase the shelf life of dairy, meat, fish, seafood, and processed food products. Optimal usage of cold storage helps food business entities improve their business management. It can reduce the risk of wasting perishable food items for longer periods and also protect the freshness. The increasing concern about food waste and its influence on the environment, food business, and the overall economy is boosting the application of cold storage facilities, which is acting as the major driving factor for the cold storage market.

Cold Storage Market Analysis: Temperature Type Overview

Based on temperature type, the cold storage market is bifurcated into chilled and frozen. The frozen segment accounted for 65.2% of the global cold storage market share in 2022 and is projected to maintain its dominance during the forecast period 2022- 2030. A cold storage, or freezer warehouse, maintains specific temperatures using a complex refrigeration system. Coolant, compressor, separator, condenser, receiver, and evaporator are major components of cold storage facilities. The primary objective of cold storage is to store temperature-sensitive goods, including perishable products, such as frozen foods, dairy items, meat and seafood, and pharmaceutical products. This helps maintain their quality and extend their product shelf life. Chilled storage helps in reducing rotting, sprouting, and insect damage. Reefer containers, ships, and trucks are usually equipped with chilled storage facilities for better management of products at the time of transportation as per supply chain requirements. A refrigerated warehouse is also known as a cold storage warehouse or chill store. These facilities primarily maintain a controlled temperature, normally between 2° and 8°, to save the quality of perishable products. Frozen warehouses or freezer warehouses are primarily operational in subzero temperatures, usually between -18°C and -25°C.

Cold Storage Market Analysis: Warehouse Type Overview

Based on warehouse type, the global cold storage market is categorized into public, private, and semi-private. The public segment accounted for 66.8% of the overall cold storage market share in 2022 and is expected to maintain its dominance from 2022 to 2030. Factors such as increasing consumer inclination toward canned food products and growing demand for frozen food items are leading to the proliferation of cold storage facilities across the globe. Also, the rising incidents of natural calamities and other crises are boosting the need for cold storage facilities to store food and other pharmaceutical products.

Cold Storage Market Analysis: Application Overview

In terms of application, the global cold storage market is categorized into dairy products, meat and seafood, fruits and vegetables, pharmaceuticals, and processed food. The meat and seafood segment accounted for 31.2% of the overall cold storage market share in 2022 and is expected to maintain its dominance from 2022 to 2030. Factors such as the increase in inclination toward processed food and the busy lifestyle of consumers are boosting the requirement for products with longer shelf lives and convenience food, which creates the demand for cold storage facilities. In addition, the growing need for online delivery services and the rising population are boosting the demand for cold storage to store dairy products, meat and seafood, processed foods, and pharmaceutical items, among others.

Cold Storage Market: Competitive Landscape and Key Developments

Contributions and market initiatives of the key players such as Constellation Cold Logistics Sarl, Nafta Frigorificos Sa De Cv, Superfrio Armazens Gerais SA, Tippmann Group, Nichirei Corp, Frialsa Frigorificos Sa De Cv, Friozem Armazens Frigoreticos Ltda, Emergent Cold Latam Management LLC, Americold Realty Trust Inc, Lineage Logistics Holdings LLC, Burris Logistics Co, Chiltern Cold Storage Group Ltd, United States Cold Storage Inc, and Newcold Cooperatief UA are influencing the cold storage market growth in the region. In addition, several other important cold storage market participants have been studied and analyzed during the study to get a holistic view of the cold storage market and its ecosystem. Producers, storage providers, and end users are among the major stakeholders operating in the cold storage market ecosystem. Expanded demand for processed food, frozen meat, and seafood has positively impacted the overall growth of the cold storage market.

| Year | News | Country |

| 2023 | Emergent Cold Latin America declared the acquisition of a cold storage facility from Frigorifico Modelo, which is a Uruguay-based cold storage company. Based in Montevideo, Frimosa is a well-known agro-industrial and logistics business. As per the terms of the deal, Frimosa’s 22,000-pallet cold storage facility in Polo Oeste was acquired by Emergent Cold LatAm. | South America |

| 2023 | Americold Realty Trust Inc., through its joint venture RSA Cold Chain in Dubai, planned to construct and operate a new US$ 35 million cold storage facility with 40,000 pallet slots in the Jebel Ali Free Zone in Dubai’s Port of Jebel Ali. This investment expanded on Americold’s strategic cooperation with DP World, the smart end-to-end supply chain logistics provider with a global port network. | Middle East & Africa |