Pharmaceutical Contract Sales Organizations Market

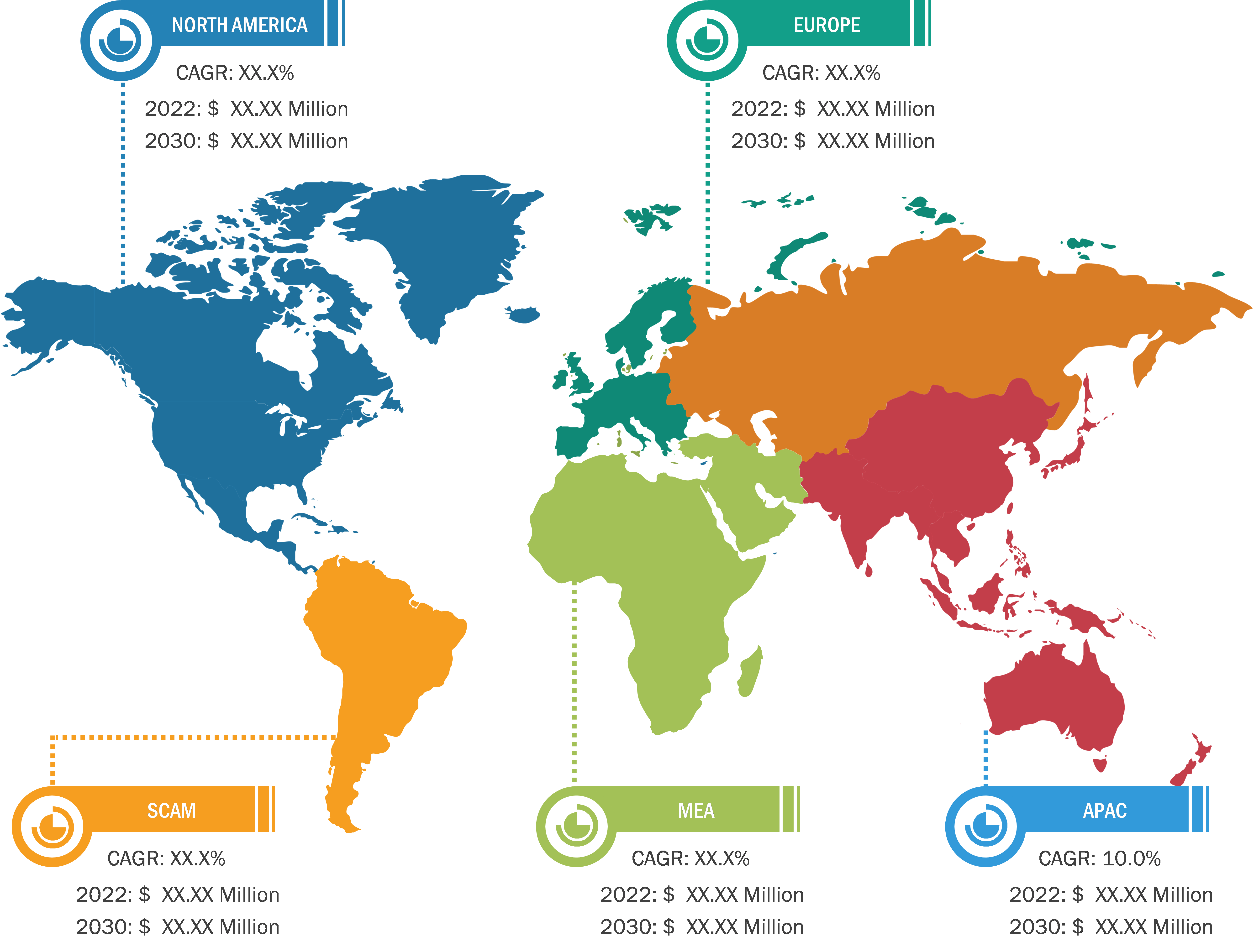

Asia Pacific is the fastest-growing region in the global pharmaceutical contract sales organizations market. The Asia Pacific pharmaceutical contract sales organization market has experienced significant growth in recent years owing to the elevated demand for cost-effective sales and marketing solutions. Pharmaceutical companies face the challenge of reaching diverse and remote markets in countries such as China, India, and Japan despite a significant demand for healthcare products in these countries. By outsourcing sales and marketing functions to CSOs, the companies can benefit from the expertise of specialized teams without the need for extensive infrastructure and personnel investments. The rise in chronic diseases and the growing aging population in Asia Pacific have also contributed to the expansion of the pharmaceutical contract sales organization market.

Increasing Integration of Digital Technologies Drives Pharmaceutical Contract Sales Organizations Market Growth

The increased deployment of digital technologies fuels a transformational surge in the pharmaceutical contract sales organization (CSO) market. This fundamental change highlights the need for a tactical response to the dynamically changing pharmaceutical market. An essential component of streamlining sales operations, increasing productivity, and navigating the complexities of a healthcare environment that is becoming increasingly digitized is integrating digital tools and technologies into CSOs. With advanced customer relationship management tools, artificial intelligence, and data analytics, CSOs can gain valuable insights, customize their sales strategies, and establish deeper relationships with healthcare professionals. In addition to speeding up information transmission, the seamless integration of digital platforms allows for real-time adaptability to market trends and legislative changes. This technological change in the pharmaceutical CSO landscape represents more than just a fad; it represents a fundamental redefining of how sales tactics are developed and implemented. The adoption of digital technologies places CSOs at the forefront of innovation. It promotes a more responsive environment that aligns with the larger digital transformation sweeping the healthcare sector. The market is positioned for sustained growth as pharmaceutical CSOs continue to use the power of digitalization, propelled by a convergence of technological expertise, strategic agility, and a clear awareness of the contemporary demands of the pharmaceutical ecosystem.

Pharmaceutical Contract Sales Organizations Market: Segmental Overview

The pharmaceutical contract sales organizations market, by service, is segmented into commercial services and non-commercial services. In 2022, the commercial segment held a larger share of the market and is expected to grow at a faster rate in the coming years.

The pharmaceutical contract sales organizations market, by module, is segmented into syndicated modules and dedicated modules. In 2022, the syndicated modules segment held a larger share of the market and is expected to grow at a faster rate in the coming years.

The pharmaceutical contract sales organizations market, by therapeutic area, is segmented into cardiovascular disorders, oncology, metabolic disorders, neurology, orthopedic diseases, infectious diseases, and others. In 2022, the oncology segment held the largest share of the market. The online pharmacies segment is estimated to grow at the highest CAGR from 2022 to 2030.

The pharmaceutical contract sales organizations market, by end user, is segmented into biopharmaceutical companies and pharmaceutical companies. In 2022, the pharmaceutical companies segment held a larger share of the market. The biopharmaceutical companies segment is estimated to grow at a higher CAGR from 2022 to 2030.

Pharmaceutical Contract Sales Organizations Market: Competitive Landscape and Key Developments CMIC Holdings Co. Ltd.; Axxelus; EPS Holdings, Inc.; MaBico, IQVIA, Inc.; Peak PharmA; QFR Solutions; Promoveo Health; Syneous Health Inc.; and Mednext Pharmaceuticals Pvt. Ltd; are a few key companies operating in the pharmaceutical contract sales organizations market. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the pharmaceutical contract sales organizations market.

A few of the recent developments in the global pharmaceutical contract sales organizations market are mentioned below:

- In September 2022, pharmaceutical organization Dr. Reddy’s Laboratories partnered with IQVIA, Inc. As per the arrangement, IQVIA gave Dr. Reddy’s access to its Orchestrated Customer Engagement (OCE) platform to assist with its CRM operations. According to the deal, Dr. Reddy’s gave IQVIA’s OCE application to all its marketing users and field staff in India so they could more effectively engage customers by integrating marketing, account management, medical scientific liaison, sales, and other activities.

- In November 2020, Expert Medical Navigation (EMN), a provider of medical affairs solutions for pharmaceutical firms, was acquired by PDI. The acquisition is anticipated to increase PDI’s capacity for medical affairs.