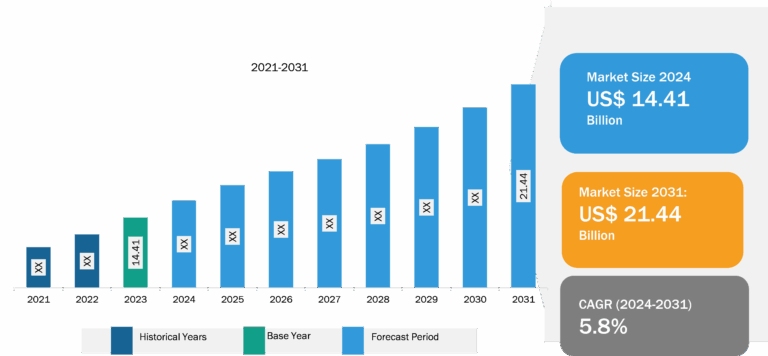

Cooling Water Treatment Chemicals Market

The cooling water treatment chemicals market is expanding at a steady pace. Power, steel, mining and metallurgy, petrochemicals, oil & gas, food & beverages, and textile industries are among the major consumers of cooling water treatment chemicals. Growing demand for cooling water treatment chemicals from the power industry and the increasing number of nuclear plants globally, coupled with the need to maintain the existing plants, boost the market growth. Furthermore, the stringent regulations by governments on water conservation and wastewater management are fueling the demand for cooling water treatment chemicals. Additionally, as population growth increases, the need for safe drinking water for human use and industrial applications is increasing. This requires highly efficient water treatment and processing plants that meet the growing needs of customers and their expectations of providing more service to all segments of society at the lowest possible cost. This further propels the demand for cooling water treatment chemicals.

Growing Emphasis on Water Recycling and Reuse Boosts Cooling Water Treatment Chemicals Market

Quick urbanization, economic improvements, and industrial expansion have resulted in a tremendous demand for water worldwide. The consumption of freshwater is surging globally due to climate change, population growth, and increased land use and energy generation, which has resulted in water scarcity, requiring prompt consideration. Additionally, rising costs of industrial water are rerouting industries’ focus on water recycling and reuse. It is crucial to maintain the hydrological cycle to ensure a sustainable future. The fundamental procedures used for water treatment are heater treatment, cooling treatment, and filtration. The adoption of cooling water treatment chemicals is high among industries such as oil & gas, pulp & paper, and electric power generation. These industries incorporate various technologies to recycle and reuse water to meet their huge water demands. For instance, the power industry uses water softener systems to reduce water hardness to prevent scale build-up, clogging, and expense. Such practices have accelerated the use of different cooling water treatment chemicals in these industries.

Cooling Water Treatment Chemicals Market: Segmental Overview

Based on type, the cooling water treatment chemicals market is segmented into scale inhibitors, corrosion inhibitors, biocide, and others. The mulch films segment held the largest share of the market in 2022, and the corrosion inhibitor segment is expected to record the highest CAGR from 2022 to 2030. Corrosion inhibitors help prevent the system from fouling to ensure the safe operation of cooling systems. They are normally classified as anodic, cathodic, film-forming, and oxygen-absorbing agents, depending on their mode of action. Water treatment includes both anodic and cathodic inhibitors, as well as a combination of these two inhibitors, depending on the application. A majority of the exclusive corrosion inhibitor formulas belong to this category. Chromate, Nitrate, Zinc, Molybdate, Polysilicate, Nitrite, Polyphosphate, and Azoles are common corrosion inhibitors used in cooling water treatment. The increasing use of these chemicals from industries such as power, steel, mining & metallurgy, petrochemicals, oil & gas, and food & beverages is driving the growth of the market for corrosion inhibitors. In these industries, these corrosion inhibitors are injected into water cooling systems in specified doses to prevent scaling, corrosion, and bacterial growth in water. All these factors are leading to the growth of the market for the corrosion inhibitor segment.

Based on the end use, the cooling water treatment chemicals market is segmented into power; steel, mining, and metallurgy; petrochemicals, oil, and gas; food and beverages; textile; and others. The steel, mining, and metallurgy segment is expected to record the highest CAGR from 2022 to 2030. The energy and water consumption of steel, metallurgy, and mining industries is high, and they produce large volumes of waste. Water is probably the most widely used raw material in these industries. In metallurgy and mining industries, it is used in mineral processing, dust suppression, slurry transport, and other miscellaneous requirements. The steel industry also utilized larger volumes of water in its manufacturing process. However, over the last several decades, this industry has made much progress in developing close-circuit approaches that capitalize on water conservation. Besides, this industry has employed specialized water systems for the treatment of groundwater, brackish water, and seawater for producing high-quality drinking water or process water. These industries have technologically advanced systems, including scale and deposit control, solid-liquid separation, filtration and dewatering, viscosity modification, and boiler/cooling water treatment, for a wide variety of water-related applications. The presence of these systems generates demand for water treatment chemicals, especially in cooling water systems. These chemicals help maximize recovery and production while reducing downtime and mitigating environmental, health, and safety risks. Factors such as the global mining industry development, water supply scarcity, and regulatory constraints are expected to promote the use of cooling water treatment chemicals in steel, mining, and metallurgy industries. Thus, all these factors are expected to positively influence the cooling water treatment chemicals market for the steel, mining, and metallurgy segment.

Impact of COVID-19 Pandemic on Cooling Water Treatment Chemicals Market

The COVID-19 pandemic severely impacted various economies across the world. Governments of various countries took several steps to restrict the spread of SARS-CoV-2 by announcing country-wide lockdowns, which directly impacted the growth of industrial sectors. The pandemic significantly hampered the growth of the cooling water treatment chemicals market due to adverse effects on the growth of industries such as food & beverages, textile, power, oil & gas, and steel and mining. Various cooling water treatment chemicals manufacturers were operating their plants at reduced capacities amid the COVID-19 pandemic. However, the market revived in 2021 with significant measures from governments, including vaccination drives. Moreover, they managed to overcome the challenges associated with disruptions in raw material supply chains.

Cooling Water Treatment Chemicals Market: Competitive Landscape and Key Developments

ChemTreat Inc, DuBois Chemicals Inc, Chemtex Speciality Ltd, Kurita Water Industries Ltd, Kemira Oyj, Ecolab Inc, Buckman Laboratories lnternational Inc, Albemarle Corp, Accepta Ltd, and Veolia Water Solutions & Technologies SA are among the players operating in the global cooling water treatment chemicals market. The market players focus on providing high-quality products to fulfill customer demand.

Key Developments:

In June 2023, Cortec Corp. launched a molybdate-free version of Cooling Loop Gator, which is the group’s corrosion inhibitor to preserve idle cooling loop systems. According to the company, Cooling Loop Gator MF offers simple, safe, easy, and effective corrosion protection for cooling water systems during seasonal, short-term, or long-term layups.