Molded Foam Market

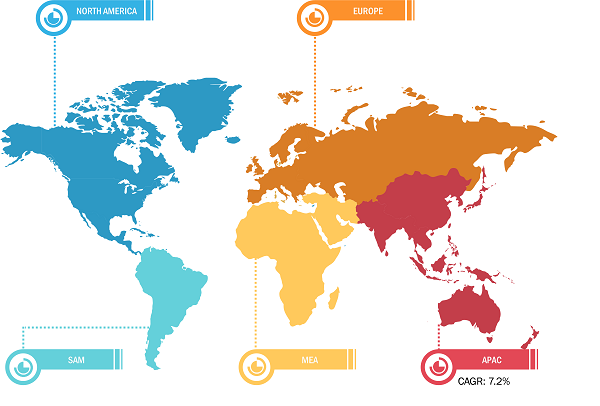

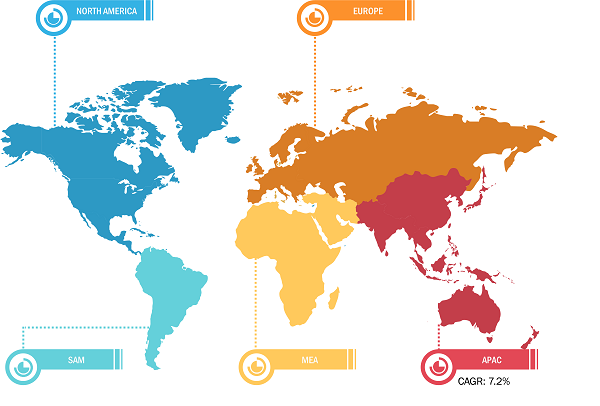

In 2022, Asia Pacific held the largest share of the global molded foam market. Increasing use of molded foam in automotive, furniture, packaging, and many other applications drives the molded foam market growth in Aisa Pacific. China dominates the regional market, followed by countries such as Japan, India, Vietnam, and South Korea. Commercial places and residential units are among the major end users of molded foam in these countries. The burgeoning furniture industry fuels the molded foam market growth in Asia Pacific.

Robust Growth of Automotive Industry Bolsters Molded Foam Market Growth

The automotive industry is growing in various countries across the world due to factors such as transition toward electric vehicles, economic growth, increasing population, government support for automotive production, and rising investments in the industry. According to the International Organization of Motor Vehicle Manufacturers, the global sales of passenger cars increased from 53.92 million in 2020 to 57.49 million in 2022. In December 2022, the passenger vehicle market in China expanded due to increased retail sales. Growing preference for molded foam by automotive and furniture industry propels the demand for molded foam.

Molded Foam Market: Segmental Overview

Based on type, the molded foam market is segmented into closed cell foam, high resilience foam, integral skins foam, memory foam, and others. The closed cell foam segment held the largest market share in 2022. Closed-cell foam is a versatile material used in various industries due to its unique properties. It consists of tiny, sealed air bubbles within its structure that create a closed cell structure. Closed cell foam is non-water-resistant, floatable, and has excellent tensile strength. Based on form, the molded foam market is segmented into rigid foam and flexible foam. The flexible foam segment held a larger market share in 2022. Flexible foam provides a plush and cushioned feel, making it a popular choice for upholstered furniture, seating cushions, and bedding products such as pillows and mattress toppers. In addition, flexible foam offers excellent shock absorption and impact resistance. This property is valuable in applications where safety and protection are essential, such as automotive seating and helmet liners. Based on material, the molded foam market is segmented into expanded polystyrene, polyurethane foam, expanded polyethylene, expanded polypropylene, and others. The molded foam market share of the polyurethane foam segment was notable in 2022. Polyurethane is a closed-cell foam commonly used for molded foam products due to its versatility, durability, and cost-effectiveness. Polyurethane foam is available in various densities, allowing customization to meet specific comfort and support requirements. This makes it ideal for applications such as mattresses, upholstery, seating cushions, and pillows, where user comfort is a priority. Based on application, the molded foam market is segmented into seating and furniture, automotive interior, bedding and mattresses, footwear, and others. The molded foam market share of the bedding and mattresses segment was notable in 2022. Molded foam plays a crucial role in bedding and mattresses, enhancing comfort, support, and overall sleep quality. Molded foam mattresses offer excellent support and pressure relief as they contour the body’s shape. This ensures that users experience comfortable and restful sleep by minimizing pressure points and promoting proper spinal alignment.

Impact of COVID-19 Pandemic on Molded Foam Market

Before the COVID-19 pandemic, the molded foam market was mainly driven by its increasing use in automotive, furniture, , and other industries. However, the chemicals & materials industry reported an adverse impact of the pandemic during the first quarter of 2020. The crisis led to social distancing restrictions and economic fallout, restricting molded foam manufacturing and distribution.

Moreover, low-income and mid-income consumers faced financial difficulties in the initial months of 2020 owing to the economic recession caused by the COVID-19 pandemic. As a result, people only purchased primary essential products, which declined the sales of molded foam.

Molded Foam Market: Competition Landscape

Superlon Baltic UAB, Carpenter Co, Intex Technologies LLC, Sheela Foam Ltd, Vita (Holdings) Ltd, Sinomax Group Ltd, International Industries LLC, Pomona Quality Foam LLC, Woodbridge Foam Corp, and CT Formpolster GmbH are among the key players operating in the global molded foam market. These players focus on providing high-quality products to fulfill customer demand. Also, they focus on strategies such as investments in research and development activities and launches of new products.