Non-Gelatin Empty Capsules Market

Non-gelatin empty capsules are widely used in the pharmaceutical and nutraceutical industries as an alternative to gelatin capsules. These capsules are made from plant cellulose or starch derivatives, making them suitable for people with dietary restrictions or religious beliefs that prohibit the consumption of gelatin, among other animal-derived raw materials. In recent years, nutraceutical and pharmaceutical companies have created a huge demand for non-gelatin empty capsules due to growing interest in considering vegetarian capsule properties. The growing preference for natural and organic products, and the increasing involvement of regulators in promoting non-animal products would further drive the demand for non-gelatin empty capsules. Key trends in the gelatin-free empty capsules market include product innovations such as enteric-coated capsules, sustained-release capsules, and capsules with improved stability and bioavailability.

The market in North America was valued at US$ 0.63 billion in 2022 and is projected to reach US$ 1.28 billion by 2030; it is expected to register a CAGR of 9.2% during 2022–2030. The North America non-gelatin empty capsules market is segmented into the US, Canada, and Mexico. One of the key factors driving the market growth in this region is the increasing acceptance of vegetarian and vegan lifestyles. As a result, there is a growing demand for herbal alternatives across various industries, including pharmaceuticals, nutraceuticals, and dietary supplements. Non-gelatin empty capsules are a popular choice for the encapsulation of nutraceuticals and dietary supplements as they provide a convenient and effective way to deliver active ingredients into the body. The US has an established market for nutraceuticals. The main dietary supplements consumed in the country include multivitamins, calcium and vitamin D supplements, and omega-3 fatty acids. The consumption of these supplements is driven by the aging population, which is more concerned about healthy aging than its predecessors. Moreover, the demand for dietary supplements to prevent age-related diseases would positively impact the non-gelatin empty capsules market in North America.

The Asia Pacific market is expected to record the fastest CAGR in the global non-gelatin empty capsules market. The region, especially with countries such as India and China, is home to a sizable pharmaceutical industry. China is a pharmaceutical manufacturing hub. The projected market growth in this region is attributed to the availability of highly functional manufacturing units and contract manufacturing facilities in the region. In addition, the introduction of strategies by the healthcare systems to implement preventive measures for positive treatment outcomes prompts the growth of the non-gelatin empty capsules market in China. Further, the cultural beliefs of most of the population in India and other countries indicate a high inclination toward non-gelatin capsules.

In terms of application, the non-gelatin empty capsules market is segmented into antibiotic and antibacterial drugs, vitamins and dietary supplements, antacids and antiflatulent preparations, and others. The antibiotic and antibacterial drugs segment held the largest market share in 2022. The market for the vitamins and dietary supplements segment is estimated to grow at the fastest CAGR of 9.9% during 2022–2030. The burgeoning demand for therapeutic drugs and nutritional supplements for better health outcomes is expected to drive the market growth of this segment. These capsules are used for the encapsulation of medicinal drugs and nutritional supplements in the pharmaceutical industry, ensuring precise dosage and controlled release. The supplement industry encapsulates vitamins, minerals, and herbal extracts to aid easy consumption. These non-gelatin capsules are also used to encapsulate skin care ingredients in the cosmetics industry, enabling targeted delivery and improved effectiveness.

Rising Focus on Sustainable Packaging to Provide Market Opportunities in Future

With growing concerns about plastic waste and environmental sustainability, consumers and regulators are actively seeking environmentally friendly packaging solutions. As non-gelatin capsules are plant-based and biodegradable, they meet these sustainability requirements. As people become more environmentally conscious and look for products that align with their sustainability values, the changing mindset of consumers is expected to drive the non-gelatin empty capsule market in the future. Additionally, consumers tend to favor companies committed to sustainability, resulting in higher customer loyalty and market share. Consequently, changing consumer preferences and stricter regulations are expected to drive the adoption of non-gelatin empty capsules, thereby providing growth opportunities for the global market.

Empty Capsules Market: Product Overview

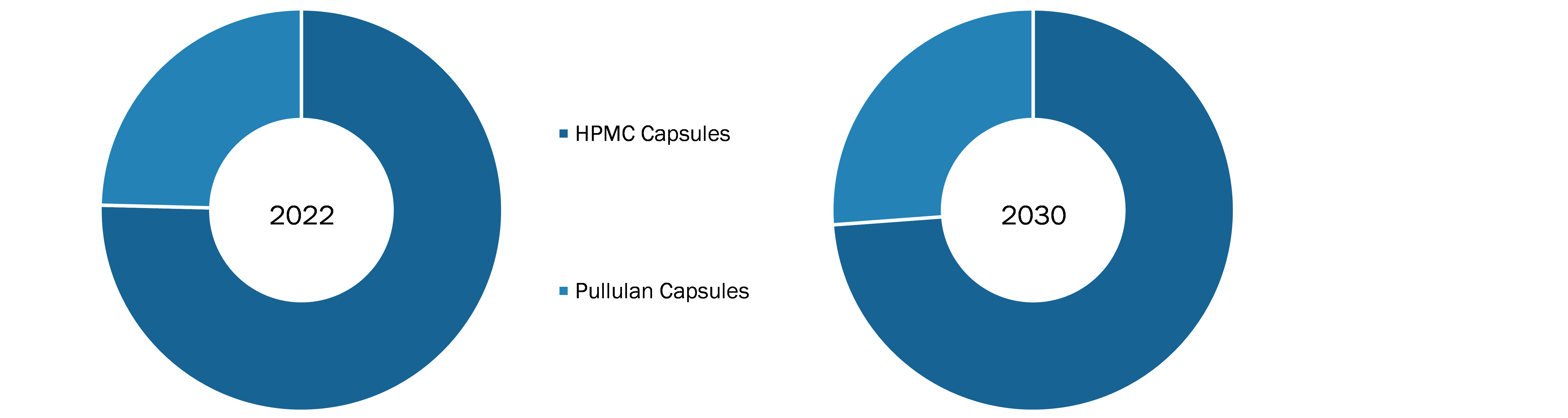

Based on type, the non-gelatin empty capsules market is divided into HPMC capsules and pullulan capsules. The HPMC capsules segment held a larger market share in 2022. The pullulan capsules segment is said to register a higher CAGR of 9.9% during 2022–2030.

HPMC capsules are derived from plant cellulose, and offer excellent stability and flexibility. These vegetable capsules offer an attractive, completely natural dosage form that is easy to swallow. Moreover, they effectively mask taste and smell, and ensure product visibility. These capsules are also starch-free, gluten-free, and preservative-free, meeting the strict nutritional needs of customers who choose a vegetarian lifestyle. Thus, capsule manufacturers use HPMC as a replacement for materials sourced from animals.

Non-Gelatin Empty Capsules Market: Competitive Landscape and Key Developments

LonzaGroup (Capsugel), Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.), Erawat Pharma Limited, ACG Worldwide, Suheung Capsule, Sunil Healthcare, CapsCanada Corporation, BrightCaps GmbH, Natural Capsules Limited, Healthcaps India Limited are among the key companies operating in the non-gelatin empty capsules market. Leading players are implementing strategies such as expansions, new product launches, and acquisitions (companies or new clientele) to tap prevailing business opportunities.

- In July 2022, Sunil Healthcare Limited reported an improvement in its export revenue by 25.0% in FY2022, reporting better profitability and operating margins from HPMC capsules.

- In June 2020, Lonza introduced DBcaps (double-blind capsules), an HPMC capsule that was designed to address the challenges associated with clinical trials.