Pharmacokinetics Services Market

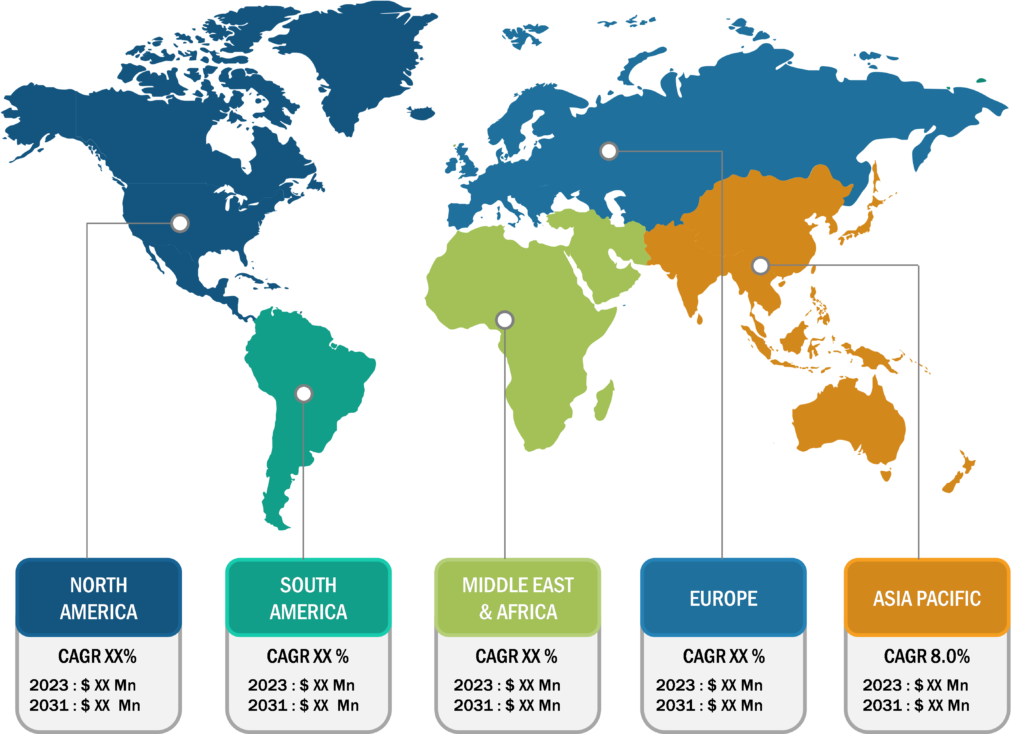

The pharmacokinetics services market growth in North America is attributed to the rising number of clinical trials and research studies, and the increasing prevalence of infectious diseases and chronic disorders. The US accounts for the largest share of the pharmacokinetics services market in North America. The country has emerged as a leading clinical research destination; it accounts for ~50% of the total clinical trials conducted in the world. The availability of established medical infrastructure, fast approval timelines, and favorable regulatory framework create a conducive environment for pharmaceutical research companies to conduct clinical trials. Moreover, the data generated in trials conducted in the US is accepted globally. As per a World Health Organization (WHO) report, the US registered the highest number of clinical trials (157,618) in 2021.

Asia Pacific is expected to record the highest CAGR in the pharmacokinetics services market during the forecast period. China holds a significant share of the market in this region. The pharmacokinetics services market growth in China is primarily attributed to the established pharmaceutical market, increasing R&D expenditures by pharmaceutical and biopharmaceutical companies, rising number of clinical trials due to lower operating costs, and favorable regulatory policies in place. According to the EFPIA report published in 2023, R&D expenditure by pharmaceutical companies in China grew from US$ 10,814.23 million in 2020 to US$ 12,989.23 million in 2021. China has the world’s second-largest pharmaceutical market. The excessive population in the country, coupled with a rise in the cases of various noncommunicable and infectious diseases, fuels the need for new drug molecules, which makes China a prime market in Asia Pacific.

Further, as stated by the International Trade Administration in 2022, advanced medical technologies are becoming increasingly important in Japan owing to its rapidly aging demographic profile. Gastric cancer and hepatitis C are among the prevalent diseases in the country, which makes it a suitable place for clinical trials aimed at treating these conditions. With 126 million people in Japan, there is a significant pool of potential participants in clinical trials. Moreover, the country has a well-established regulatory framework for clinical trials, providing clear guidelines for the development of new drugs. Clinical trials in Japan are reviewed and approved by the Pharmaceutical and Medical Devices Agency (PMDA), which has emphasized on reducing review times over the last five years, resulting in an increased number of new drug approvals. Thus, fast-paced regulatory processes encourage clinical research activities in Japan, thereby benefiting the pharmacokinetics services market.

Pharmacokinetics Services Market: Segmental Overview

The pharmacokinetics services market has been segmented on the basis of drug type, service type, therapeutic application, and end user. By drug type, the market is segmented into small molecules, large molecules, and vaccines. The small molecule segment held the largest market share in 2023. Pharmacokinetics service companies provide comprehensive PK/PD (i.e., pharmacokinetics and pharmacodynamics) services to evaluate the fundamental physicochemical properties and structural motifs that are responsible for the efficacy and safety profile of small molecules. These services include PK bioanalysis; PD biomarker analysis; high-throughput absorption, distribution, metabolism, and excretion (HT-ADME) profiling; in vitro ADME assays; drug transporter assays; and non-radiolabeled and radiolabeled in vivo ADME studies. In vitro ADME studies are crucial in gaining insights into metabolism and potential drug interactions. Companies also offer drug interaction screening services, including in vitro ADME assays, data interpretation systems, and expert study designs, to determine the ADME properties of small molecules.

By service type, the pharmacokinetics services market is segmented into preclinical ADME and human studies, PK/PD analysis and reporting, dosing simulations, risk analysis, and others. The preclinical ADME and human studies segment held the largest market share in 2023. The segment is further anticipated to register the highest CAGR during the forecast period. Drug development is a costly process for pharmaceutical and biotechnology manufacturers, and a drug’s inability to meet safety profiles often leads to failure in the final stages of clinical studies. ADME toxicology testing is meant to address this issue in the early stages of drug development, i.e., during preclinical trials. Toxicology testing is a crucial step before introducing a new drug to the market to ensure its safety. This testing aids in the better understanding of drug levels and kinetics after its exposure to the human body, reducing the time and costs of drug discovery. Preclinical ADME toxicology testing is an important aspect of drug discovery for venture capital (VC) firms, as study outcomes help them make informed financial decisions. In January 2024, CN Bio and Altis Biosystems agreed to work together to develop a next-generation human gut/liver in vitro model for advanced ADME studies. Such inorganic growth strategies adopted by market players are contributing to the pharmacokinetics market growth for the preclinical ADME and human studies segment.

The pharmacokinetics services market, by therapeutic application, is categorized into oncology, infectious diseases, neurological disorders, autoimmune diseases, gynecological disorders, cardiovascular diseases, respiratory disorders, and others. The oncology segment held the largest market share in 2023. Further, the infectious diseases segment is anticipated to register the highest CAGR during the forecast period. Human immunodeficiency virus (HIV) is a major public health issue across the world. As per the World Health Organization (WHO), nearly 58 million individuals across the world have chronic hepatitis C virus infection, and ~1.5 million new infections occur every year. Critically ill patients who suffer from severe infections are at a high risk of receiving antimicrobial drugs in suboptimal doses. PK/PD modeling is a technique used to describe and measure the relationship between drug dose, concentration, and effect. Laboratories that specialize in the treatment of patients with serious infections, such as HIV, fungal infections, and tuberculosis, focus on providing therapeutic drug monitoring using liquid chromatography-mass spectrometry (LC-MS). Therapeutic drug monitoring (TDM) is a well-established clinical tool that allows clinicians to perform ADME and clearance studies. It also helps clinicians determine the necessary doses of drugs for each patient while taking into account the complex drug–drug interactions. The Infectious Disease Pharmacokinetics Laboratory at the University of Florida (IDPL) offers drug assays that most other clinical labs do not provide.

The pharmacokinetics services market, by end user, is categorized into pharmaceutical and biotechnology companies, contract research organizations, and others. The contract research organization segment held the largest market share in 2023. It is further anticipated to register the highest CAGR during the forecast period. Contract research organizations provide services to support the pharmaceutical, biotechnology, and medical device industries. These services usually include in vivo PD and Pharmacokinetics services, PK/PD modeling, DMPK analysis, and PK mouse and rat models. PK/PD studies play a crucial role in the drug discovery process. They generate high-quality data on the pharmacokinetic (PK) and pharmacodynamic (PD) properties of drug candidates.

The pharmacokinetics services market report, based on geography, is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Pharmacokinetics Services Market: Competitive Landscape and Key Developments

Charles River Laboratories International Inc., Eurofins Scientific SE, Evotec SE, Certara Inc., Parexel International Corp, Thermo Fisher Scientific Inc., Allucent, PACIFIC BIOLABS, SGS SA, and Shanghai Medicilon Inc. are among the prominent players profiled in the pharmacokinetics services market report. These companies adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the market.

A few of the recent developments in the global market, as per company press releases, are mentioned below:

• Thermo Fisher Scientific expanded its clinical research operations with the opening of a state-of-the-art bioanalytical lab in Richmond, Virginia. The new unit will support the burgeoning demand generated in the biopharmaceutical ecosystem for consistent, high-quality laboratory services to accelerate drug development. The Richmond Bioanalytical Lab, whose entities have been operating since 1985, provides services for all phases of small molecule drug, biologics, vaccine, and biomarker development. Drug testing services include drug PK/PD, and immunogenicity and biomarker quantitation to support drug efficacy and safety. (Source: Thermo Fisher Scientific, Press Release, October 2022)

• Charles River Laboratories International, Inc., partnered with Kibur Medical to offer exclusive access to its implantable microdevice (IMD) for in vivo preclinical oncology studies. Kibur’s microdevice technology can hold up to 20 different compounds for local administration, which allows it to dose therapies directly into disease tissue, allowing for investigative studies of early-stage compounds where pharmacokinetic properties are poorly understood. (Source: Charles River Laboratories International, Inc., Newsletter, February 2021.