Fertility Services Market

The fertility services market is driven by several factors, including increasing accessibility and availability of healthcare facilities; rising success rates of in vitro fertilization (IVF) using ICSI in men with poor sperm morphology, motility, and low sperm count; and increasing healthcare and research spending. Further, the increasing prevalence of infertility-causing medical diseases such as polycystic ovary syndrome (PCOS), endometrial tuberculosis, and sexually transmitted diseases (STDs) are also driving the market growth. Increasing awareness about infertility and easier access to better healthcare facilities have also increased demand for these services in developed and emerging countries. The increase in cases of infertility-related diseases has boosted the global fertility services market growth in recent years.

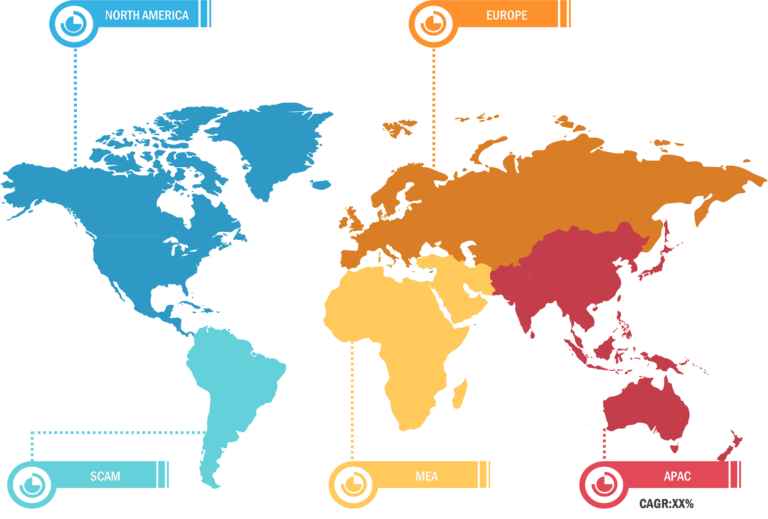

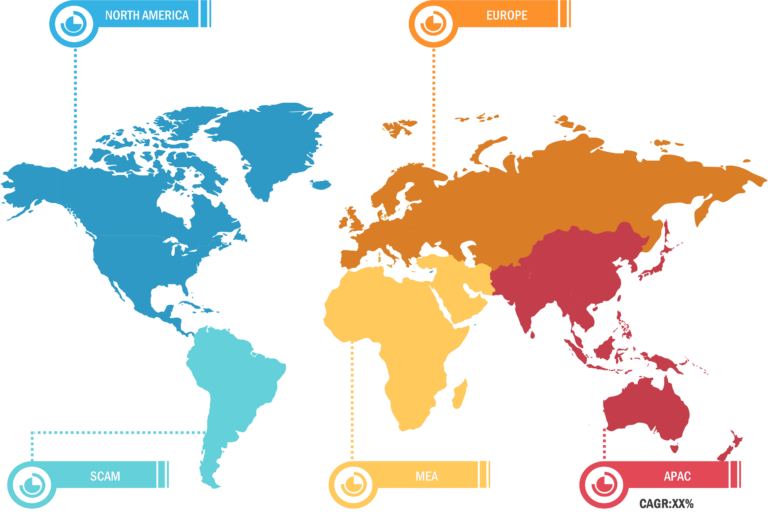

The scope of the fertility services market report focuses on North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of SCAM). North America held the substantial market share in 2023. The growth of the market in the region is attributed to factors such as introduction and rapid distribution of several infertility drugs. Increasing research activities in infertility are predicted to open up new opportunities for the regional market in the coming years. According to the Centers for Disease Control and Prevention (CDC), the IVF fertilization rate between ages 35 and 39 is reportedly very high. The inability of the reproductive system to produce fully formed eggs for fertilization increases the risk of genetic diseases in older women (over 40). In addition, older people have a reduced ability to produce high-quality eggs and a higher risk of miscarriage. Therefore, an increasing tendency of women to delay childbearing is predicted to boost the fertility services market growth in the region during the forecast period.

Europe held the third-largest fertility services market share in 2023. Europe hosts 40% of all IVF clinics worldwide, which has proven to be a key factor in the success of the European fertility testing and treatment market. In addition, the region has seen significant investments from global leaders. The overall outlook for the European market is promising, as superior IVF technology attracting significant investment from private equity investors. Germany is one of the major contributors to the regional fertility services market.

Asia Pacific held largest market share in 2023 and is expected to register the fastest CAGR from 2021 to 2031. The regional market growth is driven by the existence of key market players and their strategic initiatives to develop and commercialize new infertility drugs to treat patients. Market players’ technological advancements in developing various fertility services are expected to drive the fertility services market growth in the region during the forecast period.

Increasing Research Collaborations to Lead Future Trends in Fertility Services Market During Forecast Period

Companies in the fertility services market have seen a significant increase in the number of research collaborations and research funding approvals. Players operating in the market are expected to increase their R&D expenditure by introducing new advanced techniques and drugs for fertility treatments. In October 2022, Indira IVF collaborated with Maven Clinic, a US-based company that specializes in women’s and family health through telemedicine-based virtual clinics. The collaboration aims toward providing access to Indira IVF’s high-quality clinical care, best virtual family care, and other benefits, through the Maven platform. Indira IVF is an India-based chain of specialty infertility clinics.

Further, in February 2021, CooperSurgical, a US-based company specializing in women’s health solutions, collaborated with Virtus Health. The collaboration aims to focus on digitalization, cryogenics, and reproductive genetics. The collaboration will advance initiatives to support patients on their fertility journey, including those in need of egg, sperm, or embryo donation. Virtus Health is an Australia-based company that specializes in fertility services. Thus, such collaborations are anticipated to lead to new fertility services market trends in the coming years.

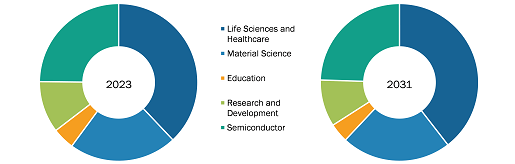

Fertility Services Market: Segmental Overview

The fertility services market analysis is carried out on the basis of procedure, patient type, end user, and geography. Based on procedure, the market is segmented into assisted reproductive technology, artificial insemination, and fertility surgeries. The assisted reproductive technology segment held the largest market share in 2023 and is projected to record the highest CAGR during 2023–2031. The market for the assisted reproductive technology segment is further segmented into in vitro fertilization and intracytoplasmic sperm injection.

The fertility services market, based on patient type, is bifurcated into male and female. The female segment held a larger market share in 2023. However, the male segment is anticipated to register a higher CAGR during the forecast period.

The fertility services market, based on end user, is segmented into fertility centers, hospitals & surgical clinics, and others. The fertility centers segment held the largest market share in 2023 and is anticipated to register the highest CAGR during 2023–2031.

Fertility Services Market: Competitive Landscape and Key Developments

CooperSurgical, Inc.; Vitrolife: Cook Medical: Care Fertility: INVO Bioscience: Carolinas Fertility Institute: Genea Limited: Merck KgaA: LABOTECT GmbH: and Monash IVF Group Limited are among the leading companies analyzed in the fertility services market report. The market players focus on expanding and diversifying their presence and acquiring a novel customer base, thereby tapping business opportunities in the market.

Several key players are launching new products in the fertility services market. As per the company press releases, below are a few recent developments:

- In December 2022, Care Fertility Group expanded its global reach by entering into the US and Spain.

- In November 2022, Mackay Specialist Day Hospital welcomed the opening of the new Virtus Rapid Access Endoscopy Clinic.

- In October 2022, Indira IVF collaborated with Maven Clinic, a US-based company specializing in women’s and family health with the help of telemedicine-based virtual clinics. The collaboration aimed to provide Maven members in India access to Indira IVF’s high-quality clinical care, other benefits, and the best virtual family education care available through the Maven platform. Indira IVF is an India-based chain of specialty infertility clinics.

- In August 2022, Genea Fertility was a Platinum Sponsor at the Australian Jewish Fertility Network’s (AJFN) Annual Major Fundraiser.